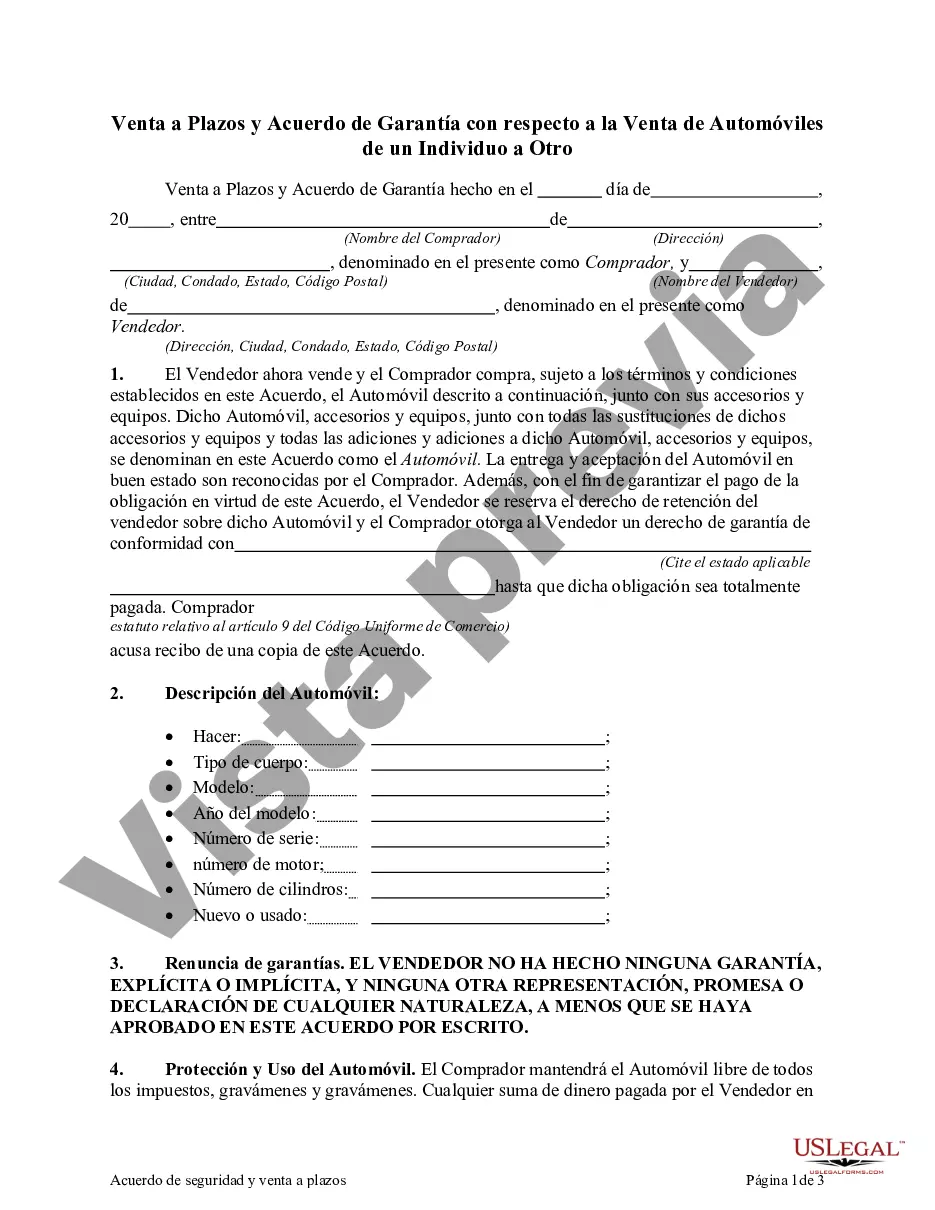

Nebraska Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another is a legal document that outlines the terms and conditions of the purchase and financing of a vehicle. It is commonly used when one individual sells a car to another individual in Nebraska and the buyer requires installment payments. This agreement serves as a binding contract between the buyer and seller, ensuring both parties are protected. It includes essential details such as the names and contact information of the buyer and seller, vehicle description including make, model, VIN number, and year, as well as the purchase price and method of payment. The Nebraska Installment Sale and Security Agreement specifies the payment terms, which typically include the down payment, interest rate, monthly installment amount, and the duration of the agreement. It is important to note that the agreement must comply with Nebraska state laws governing vehicle financing and installment sales. The primary purpose of this agreement is to establish the buyer's ownership of the vehicle while allowing them to make payments over time. The seller retains a security interest in the automobile until the full payment of the agreement is made, ensuring that the buyer has a legal obligation to complete payment. Different types of Nebraska Installment Sale and Security Agreements regarding the sale of automobiles from one individual to another can include variations such as: 1. Standard Installment Sale Agreement: This type of agreement is the most common and straightforward. It outlines the terms and conditions of the purchase, including payment schedule and interest rate. 2. Balloon Payment Agreement: In this type of agreement, the buyer makes smaller monthly payments but a larger final "balloon" payment at the end of the term. This can be beneficial for those who expect an increase in income or plan to refinance the vehicle. 3. Secured Installment Sale Agreement: This type of agreement includes an additional security interest that may require collateral other than the financed vehicle. It provides extra protection to the seller in case of default or non-payment by the buyer. 4. Variable Interest Rate Agreement: This agreement allows for a fluctuating interest rate throughout the term of the agreement. The interest rate is often tied to an external financial index, such as the prime rate. It is essential to consider consulting with a legal professional or utilizing a redrafted template specific to Nebraska laws to ensure the agreement is legally binding and properly protects both parties' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Venta a plazos y acuerdo de seguridad con respecto a la venta de automóviles de un individuo a otro - Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another

Description

How to fill out Nebraska Venta A Plazos Y Acuerdo De Seguridad Con Respecto A La Venta De Automóviles De Un Individuo A Otro?

It is possible to invest hours on the Internet trying to find the authorized document design that fits the state and federal demands you will need. US Legal Forms provides a large number of authorized forms which can be examined by professionals. You can easily acquire or produce the Nebraska Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another from your assistance.

If you have a US Legal Forms bank account, you are able to log in and click on the Acquire button. Next, you are able to comprehensive, change, produce, or sign the Nebraska Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another. Every authorized document design you purchase is your own for a long time. To get another duplicate of any bought develop, check out the My Forms tab and click on the related button.

If you work with the US Legal Forms web site the very first time, adhere to the basic recommendations below:

- Very first, make sure that you have selected the correct document design for your county/metropolis of your choosing. Read the develop information to make sure you have picked the correct develop. If offered, take advantage of the Preview button to search through the document design too.

- If you want to get another edition of the develop, take advantage of the Search area to discover the design that suits you and demands.

- Once you have discovered the design you would like, simply click Acquire now to continue.

- Select the prices program you would like, type in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You can use your charge card or PayPal bank account to cover the authorized develop.

- Select the file format of the document and acquire it to the system.

- Make alterations to the document if needed. It is possible to comprehensive, change and sign and produce Nebraska Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another.

Acquire and produce a large number of document web templates making use of the US Legal Forms website, that offers the most important assortment of authorized forms. Use expert and condition-particular web templates to deal with your business or personal needs.