Nebraska Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out Trust Agreement For Pension Plan With Corporate Trustee?

Have you been inside a placement the place you need papers for both business or individual uses just about every day time? There are plenty of legal record layouts available online, but getting types you can trust isn`t simple. US Legal Forms provides 1000s of develop layouts, like the Nebraska Trust Agreement for Pension Plan with Corporate Trustee, that happen to be published in order to meet state and federal specifications.

In case you are presently familiar with US Legal Forms internet site and also have a free account, simply log in. Next, you can download the Nebraska Trust Agreement for Pension Plan with Corporate Trustee design.

Should you not have an profile and want to start using US Legal Forms, follow these steps:

- Obtain the develop you want and ensure it is for that correct metropolis/state.

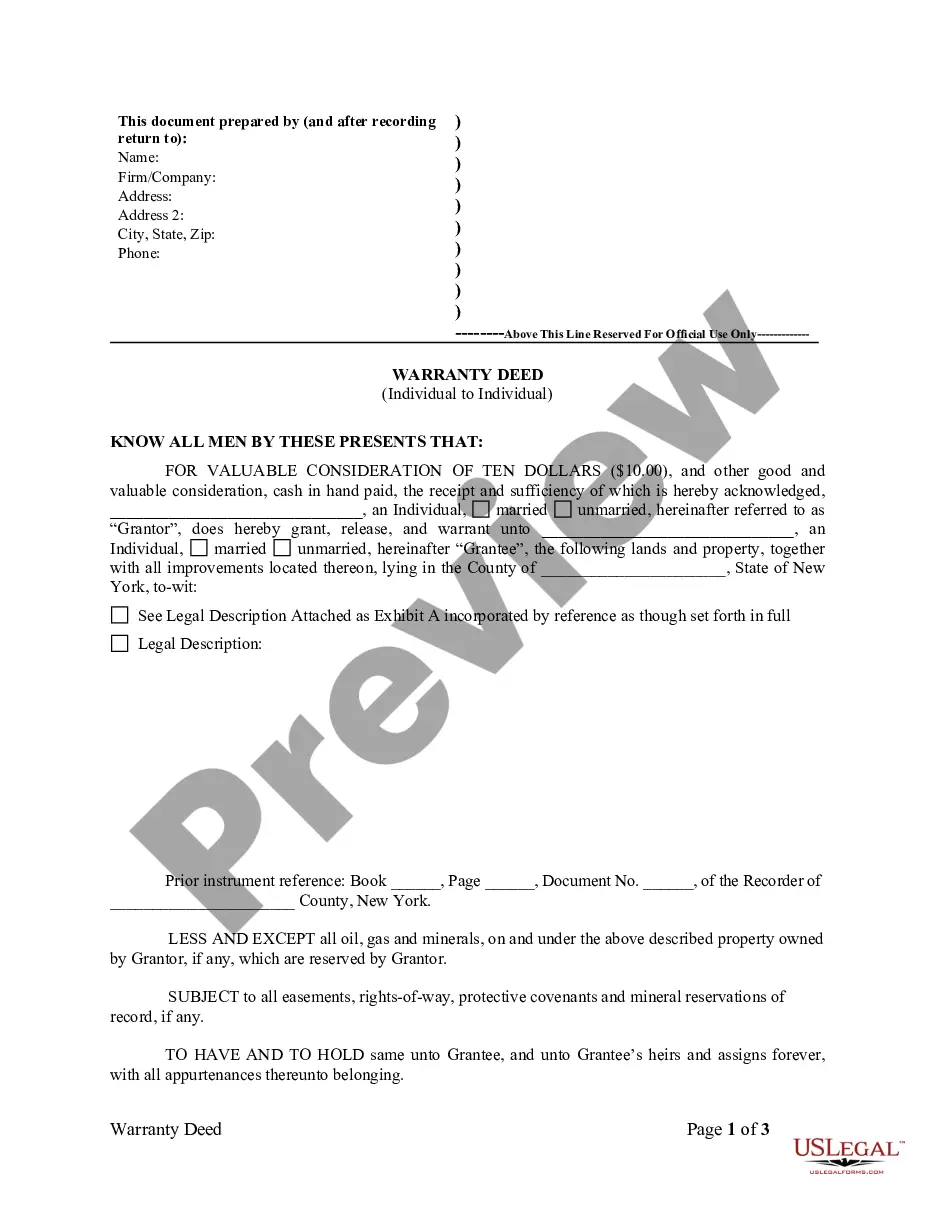

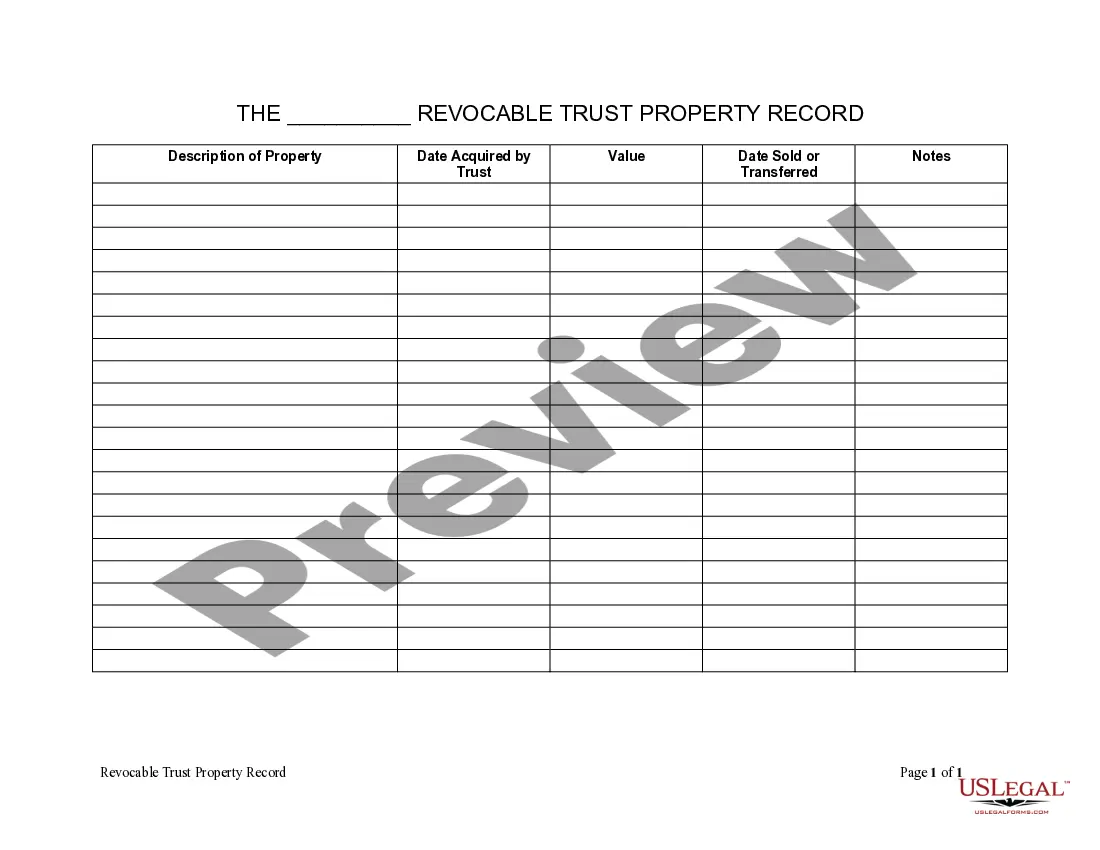

- Take advantage of the Preview button to check the shape.

- Look at the explanation to actually have selected the appropriate develop.

- In the event the develop isn`t what you`re looking for, make use of the Lookup discipline to discover the develop that suits you and specifications.

- Once you discover the correct develop, click Purchase now.

- Choose the pricing prepare you need, submit the specified information to produce your money, and buy an order with your PayPal or charge card.

- Pick a practical file formatting and download your copy.

Locate all the record layouts you may have purchased in the My Forms menus. You can get a extra copy of Nebraska Trust Agreement for Pension Plan with Corporate Trustee at any time, if needed. Just click on the necessary develop to download or print the record design.

Use US Legal Forms, the most extensive collection of legal forms, to save lots of time and steer clear of errors. The assistance provides professionally made legal record layouts which you can use for an array of uses. Make a free account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

RETIREMENT SYSTEMThe State Employees' Retirement Plan (the Plan) is designed to provide retirement benefits in recognition of service to the state of Nebraska and is administered by the Public Employees' Retirement Board (PERB). The State Employees' Retirement Plan began as a Defined Contribution Plan in 1964.

Profit sharing or 401(k) plans that are subject to the Retirement Equity Act (REA) Safe Harbor provisions, will pay your benefits under the Plan in a form other than an annuity.

A trustee is the person or entity entrusted to make investment decisions in the best interests of plan participants. A trustee is assigned by another fiduciary, such as the employer who sponsors the qualified retirement plan, and should be named in the plan documents. Additional restrictions apply for a trustee.

A qualified trust is a stock bonus, pension, or profit-sharing plan established by an employer for their employees. A qualified trust is tax-advantaged as long as it meets IRS requirements.

A pension trustee is someone who technically holds an occupational pension scheme's assets for the beneficiaries. They act separately from the employer for the benefit of scheme members and their powers are written in the trust deed and the scheme's rules.

A pension trust is an employee retirement fund that is funded by both the employer and the employee. The monetary contributions from both parties are handed over to a legal trustee who will follow the accounting standards of the United States.

A trustee is responsible for managing and maintaining trust property while the custodian is only the entity that holds the assets. When you open a trust, you must appoint a trustee to oversee the trust's activities, which includes managing, selling, and distributing trust property to beneficiaries.

What Is a 401(k) Trustee? The trustee (or trustees) of a plan is the individual that has the primary fiduciary responsibility to ensure the plan assets are being managed in the best interest of the participants and in line with the plan document. The trustee can be held personally liable for the misuse of plan asset.

A 401(k) and a pension are both employer-sponsored retirement plans. The most significant difference between the two is that a 401(k) is a defined-contribution plan, and a pension is a defined-benefit plan.

The trustee's role is to administer and distribute the assets in the trust according to your wishes, as expressed in the trust document. Trustees have the fiduciary duty, legal authority, and responsibility to manage your assets held in trust and handle day-to-day financial matters on your behalf.