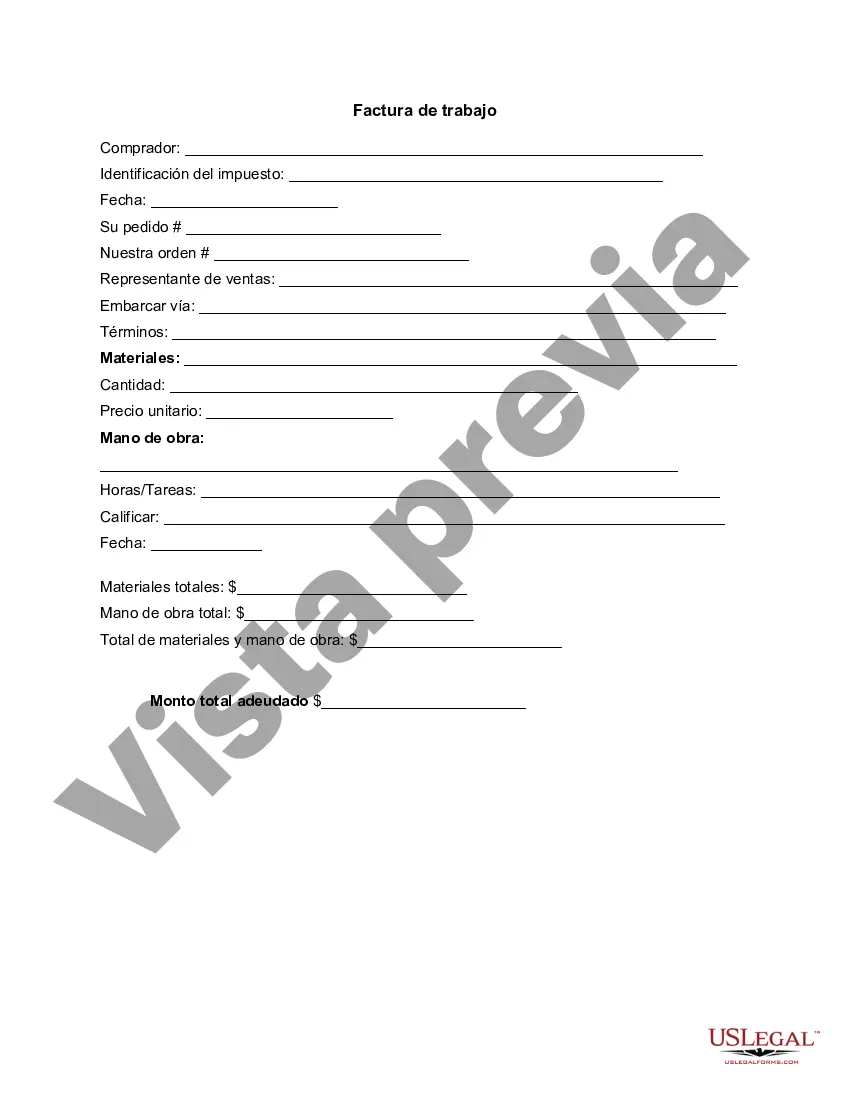

Nebraska Invoice Template for Sole Trader is a customizable and user-friendly document that helps sole traders in Nebraska create professional invoices for their business transactions. This invoice template is specifically designed to meet the invoicing needs and legal requirements of sole traders operating in Nebraska. Key features of the Nebraska Invoice Template for Sole Trader include: 1. Business Information: This template allows sole traders to enter their business information such as business name, logo, address, and contact details. It ensures the invoice reflects their professional identity. 2. Client Information: There is a provision to enter the client's details, including their name, address, and contact information. This ensures that the invoice is properly addressed and directed to the client. 3. Invoice Number: Each invoice generated using this template is assigned a unique invoice number, which aids in seamless tracking and organization of invoices. This system prevents any duplication or confusion in the invoicing process. 4. Itemized Description: The template provides ample space to list individual products or services provided, along with their detailed descriptions, quantities, rates, and applicable taxes. It allows sole traders to specify the details of each item or service being invoiced, making it transparent and easier for clients to understand. 5. Tax Calculation: Nebraska Invoice Template for Sole Trader incorporates tax calculation functionality, enabling sole traders to accurately calculate and include the appropriate taxes in their invoices, based on Nebraska's tax regulations. 6. Total Amount Due: The template automatically calculates the total amount due by summing up the individual items' prices and applicable taxes. It prominently displays the total amount payable, ensuring clients easily identify the outstanding balance. Types of Nebraska Invoice Templates for Sole Traders: 1. Basic Nebraska Invoice Template: This type of template includes essential invoice elements for smaller transactions, including business information, client details, itemized description, taxes, and total amount due. 2. Comprehensive Nebraska Invoice Template: Designed for more complex transactions, this template includes additional sections such as terms and conditions, payment due dates, and payment methods, along with all the features available in the basic template. 3. Professional Nebraska Invoice Template: This template incorporates a more polished and professional design, including a well-organized layout, customized branding elements, and advanced formatting options, offering sole traders an elevated invoicing experience. In conclusion, the Nebraska Invoice Template for Sole Trader is a valuable tool for sole traders in Nebraska to streamline their invoicing process, maintain professionalism, and ensure compliance with state tax regulations. With different types available, sole traders can choose the template that best meets their specific requirements and project a more professional image to clients.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Plantilla de factura para comerciante único - Invoice Template for Sole Trader

Description

How to fill out Nebraska Plantilla De Factura Para Comerciante único?

Choosing the right legitimate document web template can be quite a battle. Of course, there are a variety of web templates available on the net, but how would you find the legitimate kind you want? Utilize the US Legal Forms website. The support delivers a large number of web templates, such as the Nebraska Invoice Template for Sole Trader, which you can use for enterprise and personal requires. Every one of the forms are examined by specialists and meet state and federal specifications.

Should you be previously signed up, log in for your accounts and then click the Acquire switch to have the Nebraska Invoice Template for Sole Trader. Make use of accounts to check through the legitimate forms you might have acquired previously. Proceed to the My Forms tab of your respective accounts and acquire one more copy of the document you want.

Should you be a fresh end user of US Legal Forms, allow me to share basic instructions that you should follow:

- Very first, ensure you have selected the proper kind to your area/state. It is possible to look over the shape making use of the Review switch and browse the shape outline to make certain this is basically the right one for you.

- In the event the kind does not meet your needs, use the Seach area to obtain the appropriate kind.

- Once you are sure that the shape is proper, go through the Buy now switch to have the kind.

- Pick the costs prepare you need and enter in the required details. Design your accounts and pay for your order with your PayPal accounts or credit card.

- Select the submit structure and obtain the legitimate document web template for your device.

- Comprehensive, change and print out and indication the obtained Nebraska Invoice Template for Sole Trader.

US Legal Forms may be the largest local library of legitimate forms where you can see numerous document web templates. Utilize the service to obtain professionally-manufactured papers that follow state specifications.