Nebraska Demand for a Shareholders Meeting is a process through which shareholders of a Nebraska corporation can request a meeting to discuss important matters concerning the company. This mechanism ensures that shareholders have a voice in the decision-making process and can exercise their rights as owners of the corporation. The demand for a shareholders meeting in Nebraska is driven by various key factors, which include corporate governance concerns, financial performance, strategic decisions, leadership changes, and potential conflicts of interest. Shareholders may want to address issues such as board elections, executive compensation, dividend policies, mergers and acquisitions, or any other matter that affects their investment. There are two primary types of Nebraska Demand for a Shareholders Meeting, namely: 1. Ordinary Demand: This is the most common type of demand, where shareholders request a meeting to discuss routine matters that arise during the regular course of business. Examples can include the approval of audited financial statements, the appointment of auditors, or the election of directors at the end of their terms. 2. Special Demand: Also known as extraordinary demand, this type of demand is raised when shareholders want to address significant or contentious issues beyond the ordinary business agenda. Special demands may revolve around proposing changes to the company's bylaws, investigating alleged wrongdoing, challenging management decisions, or pushing for a major strategic shift, such as a large-scale acquisition or divestiture. To initiate a Nebraska Demand for a Shareholders Meeting, shareholders must comply with specific requirements outlined in the Nebraska Revised Statutes, particularly under Chapter 21, Article 1. These requirements include submitting a written request to the corporation's secretary or registered office, containing the shareholder's name, contact details, number of shares owned, the purpose of the meeting, and supporting evidence if necessary. The request should also specify the proposed date, time, and location of the meeting, ensuring compliance with Nebraska's statutory notice requirements. The corporation must then convene the meeting within a reasonable period as mandated by state law. In conclusion, Nebraska Demand for a Shareholders Meeting allows shareholders to actively participate in corporate decision-making and exercise their rights as owners. By addressing both routine and extraordinary matters, shareholders can influence the direction and governance of the corporation. Corporations must adhere to the legal framework outlined by the Nebraska Revised Statutes to ensure a fair and transparent process when responding to shareholder demands.

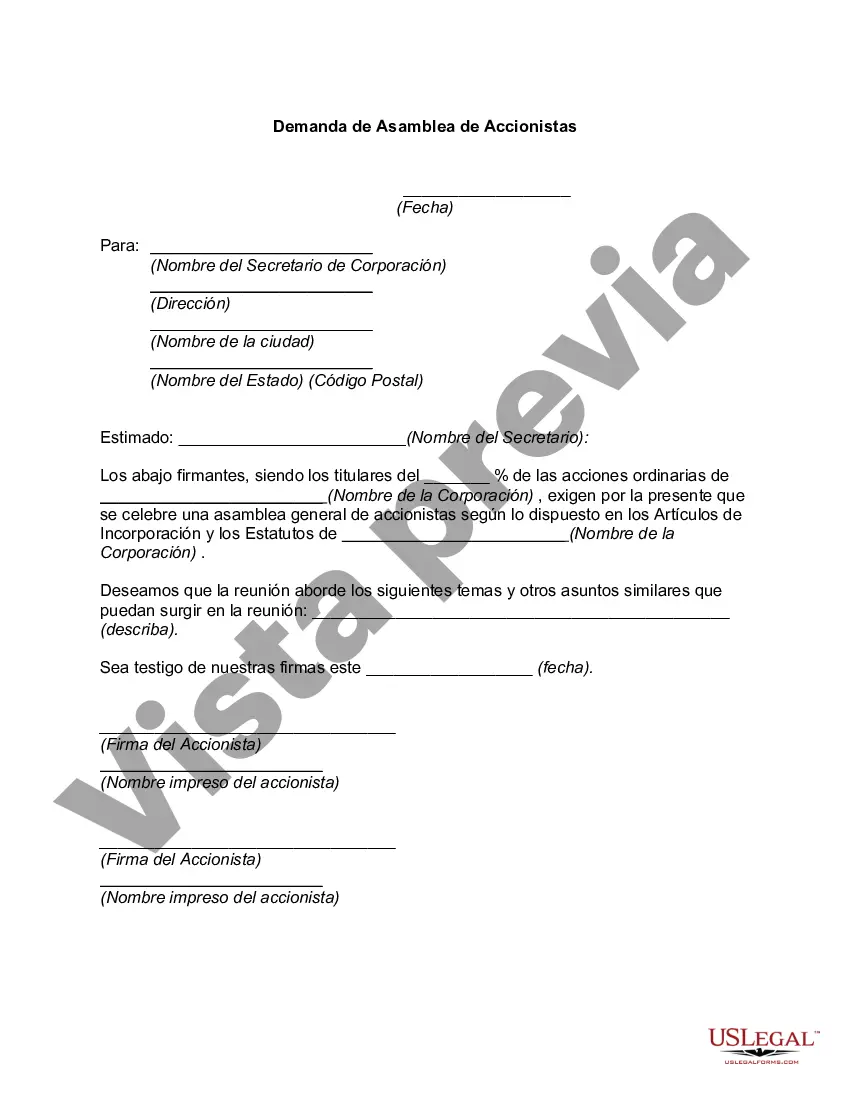

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Demanda de Asamblea de Accionistas - Demand for a Shareholders Meeting

Description

How to fill out Nebraska Demanda De Asamblea De Accionistas?

If you want to complete, acquire, or print out legal papers templates, use US Legal Forms, the largest collection of legal forms, that can be found on-line. Use the site`s simple and practical research to find the paperwork you require. Various templates for enterprise and individual functions are categorized by groups and claims, or key phrases. Use US Legal Forms to find the Nebraska Demand for a Shareholders Meeting in a handful of clicks.

If you are already a US Legal Forms customer, log in for your account and click on the Acquire switch to find the Nebraska Demand for a Shareholders Meeting. You may also entry forms you formerly delivered electronically within the My Forms tab of your account.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have selected the shape for that proper city/nation.

- Step 2. Use the Review solution to check out the form`s content material. Never forget about to read through the description.

- Step 3. If you are unsatisfied together with the develop, utilize the Look for discipline on top of the screen to locate other versions of the legal develop format.

- Step 4. Once you have identified the shape you require, select the Acquire now switch. Pick the pricing program you prefer and put your credentials to register to have an account.

- Step 5. Method the deal. You should use your credit card or PayPal account to complete the deal.

- Step 6. Pick the file format of the legal develop and acquire it on the system.

- Step 7. Full, edit and print out or sign the Nebraska Demand for a Shareholders Meeting.

Every single legal papers format you get is your own permanently. You might have acces to each and every develop you delivered electronically in your acccount. Select the My Forms portion and select a develop to print out or acquire once again.

Compete and acquire, and print out the Nebraska Demand for a Shareholders Meeting with US Legal Forms. There are thousands of skilled and state-certain forms you can utilize for your enterprise or individual requirements.