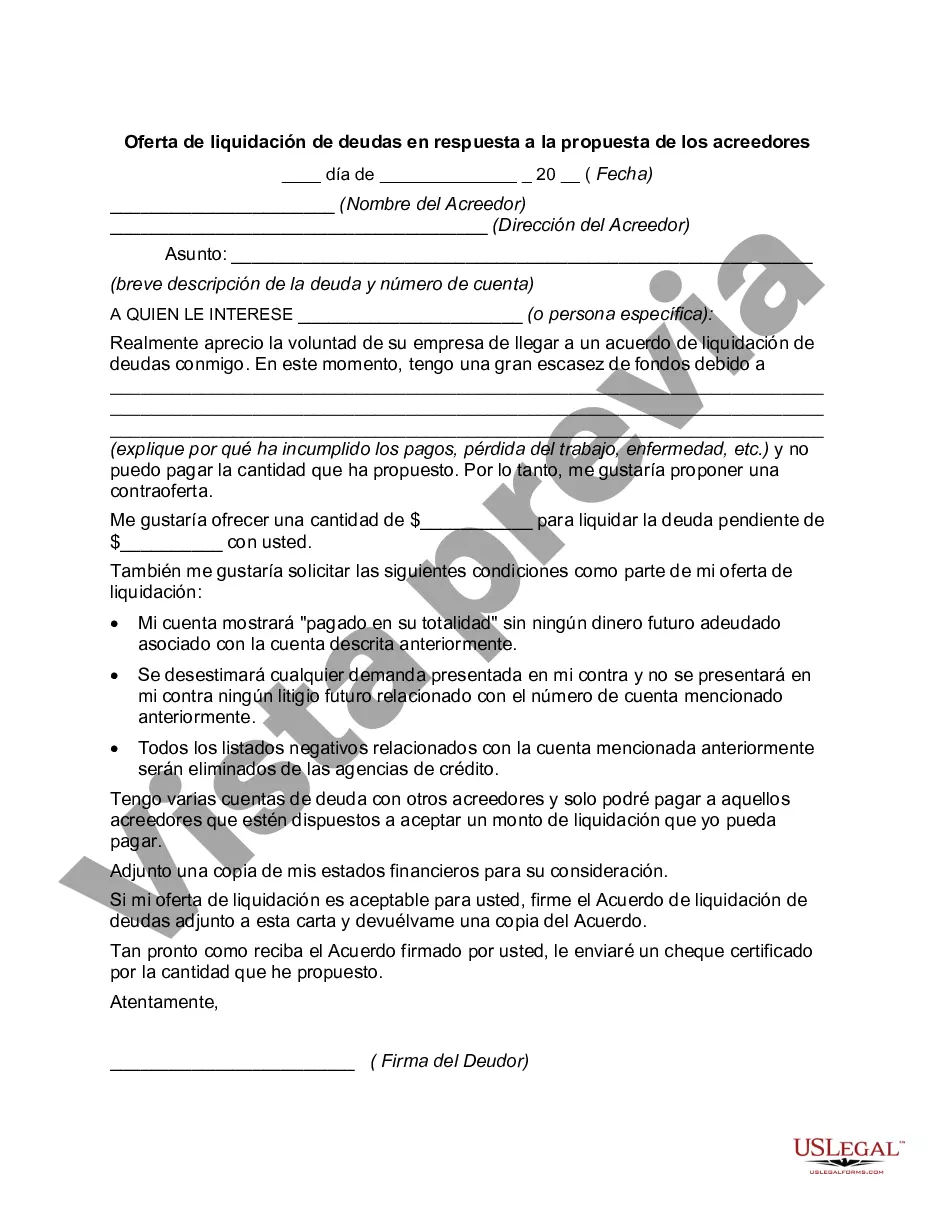

Nebraska Debt Settlement Offer in Response to Creditor's Proposal A debt settlement offer is a potential solution for individuals or businesses in Nebraska who are struggling to repay their debts. When faced with overwhelming financial obligations, creditors might propose a debt settlement as a way to recoup at least a portion of the amount owed. In response, debtors in Nebraska have the option to make their own settlement offer, outlining their proposed terms and conditions for repayment. Negotiating a debt settlement offer can be beneficial for both the debtor and the creditor. It allows the debtor to potentially reduce the total amount of debt they owe, making it more manageable to repay. On the other hand, the creditor receives a partial payment, even if it is less than the original debt, thereby mitigating their losses. Key elements of a Nebraska debt settlement offer typically include: 1. Proposed Payment Amount: Debtors need to determine the amount they can afford to pay, considering their current financial situation. This offer may be a lump sum or a structured payment plan based on income and expenses. 2. Percentage of Debt: Debtors often seek to negotiate a percentage of the total debt owed as part of their settlement offer. This percentage can vary depending on specific circumstances, but it is typically less than the full amount owed. 3. Timeline for Repayment: Debtors should outline a reasonable timeline for repayment within their settlement offer. This timeline should consider their ability to make consistent payments while meeting their other financial obligations. 4. Release of Liability: In exchange for the agreed-upon settlement, debtors often request a release of liability from the creditor. This ensures that once the settlement amount is paid, the creditor cannot pursue further collection actions related to the debt. Different types of Nebraska debt settlement offers may include: 1. Lump-Sum Settlement: This type involves offering a single payment to settle the debt. Debtors who have access to a significant sum of money, such as through a loan or savings, may opt for this approach. 2. Structured Payment Plan: Debtors who are unable to provide a lump sum amount may propose a structured payment plan. This involves making regular installments over an agreed-upon period until the debt is fully settled. 3. Partial Debt Forgiveness: In some cases, debtors may request partial debt forgiveness, indicating an inability to repay the entire debt amount. This offer may be suitable when the debtor's financial circumstances are dire. It's crucial to note that debt settlement offers should be made with careful consideration of one's financial capabilities. Seeking professional advice, such as from an attorney or debt settlement agency specializing in Nebraska laws, can greatly assist in formulating a fair and effective settlement offer that addresses the needs of both the debtor and creditor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Nebraska Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

US Legal Forms - among the biggest libraries of legal kinds in America - offers a wide array of legal document web templates you can down load or print. Utilizing the site, you will get 1000s of kinds for business and individual reasons, sorted by types, states, or keywords.You will find the latest variations of kinds like the Nebraska Debt Settlement Offer in Response to Creditor's Proposal in seconds.

If you already possess a membership, log in and down load Nebraska Debt Settlement Offer in Response to Creditor's Proposal in the US Legal Forms collection. The Download switch can look on every single form you view. You get access to all formerly downloaded kinds from the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, listed below are basic guidelines to help you started out:

- Be sure to have selected the right form for your personal metropolis/area. Go through the Preview switch to examine the form`s information. Read the form information to actually have chosen the right form.

- When the form does not satisfy your requirements, make use of the Search industry towards the top of the screen to find the one which does.

- In case you are satisfied with the form, validate your selection by clicking on the Get now switch. Then, choose the rates program you like and supply your credentials to sign up for the profile.

- Procedure the financial transaction. Utilize your bank card or PayPal profile to complete the financial transaction.

- Select the format and down load the form in your gadget.

- Make alterations. Complete, change and print and signal the downloaded Nebraska Debt Settlement Offer in Response to Creditor's Proposal.

Each template you included with your bank account does not have an expiry time and is your own for a long time. So, if you want to down load or print yet another backup, just visit the My Forms section and then click on the form you will need.

Get access to the Nebraska Debt Settlement Offer in Response to Creditor's Proposal with US Legal Forms, by far the most comprehensive collection of legal document web templates. Use 1000s of specialist and status-specific web templates that meet your organization or individual requires and requirements.