Nebraska Partnership Agreement for Development of Real Property

Description

How to fill out Partnership Agreement For Development Of Real Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can either download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Nebraska Partnership Agreement for the Development of Real Property in just moments.

If you already have a subscription, Log In to download the Nebraska Partnership Agreement for Development of Real Property from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, revise, print, and sign the saved Nebraska Partnership Agreement for Development of Real Property. Each template saved in your account has no expiration date and belongs to you permanently. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire. Access the Nebraska Partnership Agreement for Development of Real Property with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are new to US Legal Forms, here are simple steps to get started.

- Make sure you have selected the correct form for your area/state.

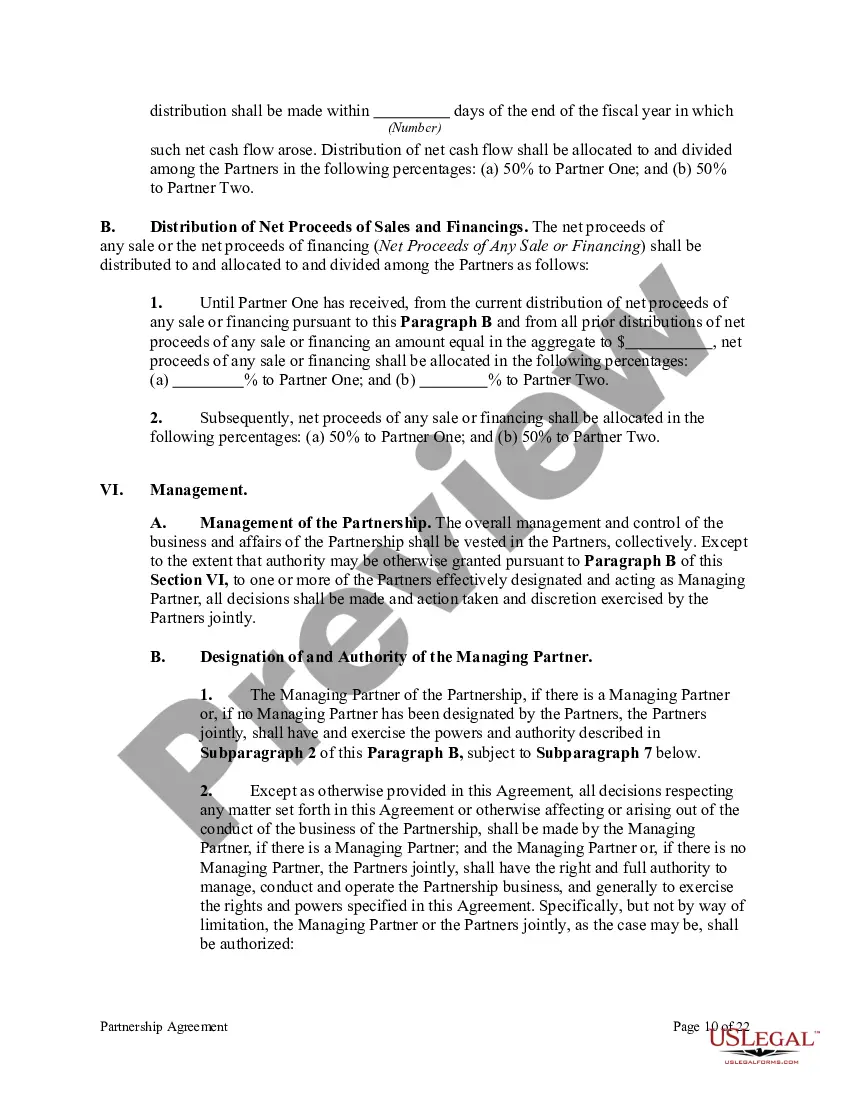

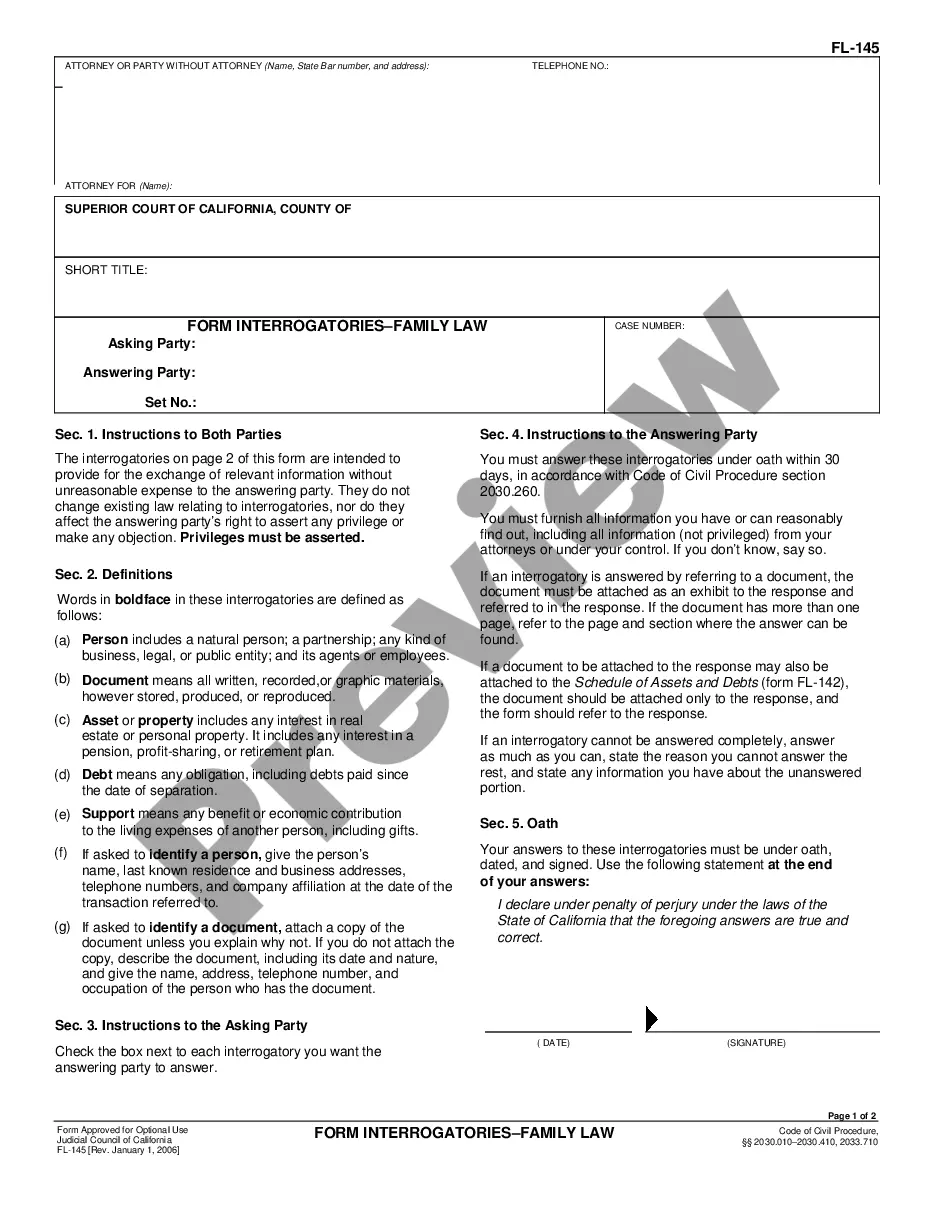

- Click on the Preview button to check the content of the form.

- Examine the form summary to confirm you have chosen the appropriate form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Get now button.

- Next, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Every partnership having either a resident partner or income derived from sources within Nebraska, regardless of whether the partners are residents or nonresidents, shall file a Form 1065N, Nebraska Partnership Return of Income, for the taxable year.

A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes.

The cost of registration can be up to $200, depending on the state or territory. Other than this, a partnership can be remarkably inexpensive to set up. A partnership is not a separate legal entity, so while the partnership requires its own ABN and must lodge its own tax return, the partnership itself is not taxed.

If Form 12N is Filed. This return must report the nonresident's share of the organization's Nebraska income attributable to his or her interest in the organization during the taxable year, as well as any other income the nonresident has earned from Nebraska sources.

The state of Nebraska requires businesses to file a Federal Form 7004 rather than requesting a separate state tax extension. State Tax extension Form can be filed only if the federal tax extension Form 7004 was not granted.

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

Here are the basic steps to forming a partnership:Choose a business name.Register a fictitious business name.Draft and sign a partnership agreement.Comply with tax and regulatory requirements.Obtain Insurance.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

A partnership agreement must contain the name and address of each partner and his contribution to the business. Contributions may consist of cash, property and services. The agreement must detail how the partners intend to allocate the company's profits and losses.

If you decide to create a partnership in Nebraska, there are a few steps to go through in order to properly establish the business.Step 1: Select a name for your partnership.Step 2: Register business name.Step 3: File organizational documents with the Secretary of State.More items...?