Nebraska Authority of Partnership to Open Deposit Account and to Procure Loans allows partnerships to access certain financial services typically provided to individuals or businesses. This authority grants partnerships the ability to open deposit accounts and acquire loans in order to manage their finances effectively and pursue growth opportunities. Partnerships refer to legal entities formed by two or more individuals or businesses who join forces operating and control a business. They are distinct from other business structures, such as sole proprietorship or corporations. In Nebraska, partnerships have specific rights and responsibilities when it comes to financial transactions, including the ability to establish deposit accounts and secure loans from financial institutions. Opening a deposit account is essential for partnerships, as it provides a safe and secure place to hold and manage their funds. A deposit account allows partnerships to deposit their earnings, receive payments from customers or clients, and make necessary business-related transactions. By having a designated account for their partnership, they can easily track their finances, separate personal from business expenses, and ensure accurate reporting during tax season. In addition, partnerships have the authority to procure loans in Nebraska. This means they can borrow funds from financial institutions to support various business needs, such as expanding operations, purchasing equipment, financing projects, or managing cash flow. Loans can be obtained based on the partnership's creditworthiness, financial stability, and ability to repay the borrowed amount. By procuring loans, partnerships can fuel their growth and achieve their business objectives. It's important to note that there are various types of partnerships recognized by Nebraska law, and the authority to open deposit accounts and procure loans applies to each of them. The most common types include general partnerships, limited partnerships (LPs), and limited liability partnerships (Laps). 1. General Partnerships: — General partnerships consist of two or more partners who share equal rights and responsibilities in managing the business. Each partner is personally liable for the partnership's debts and obligations. 2. Limited Partnerships (LPs): — LPs consist of at least one general partner and one or more limited partners. General partners have unlimited liability, while limited partners have liability limited to their investment in the partnership. LPs provide a flexible structure where limited partners are typically passive investors. 3. Limited Liability Partnerships (Laps): LapsPs are created to provide partners with limited personal liability for acts committed by other partners. This structure is commonly used in professional fields, such as law or accounting. Laps offer partners protection against personal liability for professional negligence or misconduct committed by their fellow partners. In conclusion, the Nebraska Authority of Partnership to Open Deposit Account and to Procure Loans is a crucial aspect of partnership operations. It enables partnerships to establish deposit accounts for efficient financial management and secure loans to support their growth. General partnerships, limited partnerships, and limited liability partnerships are some of the partnership types that benefit from this authority, allowing them to effectively handle their finances and make strategic business decisions.

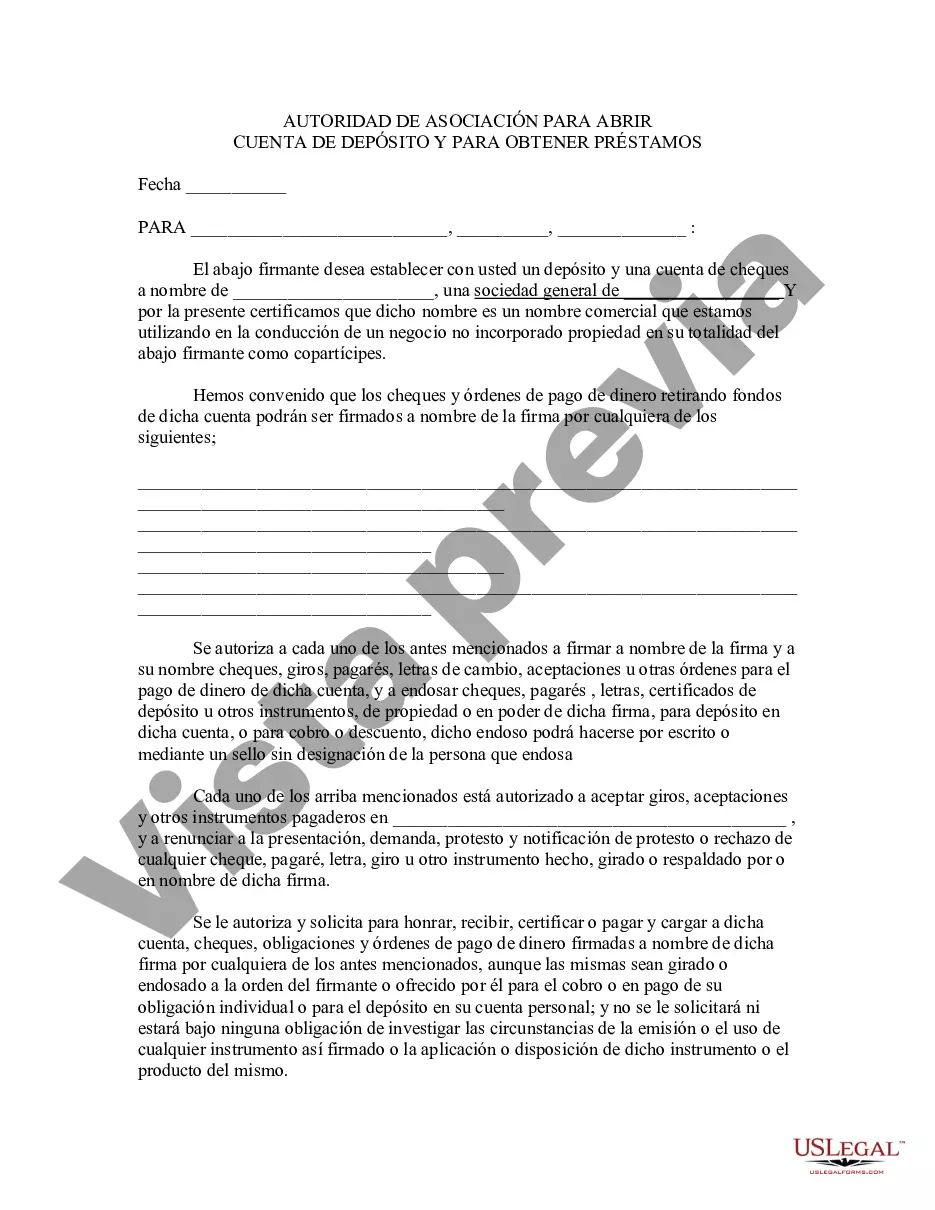

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Autoridad de la Asociación para Abrir Cuentas de Depósito y Procurar Préstamos - Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Nebraska Autoridad De La Asociación Para Abrir Cuentas De Depósito Y Procurar Préstamos?

You can devote several hours on-line attempting to find the authorized file design which fits the state and federal demands you require. US Legal Forms provides a large number of authorized kinds that are evaluated by experts. It is simple to down load or print the Nebraska Authority of Partnership to Open Deposit Account and to Procure Loans from your assistance.

If you currently have a US Legal Forms profile, you may log in and then click the Acquire option. Next, you may complete, revise, print, or indicator the Nebraska Authority of Partnership to Open Deposit Account and to Procure Loans. Every authorized file design you acquire is your own for a long time. To acquire an additional version associated with a obtained form, check out the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms site initially, adhere to the basic guidelines under:

- Very first, be sure that you have chosen the best file design to the area/town of your choice. Read the form information to make sure you have selected the right form. If accessible, make use of the Review option to look with the file design also.

- In order to find an additional variation in the form, make use of the Research area to find the design that suits you and demands.

- When you have discovered the design you want, click on Acquire now to continue.

- Find the pricing strategy you want, type your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You can utilize your Visa or Mastercard or PayPal profile to fund the authorized form.

- Find the format in the file and down load it for your device.

- Make changes for your file if needed. You can complete, revise and indicator and print Nebraska Authority of Partnership to Open Deposit Account and to Procure Loans.

Acquire and print a large number of file templates while using US Legal Forms website, which provides the most important assortment of authorized kinds. Use professional and status-distinct templates to handle your small business or individual needs.