Nebraska Simple Promissory Note for Personal Loan: A Comprehensive Guide Keywords: Nebraska, simple promissory note, personal loan Introduction: A Nebraska Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a personal loan between a borrower and a lender in the state of Nebraska. This note acts as evidence of the loan transaction and includes crucial information to protect both parties involved. Types of Nebraska Simple Promissory Notes for Personal Loan: 1. Nebraska Fixed-Rate Promissory Note: A fixed-rate promissory note in Nebraska refers to a loan agreement where the interest rate remains constant over the agreed loan term. This type of note ensures predictability as borrowers have a clear understanding of their monthly payments, facilitating effective financial planning. 2. Nebraska Variable-Rate Promissory Note: A variable-rate promissory note in Nebraska allows for changes in the interest rate throughout the loan term. The interest rate is tied to a specific financial index, such as the LIBOR or Prime Rate, and can fluctuate accordingly. Borrowers should carefully assess the risks associated with potential interest rate adjustments. 3. Nebraska Installment Promissory Note: An installment promissory note is most commonly used for personal loans in Nebraska. This type of note allows borrowers to repay the loan in regular installments over a specified period, typically monthly. Each installment includes both the principal amount and the accrued interest until the loan is fully repaid. 4. Nebraska Balloon Promissory Note: A balloon promissory note is characterized by small, periodic payments during most of the loan term, followed by one large final payment, known as the balloon payment. This type of note works well for borrowers seeking lower monthly payments initially, with the intent to pay off the remaining balance with a lump sum at the end. Key Components of a Nebraska Simple Promissory Note for Personal Loan: 1. Parties Involved: The note should identify the borrower (referred to as the promise) and the lender (referred to as the promise) involved in the loan agreement. Include their legal names, addresses, and contact information. 2. Loan Amount and Interest Rate: Clearly state the principal loan amount being borrowed and the applicable interest rate, specifying whether it is fixed or variable. These details directly impact the repayment terms. 3. Repayment Terms: Specify the repayment terms such as the loan duration, the frequency of installment payments (monthly, yearly), and the due date of each payment. If applicable, indicate any grace periods or penalties for late payments. 4. Default and Consequences: Define the consequences of defaulting on the loan, including the imposition of late fees, legal expenses, or collection costs. Clearly outline the actions that the lender can take in the event of default. 5. Signatures and Witnesses: Include spaces for both the borrower and lender to sign and date the promissory note. Having a notary public witness the signing can add an extra layer of authenticity. Conclusion: Obtaining a Nebraska Simple Promissory Note for Personal Loan is crucial to ensure the legality and protection of both parties involved in a loan transaction. Understanding the different types of notes and their respective components can help borrowers and lenders establish clear and fair borrowing terms in accordance with Nebraska state laws.

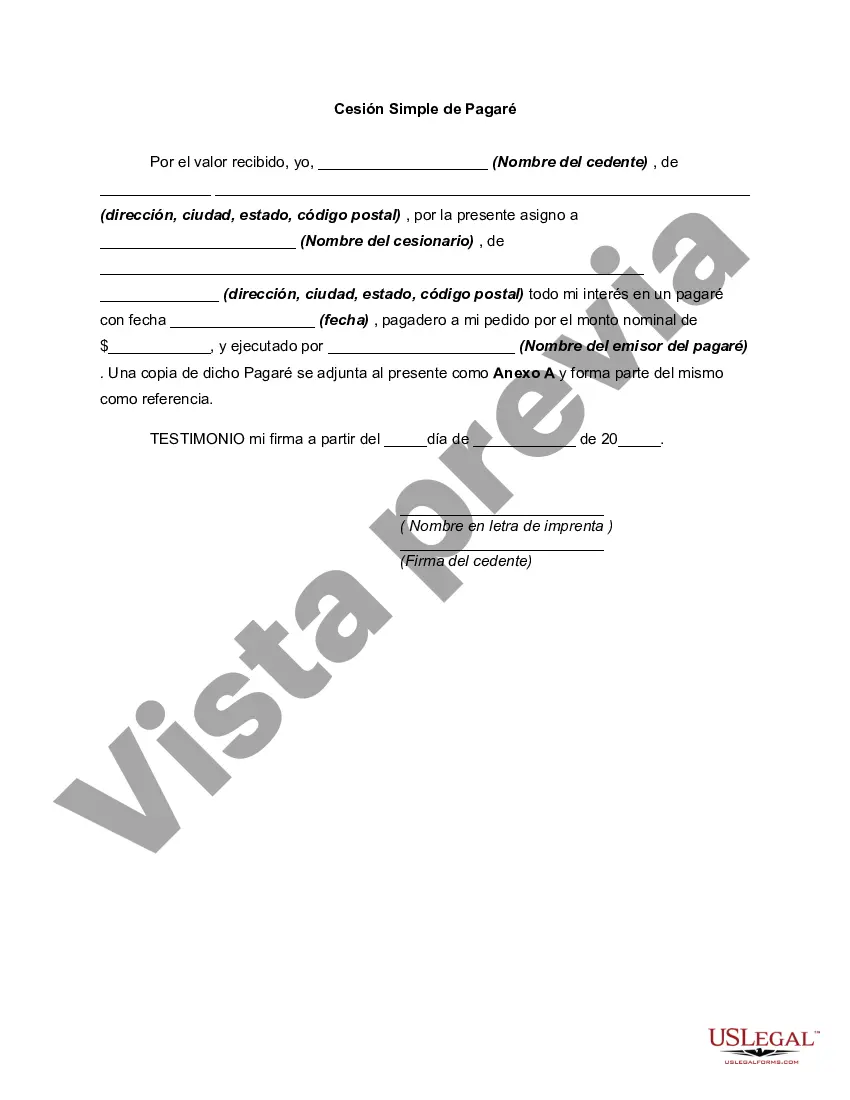

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out Nebraska Pagaré Simple Para Préstamo Personal?

Finding the right lawful document web template could be a battle. Needless to say, there are plenty of themes available on the Internet, but how can you obtain the lawful develop you want? Use the US Legal Forms internet site. The support provides a large number of themes, like the Nebraska Simple Promissory Note for Personal Loan, that can be used for business and private demands. Each of the kinds are checked out by pros and satisfy state and federal specifications.

If you are already listed, log in in your accounts and then click the Down load option to obtain the Nebraska Simple Promissory Note for Personal Loan. Utilize your accounts to check with the lawful kinds you may have ordered formerly. Go to the My Forms tab of your own accounts and get one more backup of the document you want.

If you are a whole new end user of US Legal Forms, allow me to share straightforward guidelines that you can follow:

- Initially, make sure you have chosen the right develop for your personal city/region. You can look over the form making use of the Preview option and browse the form explanation to make sure it is the best for you.

- When the develop is not going to satisfy your needs, take advantage of the Seach discipline to discover the appropriate develop.

- Once you are positive that the form is proper, click the Acquire now option to obtain the develop.

- Select the costs strategy you would like and enter the required info. Create your accounts and purchase the transaction using your PayPal accounts or charge card.

- Pick the file format and download the lawful document web template in your gadget.

- Complete, revise and produce and indication the attained Nebraska Simple Promissory Note for Personal Loan.

US Legal Forms is the greatest library of lawful kinds for which you will find a variety of document themes. Use the service to download expertly-made files that follow condition specifications.