Nebraska Checklist of Matters to be Considered in Drafting a Verification of an Account plays a vital role in ensuring accurate and trustworthy financial reporting. In Nebraska, this checklist outlines the key items that must be considered when drafting a verification of an account, providing a comprehensive framework for businesses and individuals alike to follow. Keywords: Nebraska, checklist, matters, drafting, verification, account The checklist includes several important considerations that must be taken into account to ensure the accuracy and completeness of a verification of an account. Some of these key matters to consider are: 1. Relevant Account Information: The verification must clearly specify the relevant account details such as the account number, account name, and account holder's name. 2. Financial Period: It is crucial to define the specific financial period being covered by the verification. This ensures that the information provided is up-to-date and aligns with the designated time frame. 3. Supporting Documentation: The checklist emphasizes the requirement for supporting documentation, such as bank statements, invoices, receipts, and transaction records. These documents serve as evidence to validate the accuracy of the account balance and its transactions. 4. Compliance with Applicable Laws and Regulations: The verification must ensure compliance with all relevant laws and regulations governing financial reporting in Nebraska, which may include state-specific regulations, accounting standards, and tax requirements. 5. Independent Review: It is generally recommended that the verification is prepared by an independent party or reviewed by an independent auditor to enhance its reliability and credibility. 6. Internal Control Procedures: The checklist emphasizes the importance of assessing and documenting the internal control procedures in place for the account being verified. This helps identify any weaknesses or risks in the accounting system. 7. Reconciliation: The verification should include a reconciliation process, comparing the account balance with other supporting documentation to ensure consistency and mitigating any discrepancies. 8. Signatories: The checklist provides guidance on the signing authority for the verification. It specifies who should sign the document, such as the account holder, a designated financial officer, or an authorized representative. It's worth noting that while the above checklist covers the general matters to consider in drafting a verification of an account, variations may occur depending on the specific industry or type of account being verified. For instance, separate checklists might exist for bank account verifications, credit card account verifications, investment account verifications, or even specific industry-related accounts. In conclusion, the Nebraska Checklist of Matters to be Considered in Drafting a Verification of an Account is an indispensable tool for achieving accurate financial reporting. By adhering to this checklist, individuals and businesses can ensure reliable and transparent representations of their financial positions, enhancing trust and facilitating sound decision-making.

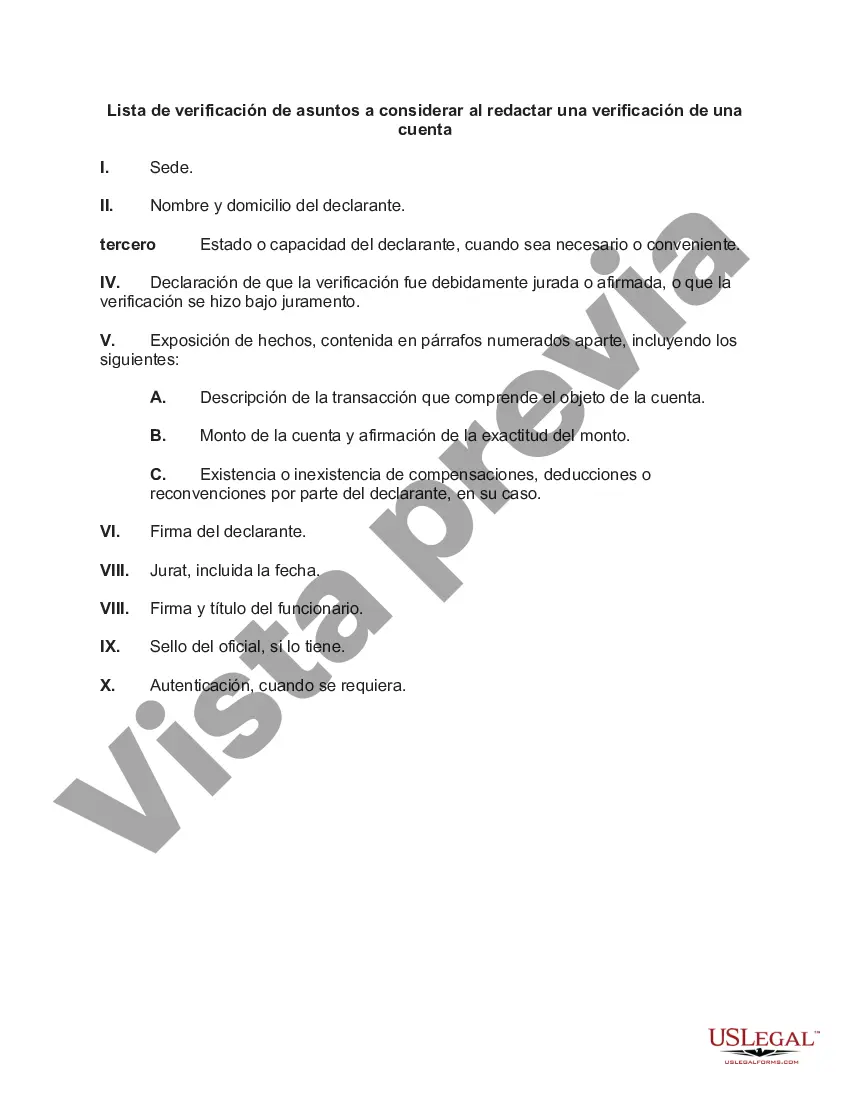

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Nebraska Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

Are you within a place the place you need to have files for either business or individual uses just about every time? There are tons of lawful file layouts accessible on the Internet, but getting versions you can trust is not straightforward. US Legal Forms provides a large number of type layouts, such as the Nebraska Checklist of Matters to be Considered in Drafting a Verification of an Account, that are published to meet federal and state requirements.

In case you are previously acquainted with US Legal Forms web site and also have an account, simply log in. Next, you may down load the Nebraska Checklist of Matters to be Considered in Drafting a Verification of an Account template.

If you do not come with an profile and want to begin to use US Legal Forms, follow these steps:

- Obtain the type you will need and ensure it is for your proper city/state.

- Use the Review switch to check the shape.

- Read the information to actually have selected the right type.

- When the type is not what you are searching for, take advantage of the Search discipline to get the type that suits you and requirements.

- Whenever you discover the proper type, click on Buy now.

- Choose the pricing plan you want, fill out the desired information and facts to generate your account, and purchase an order using your PayPal or bank card.

- Decide on a practical data file file format and down load your backup.

Get each of the file layouts you have purchased in the My Forms food selection. You can aquire a more backup of Nebraska Checklist of Matters to be Considered in Drafting a Verification of an Account whenever, if required. Just click on the required type to down load or print the file template.

Use US Legal Forms, probably the most considerable assortment of lawful types, in order to save time as well as steer clear of mistakes. The assistance provides professionally created lawful file layouts which you can use for a selection of uses. Produce an account on US Legal Forms and start producing your way of life a little easier.