This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

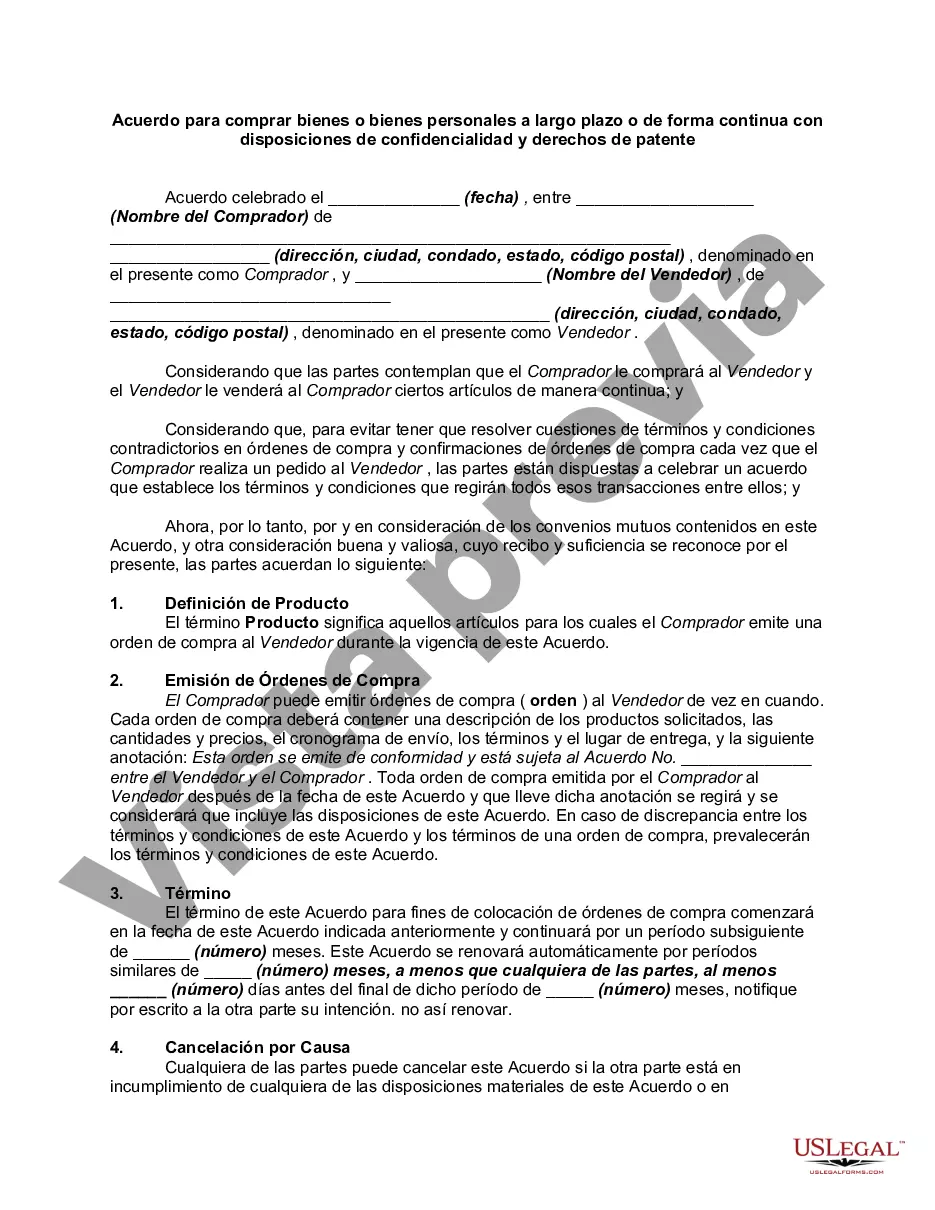

Nebraska Agreement to Purchase Goods or Personal Property over a Long Term or Ongoing Basis with Confidentially Provisions and Patent Rights is a legally binding contract that outlines the terms and conditions between a buyer and a seller for the purchase of goods or personal property over an extended period. This agreement is specific to the state of Nebraska and includes provisions regarding confidentiality and patent rights. The Nebraska Agreement to Purchase Goods or Personal Property over a Long Term or Ongoing Basis with Confidentially Provisions and Patent Rights is crucial for businesses or individuals engaging in long-term transactions, ensuring both parties are protected and have a clear understanding of their rights and obligations. This type of agreement is commonly used in various industries such as manufacturing, technology, and agriculture. Key elements covered in this agreement include: 1. Parties involved: Clearly state the names and addresses of both the buyer and the seller, along with their legal representatives, if applicable. 2. Description of goods or personal property: Provide a detailed description of the items being purchased, including relevant specifications, quality standards, and quantities. 3. Purchase price and payment terms: Specify the agreed-upon purchase price for the goods or personal property and outline the payment terms, including any installment plans or milestone payments. 4. Delivery and acceptance: Define the delivery schedule, transportation responsibilities, and procedures for inspecting and accepting the goods or personal property. 5. Confidentiality provisions: Incorporate provisions that protect both parties from unauthorized disclosure or use of any confidential information shared during the agreement. This may include trade secrets, customer lists, research and development data, or proprietary information. 6. Patent rights: Address the ownership and protection of any intellectual property, including patent rights, copyrights, or trademarks related to the goods or personal property. Specify whether any existing patents will be included in the purchase or if new patents arising from the transaction will be owned by the buyer or the seller. 7. Term and termination: Define the duration of the agreement, including any renewal options, and include provisions for termination by either party if certain conditions are met. Types of Nebraska Agreement to Purchase Goods or Personal Property over a Long Term or Ongoing Basis with Confidentially Provisions and Patent Rights: 1. Manufacturing Agreement: for the long-term purchase of goods from a manufacturer or supplier in Nebraska, ensuring confidentiality of proprietary information and addressing patent rights. 2. Technology Licensing Agreement: for ongoing use and purchase of software, patents, or other technology-related goods, with provisions protecting confidentiality and clearly defining patent rights. 3. Agricultural Product Supply Agreement: for the continuous purchase of agricultural products in Nebraska, addressing confidentiality of farming techniques, trade secrets, and potential patent rights related to new plant strains or breeding methods. In conclusion, the Nebraska Agreement to Purchase Goods or Personal Property over a Long Term or Ongoing Basis with Confidentially Provisions and Patent Rights is a comprehensive contract that protects the interests of both buyers and sellers engaging in long-term transactions involving goods or personal property. It ensures confidentiality of sensitive information and clearly defines patent rights, providing a solid foundation for a successful business relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.