Nebraska Agreement for Computer Consulting and Training Services

Description

How to fill out Agreement For Computer Consulting And Training Services?

It's feasible to spend hours online trying to locate the valid document format that satisfies both state and federal requirements you may have. US Legal Forms offers an extensive array of valid forms that are assessed by specialists.

You can download or print the Nebraska Agreement for Computer Consulting and Training Services from our platform.

If you already have a US Legal Forms account, you can sign in and then click the Download button. After that, you can fill out, modify, print, or sign the Nebraska Agreement for Computer Consulting and Training Services. Each valid document you purchase is yours permanently. To obtain another copy of any acquired form, navigate to the My documents tab and click the corresponding button.

Make modifications to your file if needed. You can fill out, modify, sign, and print the Nebraska Agreement for Computer Consulting and Training Services. Download and print a wide variety of document templates using the US Legal Forms site, which offers the largest collection of valid forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you're using the US Legal Forms site for the first time, follow the simple instructions provided below.

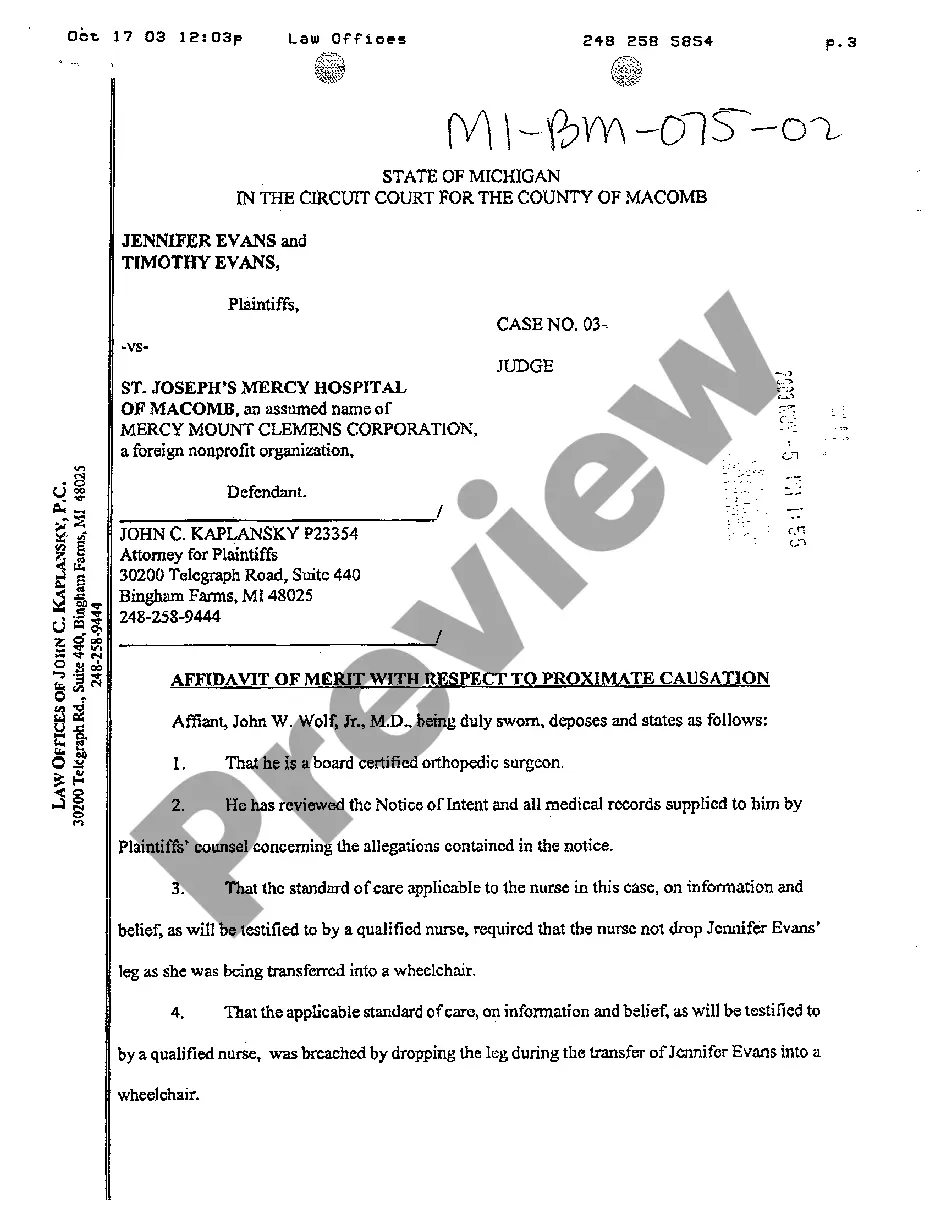

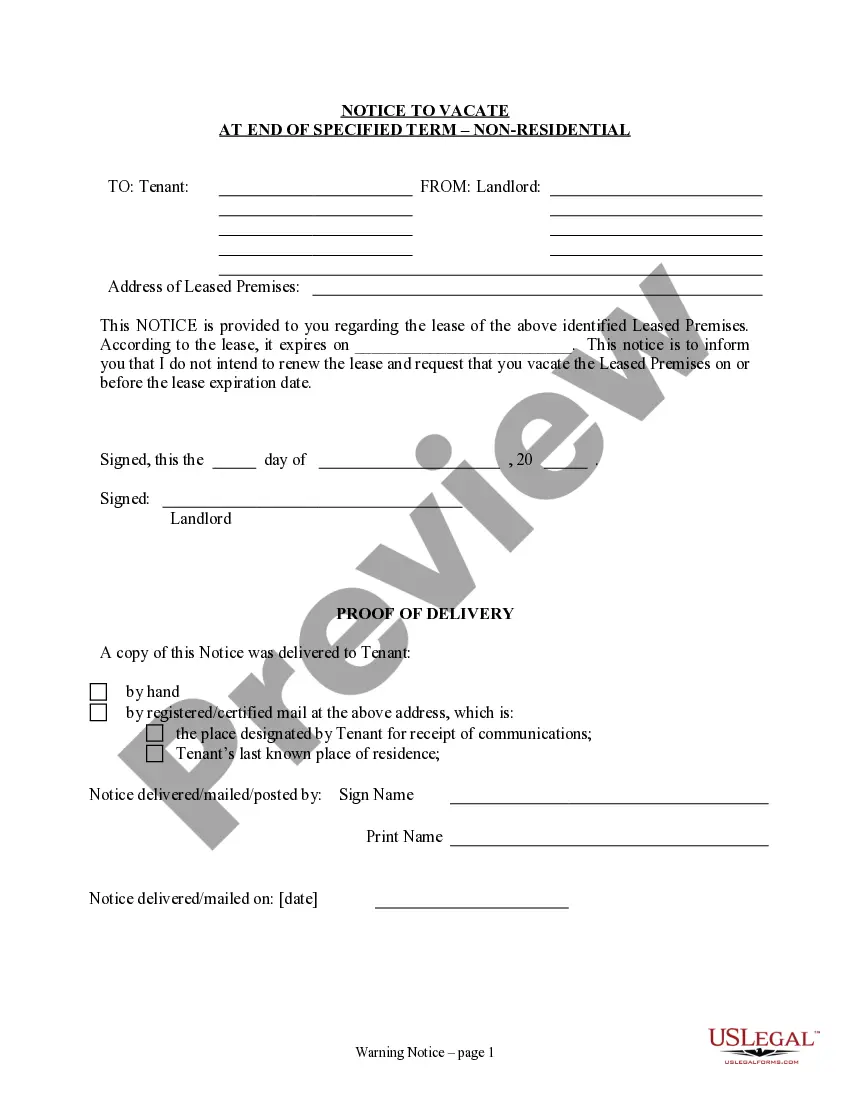

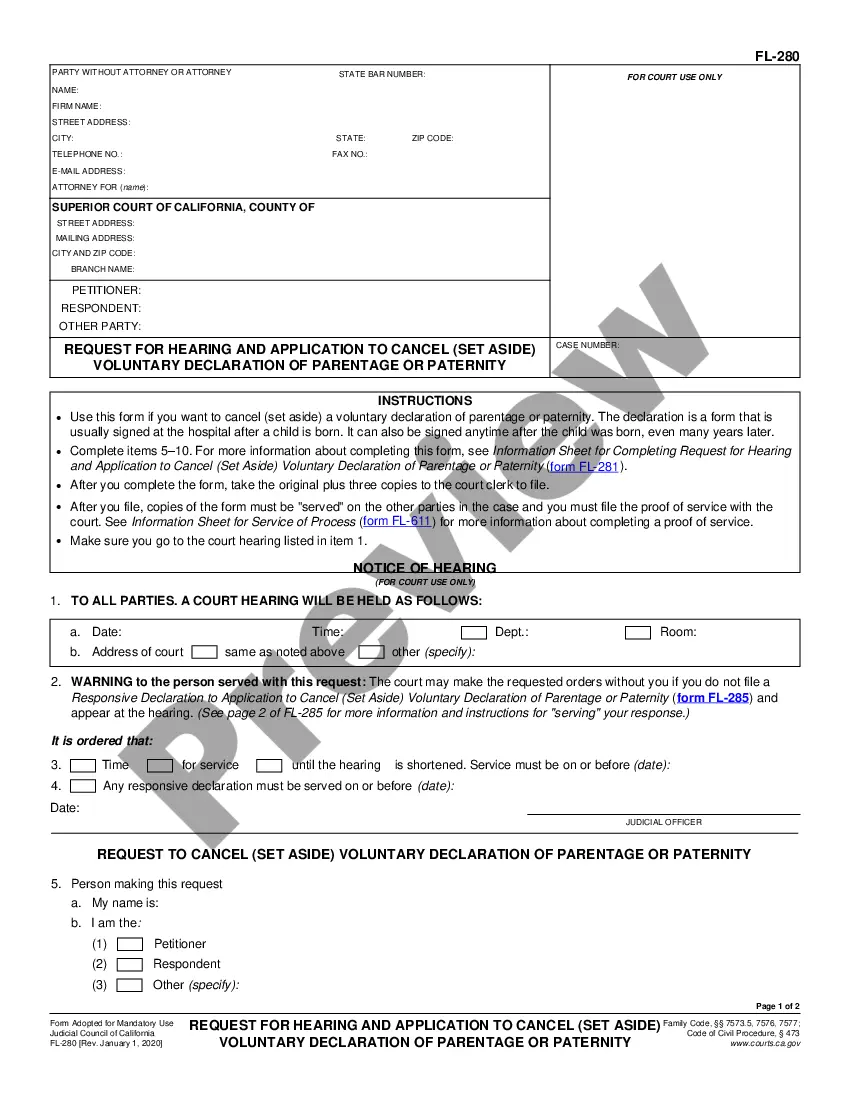

- First, make sure you have selected the correct document format for the state/region of your choice. Review the document details to ensure you've chosen the appropriate form. If available, utilize the Review button to examine the document format as well.

- If you're seeking another version of your document, use the Search field to find the format that meets your requirements and preferences.

- Once you've located the desired format, simply click Purchase now to proceed.

- Select the pricing plan you wish to use, enter your information, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the valid document.

- Choose the format of your file and download it to your device.

Form popularity

FAQ

Form 20 in Nebraska is used for reporting income and calculating Nebraska state income tax. It's important for professionals, including those in the consulting industry, to understand this form to maintain compliance. If you're working under a Nebraska Agreement for Computer Consulting and Training Services, ensure you are familiar with Form 20 and its requirements to avoid any tax-related issues.

Yes, consulting income is typically taxable at the federal level and may also be taxable at the state level in Nebraska. This means that any earnings derived from consulting agreements require reporting on your tax returns. If you are providing services under a Nebraska Agreement for Computer Consulting and Training Services, it’s vital to track your income for accurate tax reporting.

Consulting services can be taxable in Nebraska, depending on the nature of the work performed. If the consulting involves providing tangible property or certain specified services, it may incur sales tax. When you engage in a Nebraska Agreement for Computer Consulting and Training Services, be mindful of these tax regulations to ensure proper compliance.

Yes, in Nebraska, software as a service (SaaS) may be considered taxable under certain conditions. The taxation depends on how the service is delivered and its specific features. For businesses entering into a Nebraska Agreement for Computer Consulting and Training Services, it is essential to clarify the tax implications of any SaaS solutions included in the service offerings.

To write a contract agreement for services, start with a title, specifying the involved parties and the services offered. Include detailed sections on payment terms, responsibilities, and termination conditions. Using standard templates, such as the Nebraska Agreement for Computer Consulting and Training Services available on US Legal Forms, can guide you in structuring a comprehensive contract effectively.

To set up a consulting agreement, you should begin by clearly outlining the services you will provide. Once you have defined the scope of work, include payment terms and any necessary confidentiality clauses. Platforms like US Legal Forms offer templates, including the Nebraska Agreement for Computer Consulting and Training Services, which can simplify this process and ensure you cover all required elements.

A consultant contract should include crucial elements such as the scope of work, payment terms, confidentiality clauses, and dispute resolution procedures. Additionally, it is important to specify the duration of the agreement and any deliverables expected. These components ensure that both parties understand their rights and responsibilities, enhancing your Nebraska Agreement for Computer Consulting and Training Services.

There are several types of contracts, but the four main types include bilateral, unilateral, express, and implied contracts. Bilateral contracts involve mutual obligations, whereas unilateral contracts require one party to fulfill their promise upon completion of a task. Express contracts are clearly stated, while implied contracts are formed by actions or circumstances. Understanding these types can help you when drafting your Nebraska Agreement for Computer Consulting and Training Services.

Consultants should have a well-structured agreement, like the Nebraska Agreement for Computer Consulting and Training Services, to cover essential aspects of their work. This contract should specify the services provided, payment arrangement, and the duration of the engagement. By using a clear contract, you minimize misunderstandings and protect your interests.

A consulting services agreement, such as the Nebraska Agreement for Computer Consulting and Training Services, outlines the terms between a consultant and their client. This document defines the scope of work, payment terms, and responsibilities of both parties. By having this agreement in place, you ensure clear expectations and create a framework for a successful consulting relationship.