Nebraska Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a legally binding contract that outlines the terms and procedures for terminating a partnership after the death of one partner. This agreement is important in settling the affairs and distributing the assets of the partnership in a fair and orderly manner. One type of Nebraska Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is the Partnership Dissolution Agreement. This agreement encompasses the entire process of dissolving the partnership, including the settlement of debts, distribution of assets, and the final termination of the partnership's existence. Another type is the Partnership Liquidation Agreement, which focuses specifically on the liquidation and distribution of the partnership's assets. This agreement ensures that all partners and the estate of the deceased partner receive their respective share of the partnership's assets, following the predetermined distribution formula as stated in the agreement. In a Nebraska Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, some key elements and provisions often included are: 1. Identification of the surviving partners and the deceased partner's estate: The agreement should clearly state the names, addresses, and roles of all surviving partners and the legal representative of the deceased partner's estate. 2. Dissolution and termination of the partnership: The agreement outlines the effective date of the partnership's dissolution and when it will be officially terminated. 3. Assets and liabilities: The agreement specifies how the partnership's assets and liabilities will be allocated and distributed among the surviving partners and the estate of the deceased partner. It may include provisions for paying off debts, selling assets, or transferring ownership. 4. Accounting and valuation: The agreement may require an accurate accounting of the partnership's financial status, including a valuation of its assets and liabilities, to ensure a fair distribution during the winding-up process. 5. Dispute resolution: If any disagreements arise between the surviving partners and the estate of the deceased partner during the dissolution and wind-up process, the agreement may provide a mechanism for resolving disputes, such as through mediation or arbitration. 6. Confidentiality and non-compete clauses: The agreement may include provisions to protect the confidentiality of the partnership's business information and impose non-compete restrictions on the surviving partners after the dissolution is complete. It is crucial for all parties involved in a partnership's dissolution after the death of a partner to carefully consider their rights, responsibilities, and desired outcomes. Seeking legal advice during this process can help ensure that the Nebraska Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is comprehensive and adequately addresses all necessary aspects.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Acuerdo para disolver y liquidar la sociedad entre los socios supervivientes y el patrimonio del socio fallecido - Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Nebraska Acuerdo Para Disolver Y Liquidar La Sociedad Entre Los Socios Supervivientes Y El Patrimonio Del Socio Fallecido?

Finding the right lawful file format can be a struggle. Naturally, there are plenty of layouts available online, but how will you find the lawful form you need? Use the US Legal Forms website. The services provides a large number of layouts, such as the Nebraska Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, which you can use for company and private requirements. Every one of the forms are checked out by pros and meet state and federal needs.

In case you are already signed up, log in to the bank account and click the Obtain switch to find the Nebraska Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner. Make use of your bank account to search from the lawful forms you possess acquired earlier. Go to the My Forms tab of the bank account and get an additional backup in the file you need.

In case you are a new end user of US Legal Forms, allow me to share easy directions that you can stick to:

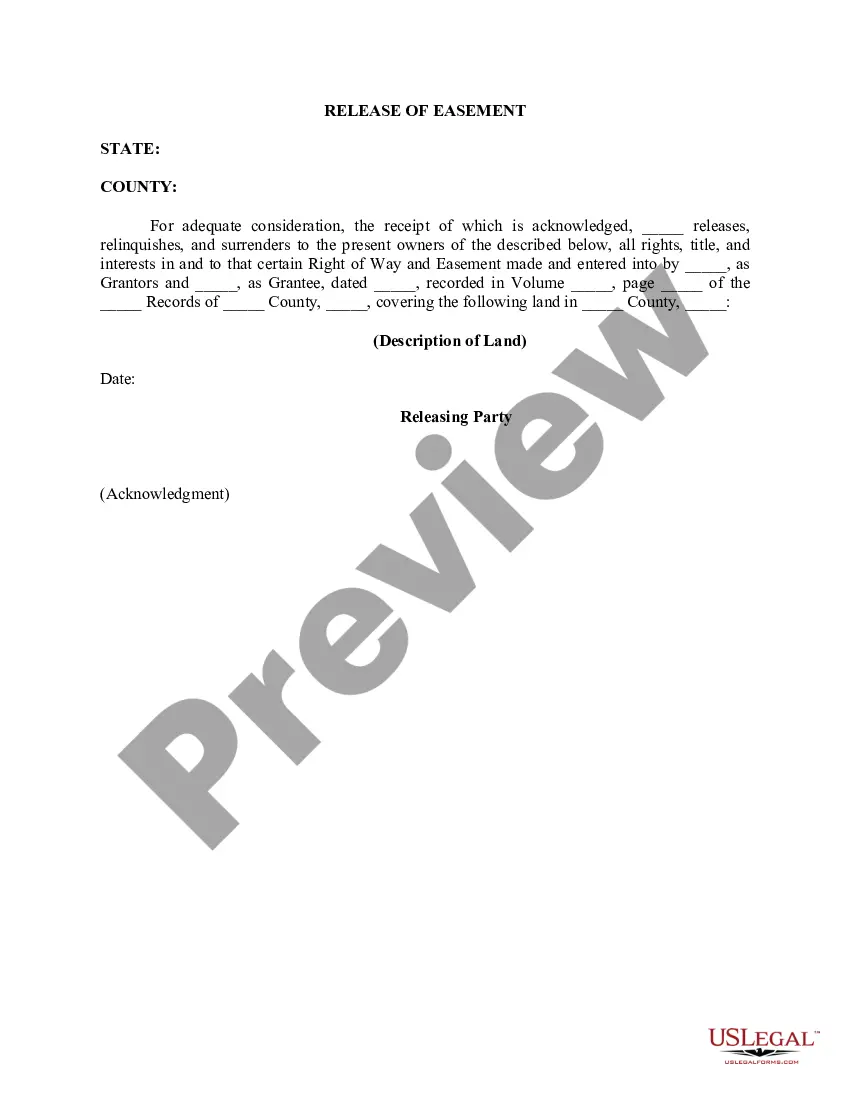

- Very first, make sure you have selected the proper form for the city/county. You can examine the shape making use of the Preview switch and look at the shape explanation to guarantee it is the right one for you.

- When the form fails to meet your requirements, make use of the Seach area to obtain the appropriate form.

- Once you are sure that the shape would work, go through the Acquire now switch to find the form.

- Select the pricing plan you want and type in the essential details. Design your bank account and buy the transaction making use of your PayPal bank account or bank card.

- Opt for the file formatting and acquire the lawful file format to the product.

- Total, edit and printing and indicator the acquired Nebraska Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner.

US Legal Forms is the largest collection of lawful forms where you can see different file layouts. Use the service to acquire professionally-manufactured papers that stick to condition needs.