Where statutes specify the manner in which a homestead may be released or waived in a particular jurisdiction, such statutes must be strictly followed. In some jurisdictions, there can be no waiver except by deed. Other statutes require that the waiver be acknowledged or witnessed, recorded, or incorporated in an instrument that is independent of the agreement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

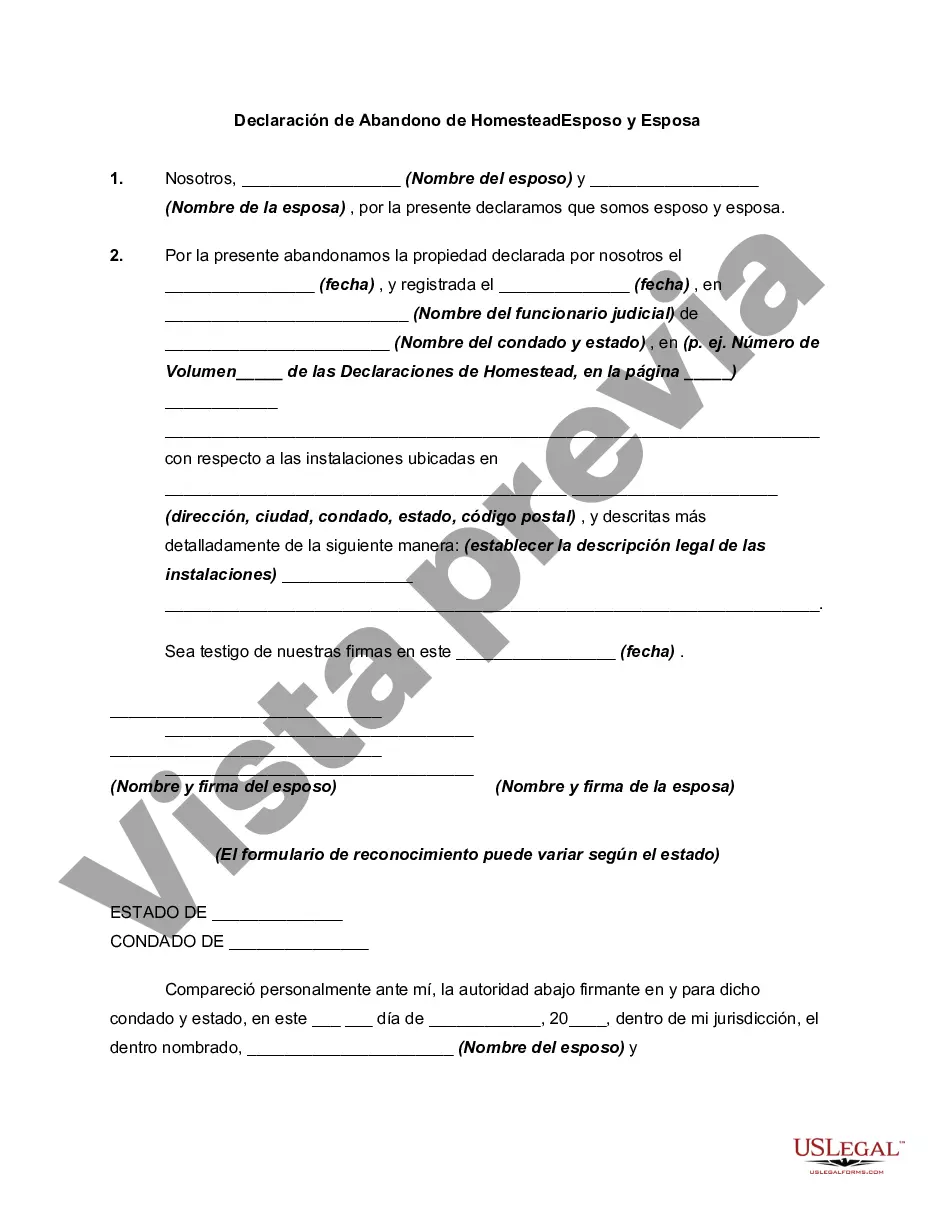

The Nebraska Declaration of Abandonment of Homestead By Husband and Wife is a legal document that pertains to the abandonment of a homestead by both the husband and wife in the state of Nebraska. This declaration is an important step in the process of officially abandoning a homestead. The Nebraska law recognizes that a homestead is a place where a family establishes their primary residence and as such, it holds a special status in terms of legal rights and protections. However, circumstances may arise where both the husband and wife decide to abandon the homestead for various reasons such as relocation, divorce, or financial difficulties. The Nebraska Declaration of Abandonment of Homestead By Husband and Wife is the formal instrument that must be filed to legally declare the abandonment of the homestead. It acts as a written record and proof of the decision by both spouses to terminate their rights and interest in the homestead property. When filing the Nebraska Declaration of Abandonment of Homestead By Husband and Wife, certain key details need to be included. These include the names of both spouses, the property address, the date of abandonment, and a clear statement expressing the intent to abandon the homestead. Signatures of both parties are required to validate the document. It is important to note that there may be variations or specific types of Nebraska Declarations of Abandonment of Homestead By Husband and Wife, depending on the circumstances of the abandonment. For example, if the abandonment is a result of divorce proceedings, a specific divorce-related declaration may be required. In conclusion, the Nebraska Declaration of Abandonment of Homestead By Husband and Wife is a legal document that allows both spouses to officially declare the abandonment of their homestead in Nebraska. It serves as a formal record of their decision and helps to protect the rights of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.