This form involves the sale or gift of a small business from one individual to another. The word memorandum is sometimes used when the agreement and transfer has already taken place, but has not yet been reduced to writing. If the transfer is a gift (e.g., on family member to another), the figure of $1.00 could be used or $0.00. Another alternative could be to write the word gift in the blank for the consideration.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

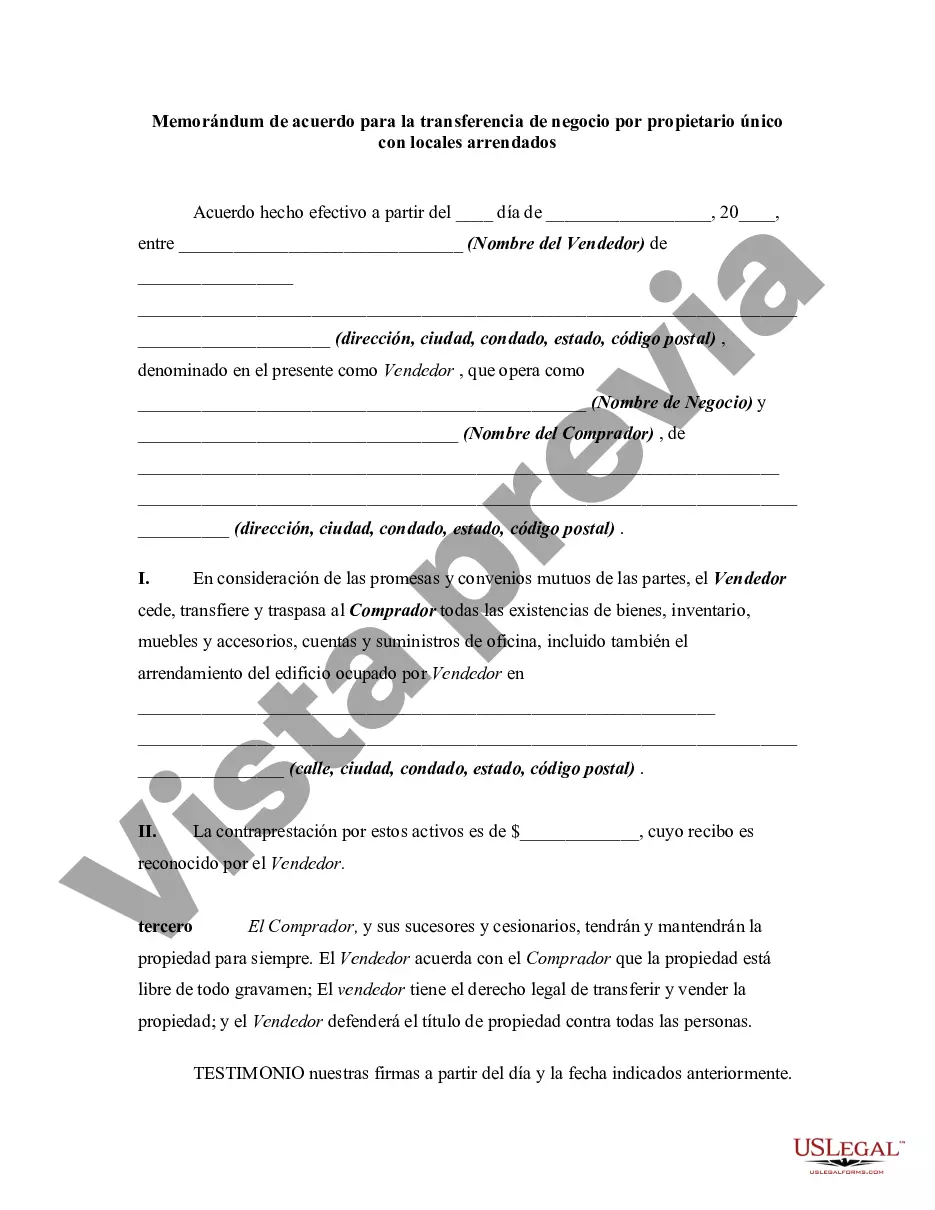

The Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions of transferring ownership of a sole proprietorship business, along with the associated lease agreement for the premises. This memorandum is crucial for documenting the agreement between the current owner (the transferring party) and the new owner (the acquiring party) of the business. Keywords: Nebraska, Memorandum of Agreement, Transfer of Business, Sole Proprietorship, Leased Premises. There are different types of Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises, depending on specific circumstances and considerations. Here are the two common types: 1. Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Lease Assumption: This type of agreement is used when the acquiring party agrees to assume the existing lease agreement for the business premises. The memorandum outlines the terms of the transfer, including the adjustments to be made for the lease terms, rental payments, security deposits, and any other lease-related obligations. 2. Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with New Lease: In this type of agreement, the acquiring party opts to negotiate a new lease agreement with the landlord or property owner. This memorandum outlines the terms and conditions of the business transfer, including the establishment of a new lease agreement for the premises. It covers aspects such as lease negotiations, rental amounts, lease duration, and any additional provisions particular to the new lease agreement. Both types of memorandums typically cover important aspects of the business transfer, including purchase price or consideration, transfer of assets, liabilities, customer lists, inventory, intangible assets, and intellectual property rights. They may also include non-compete agreements, requirements for due diligence, seller financing details, and any additional terms agreed upon by both parties. It is essential to consult with a legal professional or attorney while drafting or reviewing the Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises to ensure compliance with state laws and to protect the rights and interests of all parties involved.The Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions of transferring ownership of a sole proprietorship business, along with the associated lease agreement for the premises. This memorandum is crucial for documenting the agreement between the current owner (the transferring party) and the new owner (the acquiring party) of the business. Keywords: Nebraska, Memorandum of Agreement, Transfer of Business, Sole Proprietorship, Leased Premises. There are different types of Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises, depending on specific circumstances and considerations. Here are the two common types: 1. Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Lease Assumption: This type of agreement is used when the acquiring party agrees to assume the existing lease agreement for the business premises. The memorandum outlines the terms of the transfer, including the adjustments to be made for the lease terms, rental payments, security deposits, and any other lease-related obligations. 2. Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with New Lease: In this type of agreement, the acquiring party opts to negotiate a new lease agreement with the landlord or property owner. This memorandum outlines the terms and conditions of the business transfer, including the establishment of a new lease agreement for the premises. It covers aspects such as lease negotiations, rental amounts, lease duration, and any additional provisions particular to the new lease agreement. Both types of memorandums typically cover important aspects of the business transfer, including purchase price or consideration, transfer of assets, liabilities, customer lists, inventory, intangible assets, and intellectual property rights. They may also include non-compete agreements, requirements for due diligence, seller financing details, and any additional terms agreed upon by both parties. It is essential to consult with a legal professional or attorney while drafting or reviewing the Nebraska Memorandum of Agreement for Transfer of Business by Sole Proprietorship with Leased Premises to ensure compliance with state laws and to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.