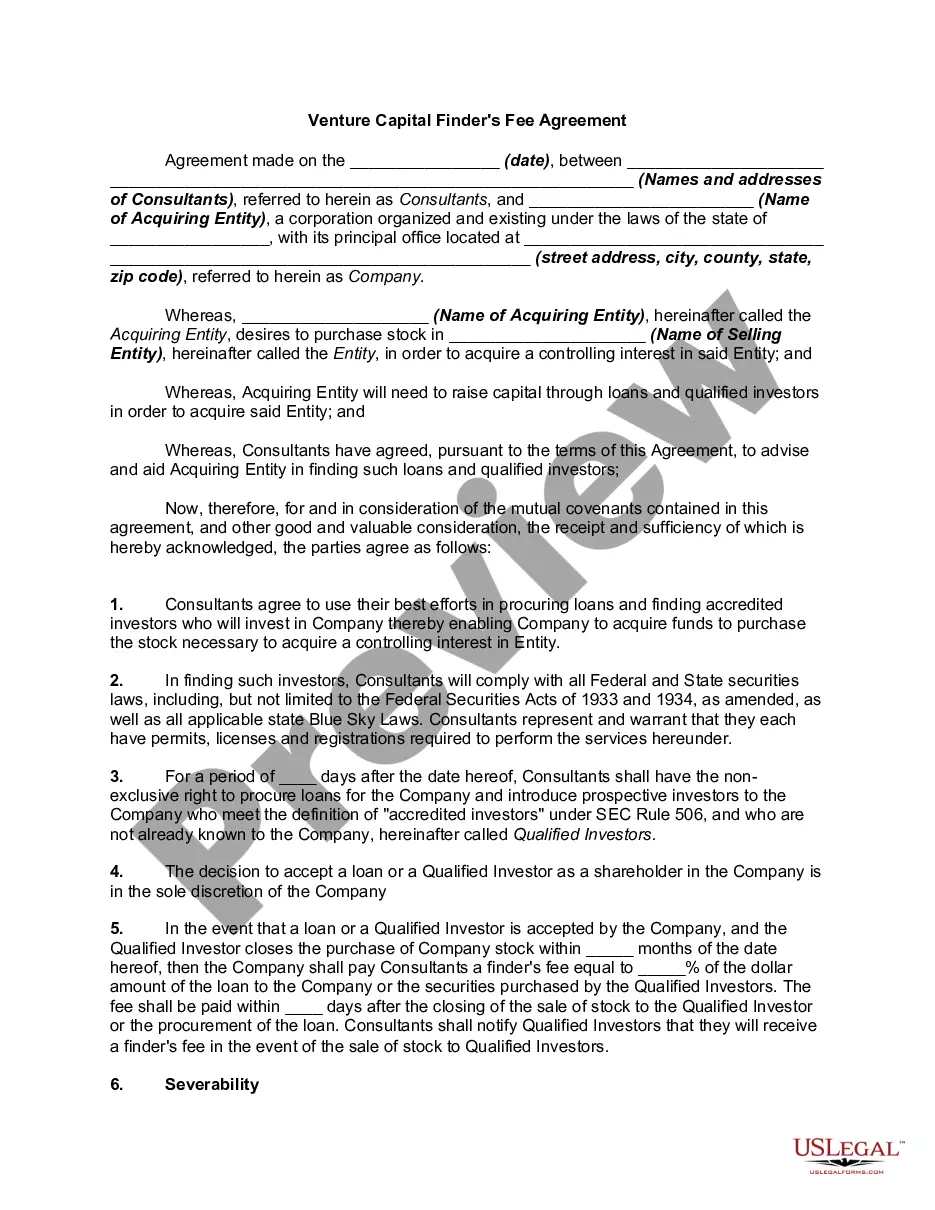

Nebraska Venture Capital Finder's Fee Agreement

Description

Companies who seek venture capital are willing to exchange equity in the company in return for money to grow or expand the business. Those who provide venture capital generally seek a greater degree of control in the company affairs and quicker return on their investment than standard investors.

How to fill out Venture Capital Finder's Fee Agreement?

You can spend numerous hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms provides a multitude of legal documents that are vetted by professionals.

It's easy to obtain or create the Nebraska Venture Capital Finder's Fee Agreement from the service.

If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Nebraska Venture Capital Finder's Fee Agreement.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the appropriate document template for the state/city of your choice.

- Review the form description to ensure you've chosen the correct one.

Form popularity

FAQ

While there is no set percentage, the average finder's fee for real estate commonly ranges from 5% to 35% of the seller's commission. Sometimes a finder's fee is money, and other times it's a gift.

Finder's fees are usually determined by how much money the finder's efforts bring in for the company. But a legal issue arises when the finder is not properly licensed as a broker-dealer. In that case, the finder's fee agreement "is an illegal contract and is likely unenforceable," Johnson writes for Inside Counsel.

The commission is usually a percentage of the sale price. Sales agents who earn commissions can work for the buyer or the seller. A finders fee, on the other hand, is a payment that someone earns after making an introduction or discovering an opportunity that results in a sale.

While there is no set percentage, the average finder's fee for real estate commonly ranges from 5% to 35% of the seller's commission. Sometimes a finder's fee is money, and other times it's a gift.

Kickbacks and referral fees are essentially a hidden markup on the product or service. If they are not disclosed, they have the great potential of violating trust between the referrer and the individual being referred.

A finder's fee isn't legally binding, so it is often simply a gift from one party to another. This is commonly seen in real estate deals. If someone is selling their home and their friend connects them with a potential buyer, the seller might give their friend a small portion of the sale when the deal is finalized.

A Finder's Fee Agreement outlines the relationship and the compensation to be expected in a relationship where an incentive is being offered in exchange for new leads or clients. Documenting your arrangement on paper helps ensure that the interests of both parties are laid out in certain terms.

The terms of finder's fees can vary greatly, with some citing 5% to 35% of the total value of the deal being used as a benchmark. It's a staple of Fundera's business model. In many cases, the finder's fee may simply be a gift from one party to another, as no legal obligation to pay a commission exists.

Follow these steps to compose a business Referral Fee Agreement:State the names of the parties - customer and finder.Describe the purpose of the contract.Term of the agreement.Finder's fee.Exclusivity clause.Confidentiality clause.Termination clause.Signatures of the parties and the actual date of signing.