A debt adjustment agreement is a legally binding agreement made between a debtor and a creditor to facilitate the repayment of outstanding debts. In the state of Nebraska, debt adjustment agreements are governed by specific laws and regulations to ensure fairness and protection for both parties involved. Nebraska Debt Adjustment Agreement with Creditor allows debtors to develop a repayment plan that suits their financial situation while offering creditors the possibility of recouping at least a portion of their owed funds. This agreement provides a structured approach to debt management, offering an alternative to bankruptcy or other drastic measures. There are different types of Nebraska Debt Adjustment Agreements with Creditors, each designed to accommodate varying financial circumstances: 1. Voluntary Debt Adjustment Agreement: This type of agreement is entered into willingly by both the debtor and creditor. It involves negotiating new terms, such as reduced interest rates, lower monthly payments, or extended repayment periods. The debtor continues to make regular payments over an agreed-upon period until the debt is fully repaid. 2. Court-Ordered Debt Adjustment Agreement: In some cases, debtors might be unable to reach a voluntary agreement with their creditors. In such instances, a court may intervene and order a debt adjustment agreement to provide relief and establish a manageable repayment plan. This ensures that both parties are bound by the terms set forth by the court. When entering into a Nebraska Debt Adjustment Agreement with a Creditor, it is essential to consider the following key elements: a) Reviewing Debts: Before initiating any agreement, it is crucial for the debtor to assess all outstanding debts. This includes understanding the total amount owed, interest rates, and any associated fees. This evaluation helps determine if a debt adjustment agreement is a viable solution. b) Negotiating New Terms: Once the debtor has a comprehensive understanding of their debts, they can negotiate new terms with their creditors. This may involve reducing interest rates, waiving late payment fees, or agreeing on a new repayment plan that aligns with the debtor's financial capabilities. c) Establishing a Repayment Plan: A critical component of a debt adjustment agreement is creating a repayment plan that satisfies both debtor and creditor requirements. The plan outlines the amount to be paid, intervals for payment, and the duration of the agreement. Adhering to this plan is essential to achieving financial stability and successfully reestablishing creditworthiness. d) Legal Considerations: To ensure the agreement is enforceable and binding, it is advisable to consult an attorney who specializes in debt management. They can review the agreement, provide guidance, and ensure compliance with Nebraska laws and regulations. In conclusion, a Nebraska Debt Adjustment Agreement with Creditor is a formal arrangement between a debtor and creditor that aims to facilitate the repayment of outstanding debts. By negotiating new terms and agreeing on a repayment plan, debtors can regain control over their finances while providing creditors with a structured path towards debt recovery. Whether voluntary or court-ordered, these agreements offer a valuable alternative to more extreme measures like bankruptcy, allowing debtors to achieve financial stability while honoring their obligations.

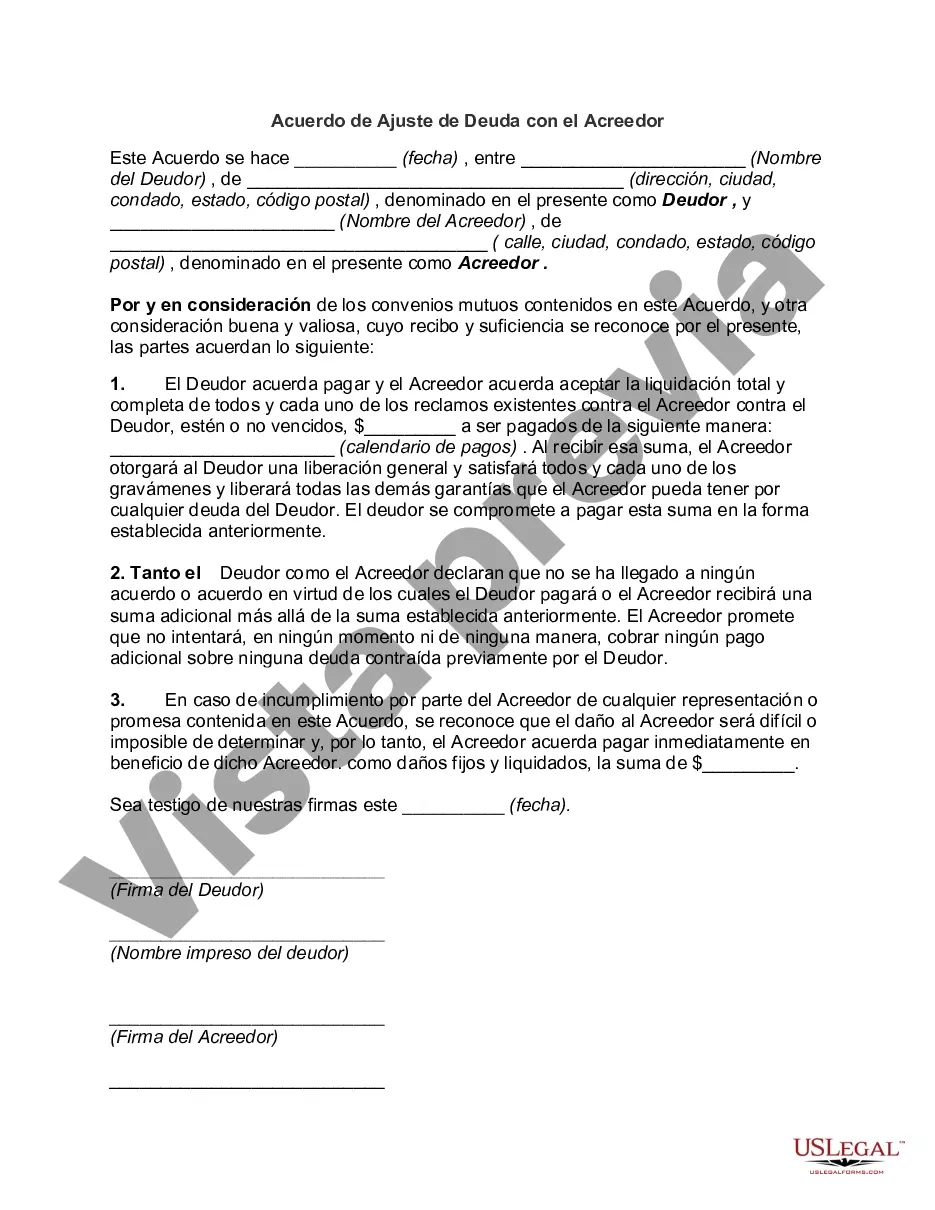

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Nebraska Acuerdo De Ajuste De Deuda Con El Acreedor?

US Legal Forms - one of several greatest libraries of legitimate types in the States - delivers a wide range of legitimate record web templates it is possible to down load or print. Using the internet site, you will get thousands of types for business and individual functions, sorted by types, claims, or search phrases.You will discover the newest models of types just like the Nebraska Debt Adjustment Agreement with Creditor within minutes.

If you already possess a monthly subscription, log in and down load Nebraska Debt Adjustment Agreement with Creditor from your US Legal Forms collection. The Obtain button will appear on every type you view. You have access to all earlier delivered electronically types inside the My Forms tab of the bank account.

If you wish to use US Legal Forms the first time, listed here are simple directions to obtain started off:

- Ensure you have picked the right type for the area/region. Click on the Preview button to review the form`s content. Look at the type outline to ensure that you have chosen the correct type.

- In case the type does not suit your demands, make use of the Search area near the top of the screen to get the one which does.

- In case you are content with the shape, verify your option by clicking the Purchase now button. Then, pick the costs plan you like and offer your accreditations to sign up to have an bank account.

- Method the deal. Make use of your Visa or Mastercard or PayPal bank account to complete the deal.

- Find the file format and down load the shape on your own gadget.

- Make changes. Complete, edit and print and signal the delivered electronically Nebraska Debt Adjustment Agreement with Creditor.

Each and every format you added to your bank account does not have an expiration day which is your own forever. So, if you would like down load or print another backup, just proceed to the My Forms segment and then click around the type you want.

Obtain access to the Nebraska Debt Adjustment Agreement with Creditor with US Legal Forms, by far the most considerable collection of legitimate record web templates. Use thousands of professional and express-specific web templates that fulfill your organization or individual requirements and demands.