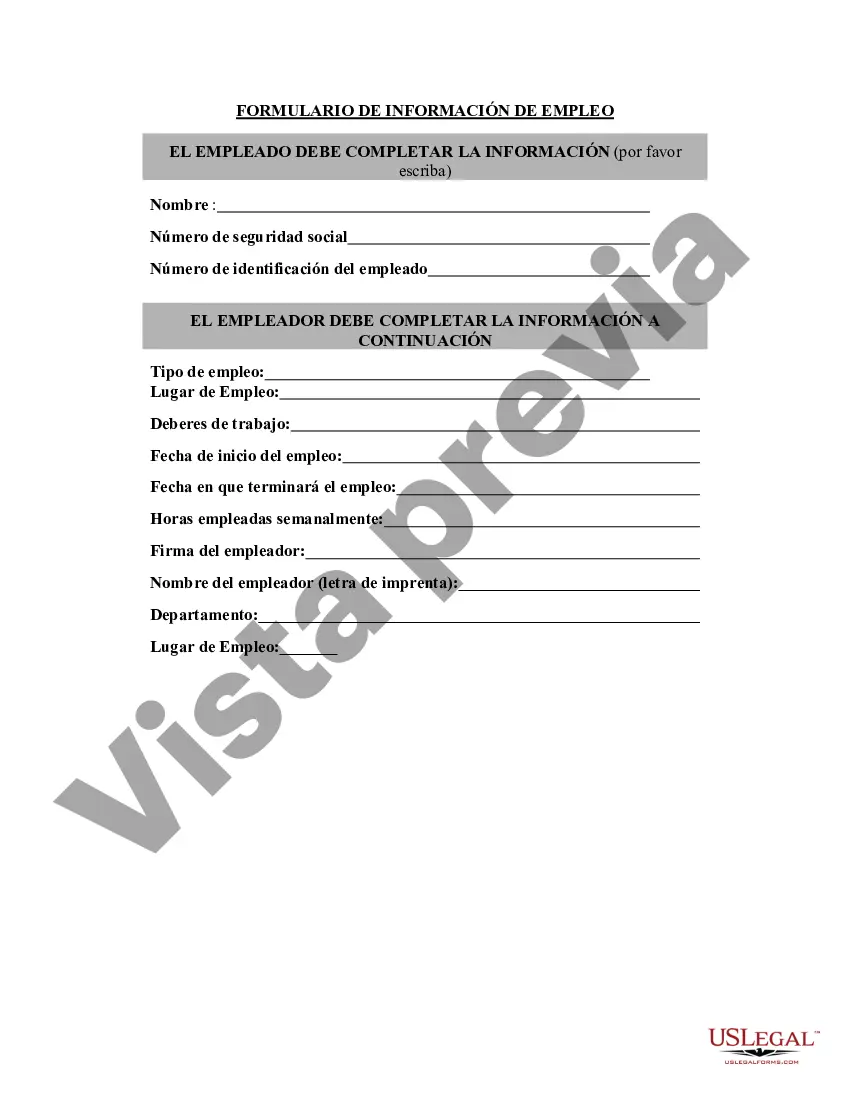

Nebraska Employment Information Form serves as a crucial document for employers in the state of Nebraska to gather essential information about their employees. This form acts as a reliable source for employers to organize, track, and maintain vital employee data. It caters to various aspects related to employment, benefits administration, tax withholding, and compliance with labor laws and regulations. The Nebraska Employment Information Form ensures employers can accurately determine tax withholding for employees. It collects details on an employee's personal information, including their full name, address, Social Security number, date of birth, and contact information. Employers also request employees to provide their marital status, the number of dependents they have, and any relevant information that could affect the employee's tax deductions. Furthermore, this form covers a range of other important topics related to employment. It includes sections where employees can specify their employment status, job title, department, and date of hire. Additionally, it may contain sections for employees to indicate their preferred method of receiving payments, such as direct deposit or paper checks. To ensure compliance with state and federal labor laws, the form may also request information regarding an employee's immigration status and work authorization. It is important to note that this section must be handled with utmost confidentiality and in accordance with applicable laws. Different types or variations of Nebraska Employment Information Form may exist depending on the specific needs of different organizations or industries. For instance, there could be separate forms for full-time and part-time employees, seasonal workers, or contractors. Each form type may collect similar information but tailored to meet the specific requirements of the employment arrangement. Completing a Nebraska Employment Information Form accurately and promptly is crucial for both the employer and employee. It enables the employer to fulfill legal requirements, accurately calculate payroll and taxes, and maintain proper documentation. For employees, it ensures that their personal and employment information is securely recorded, allowing for efficient communication, benefits administration, and compliance with applicable employment laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Formulario de información de empleo - Employment Information Form

Description

How to fill out Nebraska Formulario De Información De Empleo?

Have you been inside a place that you require documents for sometimes enterprise or personal functions virtually every day? There are a variety of authorized papers themes available on the Internet, but finding kinds you can depend on isn`t simple. US Legal Forms delivers 1000s of kind themes, much like the Nebraska Employment Information Form, which are published to fulfill state and federal requirements.

In case you are already informed about US Legal Forms web site and have an account, basically log in. Following that, you may acquire the Nebraska Employment Information Form web template.

Should you not provide an bank account and want to start using US Legal Forms, abide by these steps:

- Discover the kind you want and ensure it is for the right area/area.

- Utilize the Review key to review the form.

- Read the explanation to ensure that you have chosen the right kind.

- In the event the kind isn`t what you are looking for, utilize the Research discipline to get the kind that meets your requirements and requirements.

- Whenever you find the right kind, just click Purchase now.

- Choose the pricing plan you need, submit the desired information and facts to create your money, and pay for your order using your PayPal or bank card.

- Pick a hassle-free paper formatting and acquire your duplicate.

Get all of the papers themes you might have bought in the My Forms menus. You can obtain a extra duplicate of Nebraska Employment Information Form at any time, if necessary. Just click on the essential kind to acquire or printing the papers web template.

Use US Legal Forms, one of the most comprehensive variety of authorized kinds, to save lots of efforts and avoid blunders. The service delivers skillfully created authorized papers themes which can be used for an array of functions. Produce an account on US Legal Forms and initiate producing your way of life a little easier.