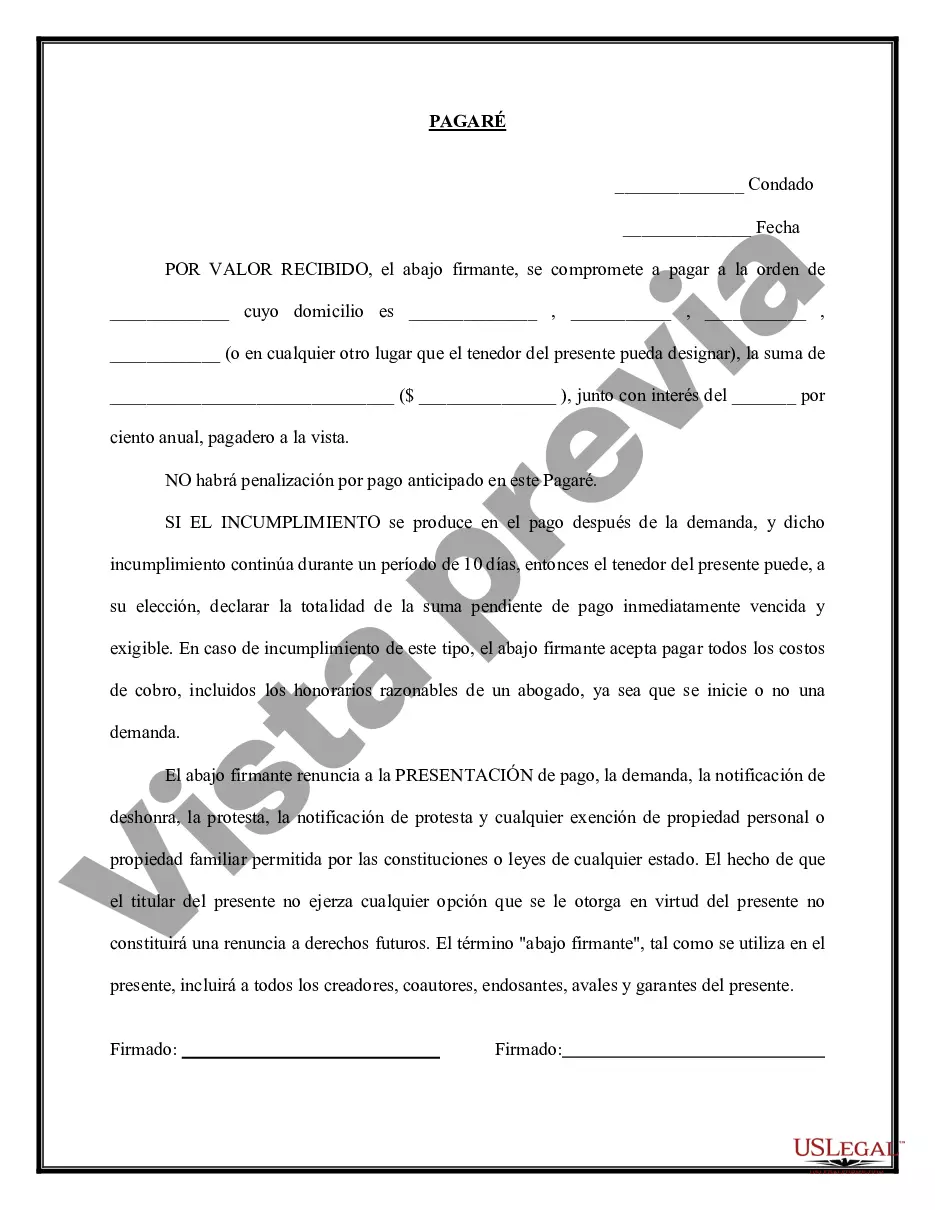

A Nebraska Promissory Note — Payable on Demand is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note ensures that the borrower promises to repay a specific amount of money borrowed from the lender, plus any accrued interest, upon demand. In Nebraska, there are different variations of Promissory Note — Payable on Demand, designed to cater to various loan scenarios and purposes. Some common types include: 1. Unsecured Promissory Note — Payable on Demand: This type of promissory note does not require any collateral, meaning that the borrower does not have to provide any specific asset as security for the loan. In case of default, the lender may have less recourse to recover the outstanding debt. 2. Secured Promissory Note — Payable on Demand: This variation of the promissory note necessitates the borrower to provide collateral, such as real estate, a vehicle, or any valuable asset, to secure the loan. If the borrower fails to repay, the lender can seize the collateral as compensation. 3. Demand Promissory Note with Acceleration Clause: This type of promissory note includes an acceleration clause, which allows the lender to demand full payment of the loan if the borrower fails to meet specific conditions, such as missing monthly installments or breaching the agreement's terms. 4. Demand Promissory Note with Installment Option: Unlike the typical payable on demand promissory note, this variation sets specific dates for installment payments rather than requiring immediate repayment. The lender may choose to demand full payment in the event of default or on a specified date. Nebraska Promissory Notes — Payable on Demand should include essential details to ensure their validity and enforcement, such as the names and addresses of both the lender and borrower, the loan amount, the interest rate, payment terms, repayment method, and any terms and conditions related to late fees or penalties. It is crucial for both parties to carefully review and understand the terms before signing the promissory note to protect their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Nebraska Pagaré - Pagadero A La Vista?

US Legal Forms - among the biggest libraries of authorized forms in the United States - delivers an array of authorized document layouts you are able to acquire or print. Utilizing the internet site, you can find a huge number of forms for organization and individual reasons, sorted by categories, says, or keywords and phrases.You will discover the newest versions of forms just like the Nebraska Promissory Note - Payable on Demand within minutes.

If you already possess a registration, log in and acquire Nebraska Promissory Note - Payable on Demand from your US Legal Forms library. The Download key will appear on each and every develop you look at. You get access to all previously delivered electronically forms within the My Forms tab of your respective accounts.

In order to use US Legal Forms the first time, listed here are easy instructions to help you get started off:

- Be sure to have picked out the right develop to your metropolis/area. Go through the Preview key to review the form`s information. Look at the develop description to actually have chosen the right develop.

- If the develop does not satisfy your needs, take advantage of the Look for field at the top of the screen to get the the one that does.

- If you are content with the form, confirm your decision by visiting the Buy now key. Then, opt for the costs program you favor and give your accreditations to sign up on an accounts.

- Process the financial transaction. Use your bank card or PayPal accounts to finish the financial transaction.

- Pick the file format and acquire the form on the device.

- Make alterations. Load, change and print and signal the delivered electronically Nebraska Promissory Note - Payable on Demand.

Every template you added to your bank account does not have an expiry day and is the one you have forever. So, in order to acquire or print another backup, just proceed to the My Forms segment and click on the develop you require.

Get access to the Nebraska Promissory Note - Payable on Demand with US Legal Forms, one of the most extensive library of authorized document layouts. Use a huge number of skilled and condition-distinct layouts that fulfill your organization or individual requirements and needs.