The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

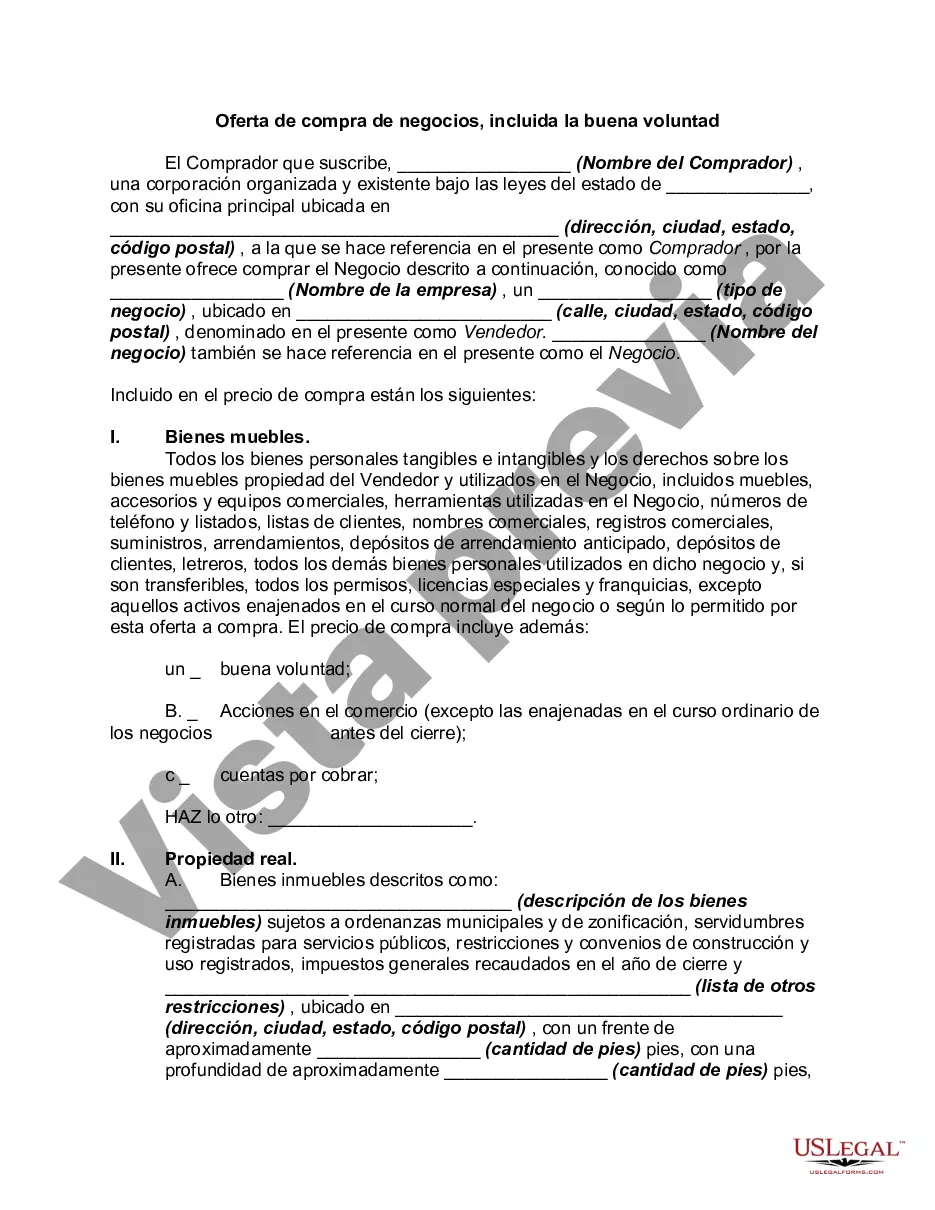

Nebraska Offer to Purchase Business, Including Good Will, is a legal document used in the state of Nebraska when buying a business. This document outlines the terms and conditions of the sale, including the transfer of assets, liabilities, and the goodwill associated with the business. It is important to understand the different types of Nebraska Offer to Purchase Business, Including Good Will, as they may vary based on the structure of the sale. 1. Asset Purchase Agreement: This type of Offer to Purchase Business involves the buyer acquiring specific assets of the business, such as equipment, inventory, intellectual property, and customer contracts. The buyer assumes minimal liabilities and obligations of the seller, except those expressly agreed upon in the agreement. 2. Stock Purchase Agreement: In this type of Offer to Purchase Business, the buyer acquires the entire ownership interest in the business by purchasing the seller's outstanding shares of stock. The buyer assumes both the assets and liabilities of the business, along with its goodwill. 3. Merger Agreement: A merger Offer to Purchase Business involves the combination of two or more businesses, resulting in a single entity. The agreement outlines the terms of the merger, including the transfer of assets, liabilities, and the pooling of goodwill from the merging entities. The Nebraska Offer to Purchase Business, Including Good Will, typically includes various sections, such as: 1. Purchase Price and Payment Terms: This section specifies the total purchase price and the agreed-upon payment terms, whether it's a lump sum or installment payments. 2. Asset Description: It includes a detailed description of the assets being transferred, such as property, equipment, contracts, licenses, trademarks, and any other relevant items. 3. Liabilities and Indemnification: This section outlines the liabilities that the buyer agrees to assume and the indemnification clause, which protects the buyer from undisclosed or unknown liabilities. 4. Non-Compete and Non-Disclosure Agreements: These agreements restrict the seller from competing with the buyer's business within a specific geographic area and prevent the seller from disclosing confidential information about the business. 5. Goodwill: The Nebraska Offer to Purchase Business, Including Good Will, explicitly includes the transfer of goodwill, which represents the intangible value associated with the business, such as its reputation, customer base, brand recognition, and relationships. A well-drafted Nebraska Offer to Purchase Business, Including Good Will, protects both the buyer and seller by clearly outlining their rights, responsibilities, and expectations throughout the transaction. It is advised to seek legal counsel to ensure the agreement complies with Nebraska state laws and adequately represents the interests of all parties involved.Nebraska Offer to Purchase Business, Including Good Will, is a legal document used in the state of Nebraska when buying a business. This document outlines the terms and conditions of the sale, including the transfer of assets, liabilities, and the goodwill associated with the business. It is important to understand the different types of Nebraska Offer to Purchase Business, Including Good Will, as they may vary based on the structure of the sale. 1. Asset Purchase Agreement: This type of Offer to Purchase Business involves the buyer acquiring specific assets of the business, such as equipment, inventory, intellectual property, and customer contracts. The buyer assumes minimal liabilities and obligations of the seller, except those expressly agreed upon in the agreement. 2. Stock Purchase Agreement: In this type of Offer to Purchase Business, the buyer acquires the entire ownership interest in the business by purchasing the seller's outstanding shares of stock. The buyer assumes both the assets and liabilities of the business, along with its goodwill. 3. Merger Agreement: A merger Offer to Purchase Business involves the combination of two or more businesses, resulting in a single entity. The agreement outlines the terms of the merger, including the transfer of assets, liabilities, and the pooling of goodwill from the merging entities. The Nebraska Offer to Purchase Business, Including Good Will, typically includes various sections, such as: 1. Purchase Price and Payment Terms: This section specifies the total purchase price and the agreed-upon payment terms, whether it's a lump sum or installment payments. 2. Asset Description: It includes a detailed description of the assets being transferred, such as property, equipment, contracts, licenses, trademarks, and any other relevant items. 3. Liabilities and Indemnification: This section outlines the liabilities that the buyer agrees to assume and the indemnification clause, which protects the buyer from undisclosed or unknown liabilities. 4. Non-Compete and Non-Disclosure Agreements: These agreements restrict the seller from competing with the buyer's business within a specific geographic area and prevent the seller from disclosing confidential information about the business. 5. Goodwill: The Nebraska Offer to Purchase Business, Including Good Will, explicitly includes the transfer of goodwill, which represents the intangible value associated with the business, such as its reputation, customer base, brand recognition, and relationships. A well-drafted Nebraska Offer to Purchase Business, Including Good Will, protects both the buyer and seller by clearly outlining their rights, responsibilities, and expectations throughout the transaction. It is advised to seek legal counsel to ensure the agreement complies with Nebraska state laws and adequately represents the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.