Title: Understanding the Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift Description: In Nebraska, nonprofit church corporations play a crucial role in accepting and acknowledging gifts received by donors. This article provides a detailed overview of the Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, including its purpose, requirements, and different types of acknowledgments. Keywords: Nebraska, nonprofit church corporation, receipt of gift, acknowledgment, requirements, types 1. Purpose of Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift: The Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift serves as an essential legal document that acknowledges the receipt of a gift by a nonprofit church corporation. This acknowledgment allows the donor to qualify for potential tax deductions. 2. Requirements for Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift: To create a valid acknowledgment, certain requirements must be met. These typically include: — Correct identification of the nonprofit church corporation. — Accurate date of the gift— - Description of the gifted item, property, or monetary value. — Statements regarding whether the church provided any goods or services in exchange for the gift. — Date received by the church corporation. 3. Different Types of Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift: While the fundamental purpose remains the same, there may be variations based on the type of gift or its value. Here are some common types: — General Gift Acknowledgment: Used for acknowledging cash donations, material assets, or real estate property gifted to the nonprofit church corporation. — In-Kind Gift Acknowledgment: Applicable when the gift involves non-cash items such as donated goods, equipment, or services that hold value. — Non-Cash Charitable Contribution Acknowledgment: Specifically designed for gifts that qualify as non-cash charitable contributions, such as stocks, bonds, or other securities. — Recurring Contribution Acknowledgment: Used to acknowledge regular and ongoing financial contributions from a donor to the nonprofit church corporation. Remember to consult legal experts or professionals well-versed in Nebraska's nonprofit laws for precise requirements and guidance when creating the Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. In conclusion, understanding the Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift is crucial for both nonprofit organizations and donors. By fulfilling the acknowledgment requirements, both parties can ensure compliance with tax laws and enjoy the benefits associated with charitable giving. Note: It is essential to consult an attorney or legal advisor for accurate and specific information regarding Nebraska's nonprofit laws and acknowledgment requirements.

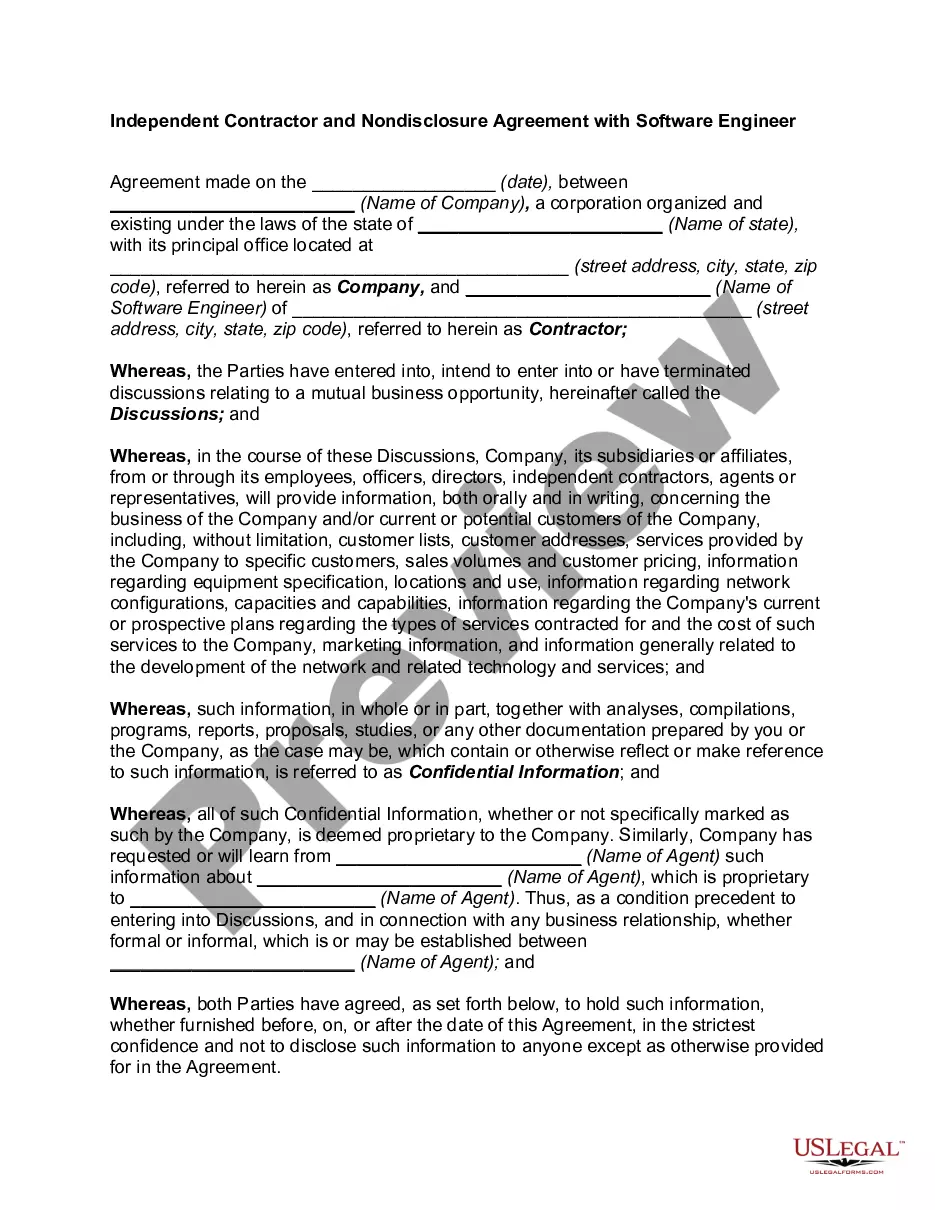

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

How to fill out Nebraska Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

You can devote time online searching for the authorized papers web template that fits the state and federal needs you want. US Legal Forms provides a large number of authorized varieties that are examined by specialists. You can easily download or produce the Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift from our services.

If you currently have a US Legal Forms bank account, you may log in and click the Download switch. Afterward, you may full, edit, produce, or signal the Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. Every authorized papers web template you purchase is the one you have for a long time. To have one more version of any bought form, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms web site the very first time, adhere to the simple guidelines below:

- First, ensure that you have selected the correct papers web template for that area/area of your liking. See the form information to make sure you have picked the right form. If available, utilize the Preview switch to appear throughout the papers web template as well.

- In order to discover one more model from the form, utilize the Lookup discipline to get the web template that fits your needs and needs.

- When you have identified the web template you would like, click on Get now to continue.

- Choose the costs program you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Total the deal. You may use your charge card or PayPal bank account to purchase the authorized form.

- Choose the format from the papers and download it in your device.

- Make adjustments in your papers if necessary. You can full, edit and signal and produce Nebraska Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift.

Download and produce a large number of papers layouts using the US Legal Forms web site, which offers the greatest variety of authorized varieties. Use professional and status-distinct layouts to tackle your small business or individual requirements.