Nebraska Cash Receipts Control Log is an essential financial management tool used by businesses and organizations in the state of Nebraska to monitor, document, and track all incoming cash payments. This log provides a comprehensive record of cash receipts, ensuring accurate record-keeping, increased financial transparency, and internal control over the cash management process. The primary purpose of the Nebraska Cash Receipts Control Log is to record and reconcile all cash received by an entity. It serves as an effective means to prevent fraud, errors, and discrepancies in cash handling. The log typically includes various details such as the date of receipt, source or payer information, amount received, purpose of payment, and any additional remarks or notes that might be pertinent. Keywords: Nebraska, cash receipts, control log, financial management, businesses, organizations, monitor, document, track, incoming cash payments, record-keeping, financial transparency, internal control, cash management process, reconcile, fraud, errors, discrepancies, cash handling, date of receipt, source, payer information, amount received, purpose of payment, remarks, notes. Different types of Nebraska Cash Receipts Control Log: 1. General Cash Receipts Control Log: This is the standard version used by most businesses and organizations in Nebraska. It allows them to record all types of cash receipts received, including payments from customers, clients, donors, and other sources. 2. Sales Cash Receipts Control Log: This specific type of cash receipts control log is primarily used by retail businesses or those involved in sales transactions. It focuses on recording cash receipts related to product or service sales, including details like the sales date, customer information, sales amount, and payment method. 3. Donation Cash Receipts Control Log: Nonprofit organizations or entities reliant on donations often use this type of control log to keep track of cash donations received. It helps maintain transparency, accuracy, and accountability in handling donations while providing the necessary data for tax reporting and compliance purposes. 4. Event Cash Receipts Control Log: Entities hosting events or fundraisers often employ this log to document and manage cash receipts generated at these occasions. It allows them to properly account for ticket sales, concessions, sponsorships, and other cash inflows associated with the event. 5. Petty Cash Receipts Control Log: This particular control log is used to track and manage small, everyday cash transactions typically reimbursed from a petty cash fund. It helps businesses maintain control over petty expenses, ensuring proper documentation of each disbursement and receipt. Keywords: General Cash Receipts Control Log, Sales Cash Receipts Control Log, Donation Cash Receipts Control Log, Event Cash Receipts Control Log, Petty Cash Receipts Control Log, businesses, organizations, retail, sales transactions, product, service sales, sales date, customer information, payment method, donations, nonprofit organizations, tax reporting, compliance, fundraisers, ticket sales, concessions, sponsorships, inflows, petty cash fund, expenses, disbursement, receipt.

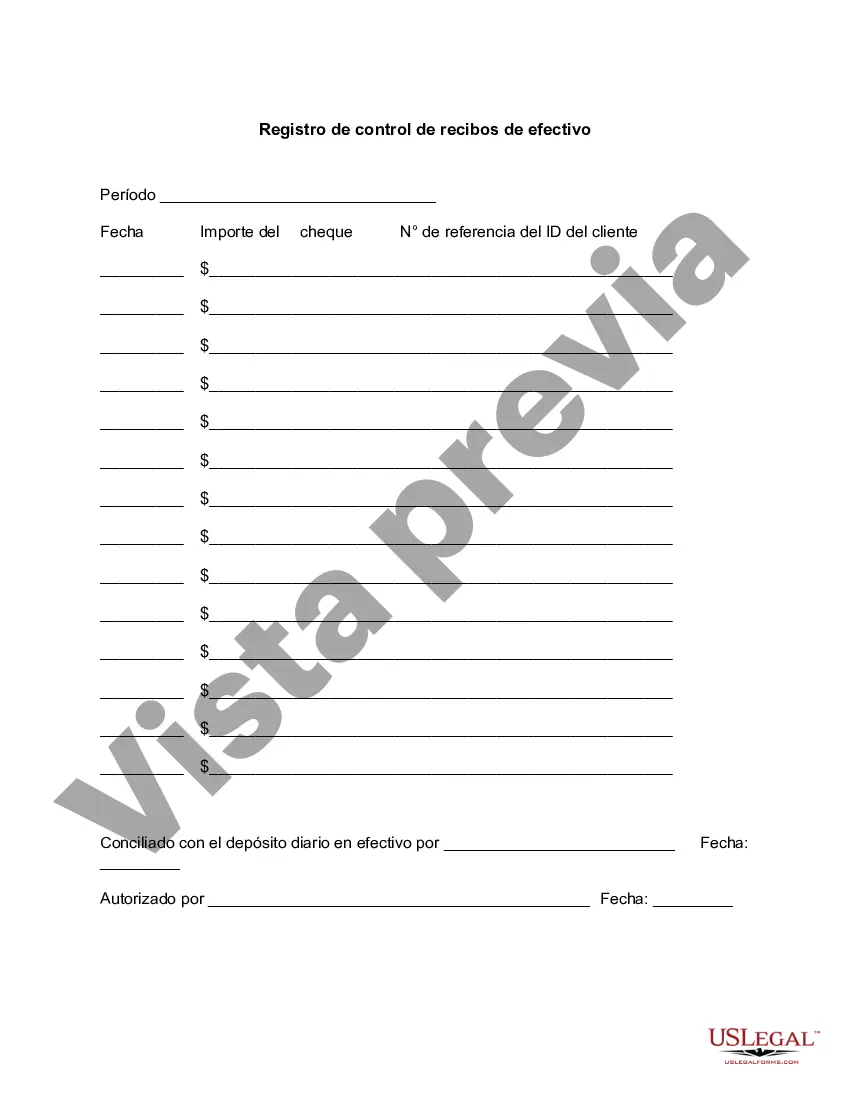

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Nebraska Registro De Control De Recibos De Efectivo?

Have you been within a place the place you will need paperwork for sometimes enterprise or person reasons virtually every day? There are a lot of legal papers layouts accessible on the Internet, but locating types you can rely on isn`t effortless. US Legal Forms offers a large number of type layouts, like the Nebraska Cash Receipts Control Log, which can be created to satisfy federal and state requirements.

In case you are presently acquainted with US Legal Forms internet site and have your account, basically log in. Following that, you may down load the Nebraska Cash Receipts Control Log format.

If you do not have an profile and need to start using US Legal Forms, abide by these steps:

- Obtain the type you want and make sure it is to the appropriate town/state.

- Utilize the Review switch to analyze the form.

- Read the information to actually have chosen the appropriate type.

- When the type isn`t what you`re looking for, take advantage of the Look for field to obtain the type that meets your requirements and requirements.

- Once you discover the appropriate type, simply click Purchase now.

- Opt for the pricing plan you would like, complete the necessary information to make your account, and pay money for your order with your PayPal or bank card.

- Pick a practical file file format and down load your duplicate.

Find every one of the papers layouts you possess bought in the My Forms food list. You can aquire a extra duplicate of Nebraska Cash Receipts Control Log at any time, if possible. Just select the needed type to down load or print out the papers format.

Use US Legal Forms, one of the most comprehensive collection of legal varieties, in order to save some time and avoid blunders. The assistance offers expertly created legal papers layouts that you can use for a selection of reasons. Make your account on US Legal Forms and initiate generating your lifestyle a little easier.