Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor: Explained The Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a vital legal process that allows collection agencies to assert their claims on unpaid debts and report their experiences with debtors in the state of Nebraska. This detailed description aims to shed light on the purpose, procedure, and variations of this essential process. Purpose: The primary purpose of Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor is to provide a platform for collection agencies to officially record their claims against debtors and share their experiences regarding payment delinquencies with relevant authorities. By formalizing these claims, the process helps protect the rights of collection agencies and provides a legal framework to encourage debtors to fulfill their financial obligations. Procedure: 1. Filing a Claim: Collection agencies seeking to assert their claims on unpaid debts in Nebraska must initiate the process by submitting a formal claim with the appropriate legal entity or authority. The claim should contain accurate and comprehensive information about the debtor, the nature of the debt, and any supporting documentation available. 2. Verification Process: After the claim is submitted, the relevant entity will review and verify the submitted information to establish its authenticity. This step ensures that the claim is genuine and upholds the due diligence of all parties involved. 3. Acceptance: Once the claim is verified, the Nebraska Acceptance of Claim by Collection Agency allows the entity to officially accept the claim. This acceptance legally acknowledges the collection agency's rights to collect the unpaid debt from the debtor in accordance with applicable laws and regulations. 4. Reporting Experience with Debtor: Alongside the acceptance of a claim, collection agencies are encouraged to provide a detailed report of their experience with the debtor. This report typically includes information on the debt repayment history, communication attempts, and any relevant interactions or agreements between the agency and debtor. It helps provide a comprehensive overview to assist in evaluating the legitimacy and validity of the claim. Variations: While there may not be specific subtypes of Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor, variations may arise in terms of the types of debts being claimed and the entities involved. Different collection agencies may submit claims for various kinds of debts such as outstanding credit card bills, medical expenses, loans, or utility bills. Furthermore, depending on the jurisdiction, the Nebraska Acceptance of Claim by Collection Agency may involve different types of administrative bodies, legal authorities, or even private entities responsible for overseeing the claims process. It is crucial for collection agencies to familiarize themselves with the specific guidelines and regulations set forth by the relevant entities to ensure compliance and maximize their chances of successful claim acceptance and debt recovery. In conclusion, the Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor provides a structured procedure for collection agencies to assert their claims on unpaid debts and share their experiences with debtors. By adhering to the proper steps and meeting the requirements, collection agencies can protect their rights and contribute towards ensuring fair debt collection practices within the state of Nebraska.

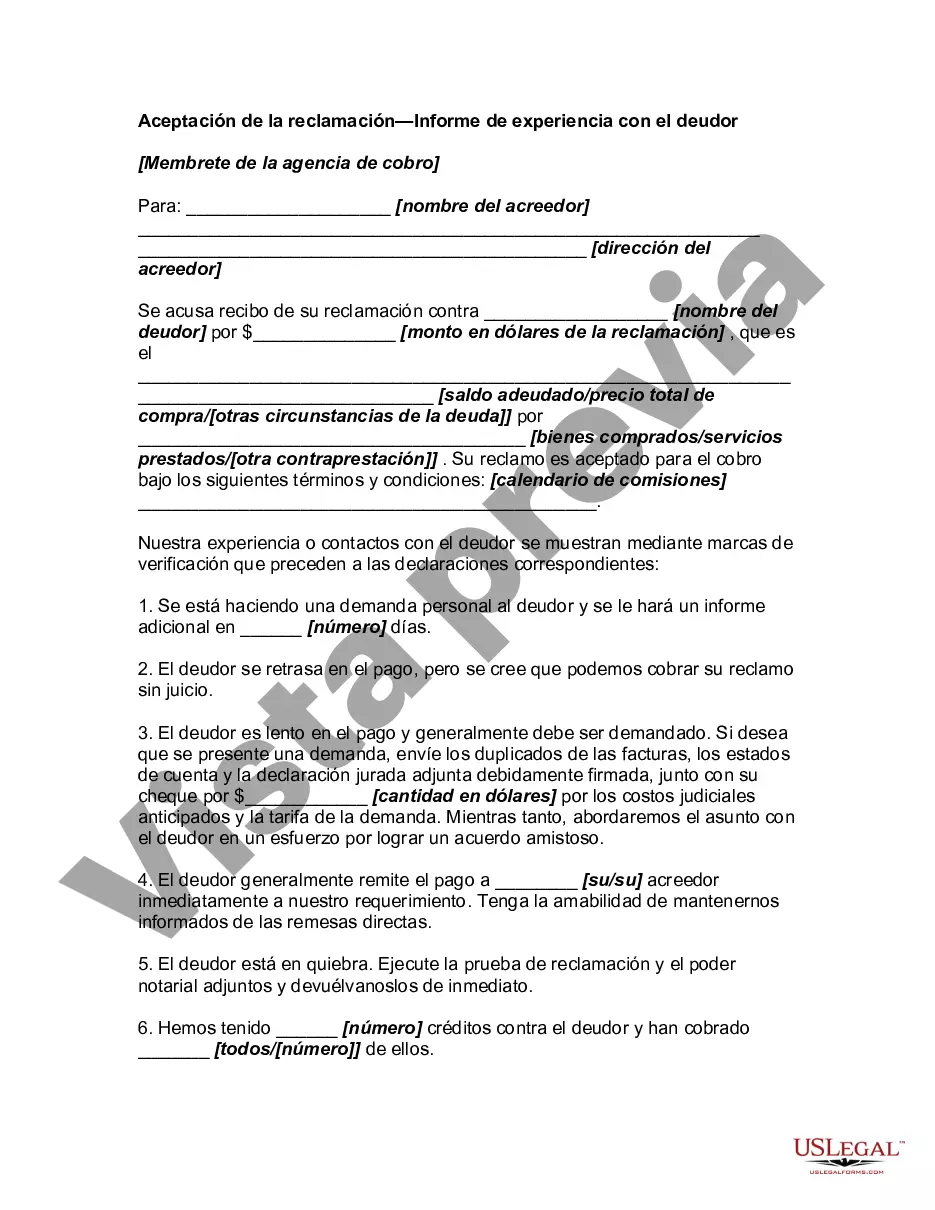

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Nebraska Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

If you need to complete, download, or printing authorized record layouts, use US Legal Forms, the biggest selection of authorized forms, that can be found on-line. Take advantage of the site`s basic and handy research to get the paperwork you need. Various layouts for enterprise and specific functions are sorted by groups and suggests, or keywords. Use US Legal Forms to get the Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor in a couple of clicks.

If you are already a US Legal Forms buyer, log in for your account and click on the Acquire key to have the Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor. You may also entry forms you earlier saved in the My Forms tab of your account.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for your appropriate city/region.

- Step 2. Use the Preview method to check out the form`s content material. Don`t overlook to read through the outline.

- Step 3. If you are unsatisfied using the type, make use of the Look for discipline at the top of the display to discover other versions in the authorized type web template.

- Step 4. After you have found the form you need, click the Get now key. Opt for the rates prepare you favor and add your qualifications to register for an account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal account to finish the financial transaction.

- Step 6. Pick the file format in the authorized type and download it in your gadget.

- Step 7. Total, change and printing or signal the Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

Every authorized record web template you get is the one you have eternally. You possess acces to each and every type you saved within your acccount. Click on the My Forms area and pick a type to printing or download once again.

Compete and download, and printing the Nebraska Acceptance of Claim by Collection Agency and Report of Experience with Debtor with US Legal Forms. There are millions of expert and status-distinct forms you can utilize for the enterprise or specific requires.