Nebraska Charity Subscription Agreement

Description

How to fill out Charity Subscription Agreement?

Are you currently in a situation in which you will need files for both business or personal functions just about every time? There are plenty of lawful document themes available on the net, but getting kinds you can rely isn`t easy. US Legal Forms delivers a large number of type themes, such as the Nebraska Charity Subscription Agreement, that are created to fulfill federal and state demands.

If you are already familiar with US Legal Forms internet site and get your account, just log in. Next, you may obtain the Nebraska Charity Subscription Agreement format.

If you do not provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Discover the type you will need and ensure it is for your appropriate metropolis/state.

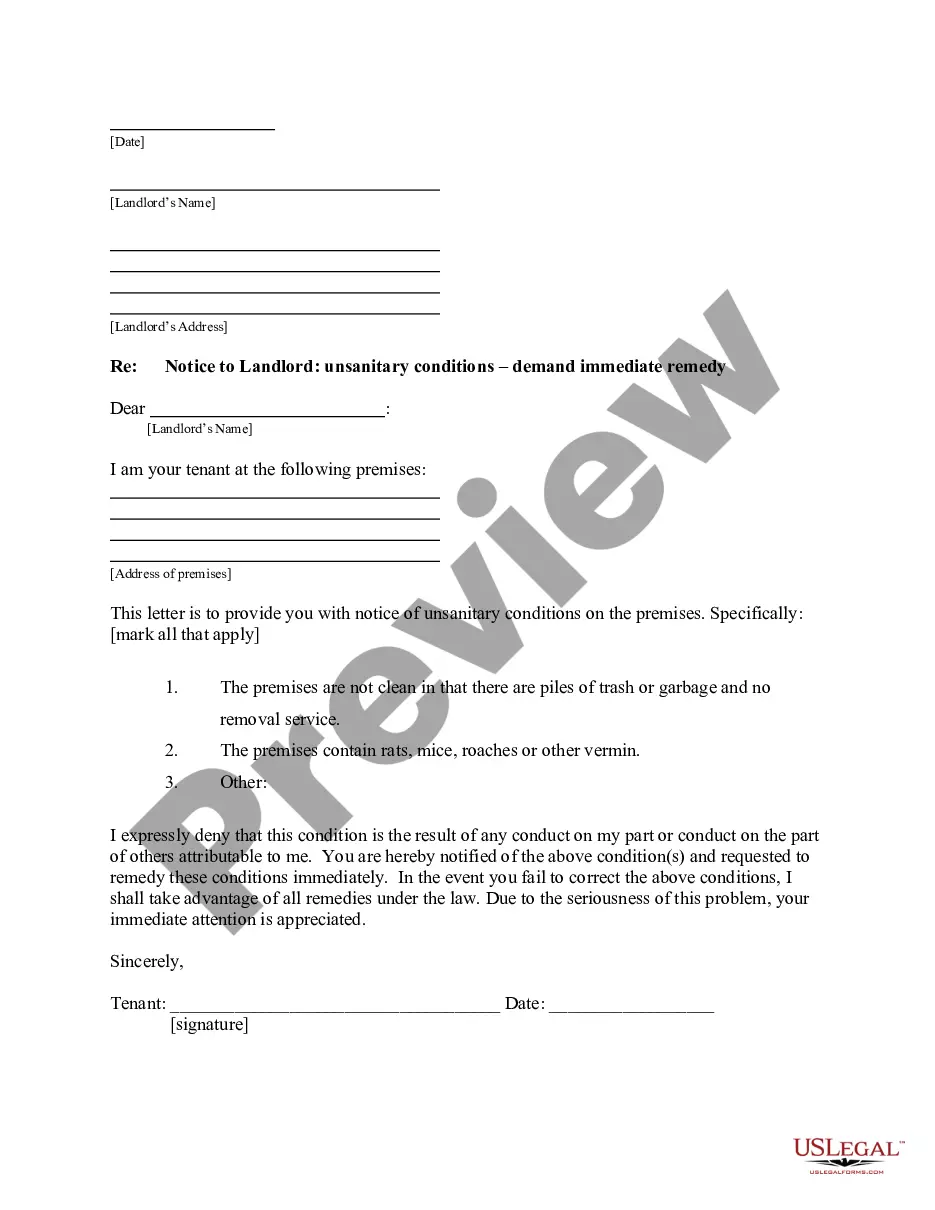

- Take advantage of the Preview option to examine the shape.

- Read the description to ensure that you have selected the proper type.

- If the type isn`t what you are looking for, utilize the Look for industry to discover the type that suits you and demands.

- Whenever you discover the appropriate type, click on Acquire now.

- Opt for the prices strategy you want, fill out the required details to create your account, and purchase the order with your PayPal or charge card.

- Pick a practical data file formatting and obtain your backup.

Get every one of the document themes you may have purchased in the My Forms menu. You can aquire a extra backup of Nebraska Charity Subscription Agreement at any time, if necessary. Just go through the necessary type to obtain or produce the document format.

Use US Legal Forms, by far the most extensive collection of lawful forms, to save time and steer clear of blunders. The services delivers skillfully made lawful document themes which can be used for a variety of functions. Create your account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Under traditional contract law principles, a charitable pledge is enforceable if it meets the requirements for a legally binding contract. There must be an agreement between the donor and the charity -- in effect, the donor must promise to make a gift and the charity must promise to accept it.

In California, a pledge is enforceable as a binding contract only if there is consideration. In certain other states, the rules are less strict: Even a promise to make a payment to a charitable organization without anything given in return may be enforceable as a matter of public policy.

Most courts view charitable pledges as legally enforceable commitments. Failure to enforce pledge collection could result in personal liability for the trustees of a non-profit. IRS rules prohibit donors from fulfilling a legally enforceable pledge from their donor advised fund.

An example of promissory estoppel might be applied in a case where an employer makes an oral promise to an employee to pay the employee a specified monthly or annual amount of money throughout the full duration of the employee's retirement.

Within contract law, promissory estoppel refers to the doctrine that a party may recover on the basis of a promise made when the party's reliance on that promise was reasonable, and the party attempting to recover detrimentally relied on the promise.

A charitable subscription, also called a charitable pledge, is a donor's written or oral promise or statement of intent to contribute money or property to a charity.

A contract without consideration is void because it is not legally enforceable. "Consideration" means that each party must provide something of value to the other party as designated by the contract terms.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge. These are known as the three essential elements of a contract.

Within contract law, promissory estoppel refers to the doctrine that a party may recover on the basis of a promise made when the party's reliance on that promise was reasonable, and the party attempting to recover detrimentally relied on the promise.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge.