Nebraska Determining Self-Employed Contractor Status

Description

How to fill out Determining Self-Employed Contractor Status?

Have you ever been in a location where you require paperwork for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t simple.

US Legal Forms offers a vast array of form templates, including the Nebraska Determining Self-Employed Contractor Status, that are designed to comply with federal and state regulations.

Once you find the correct form, simply click Get now.

Choose the pricing plan you prefer, fill out the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nebraska Determining Self-Employed Contractor Status template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/county.

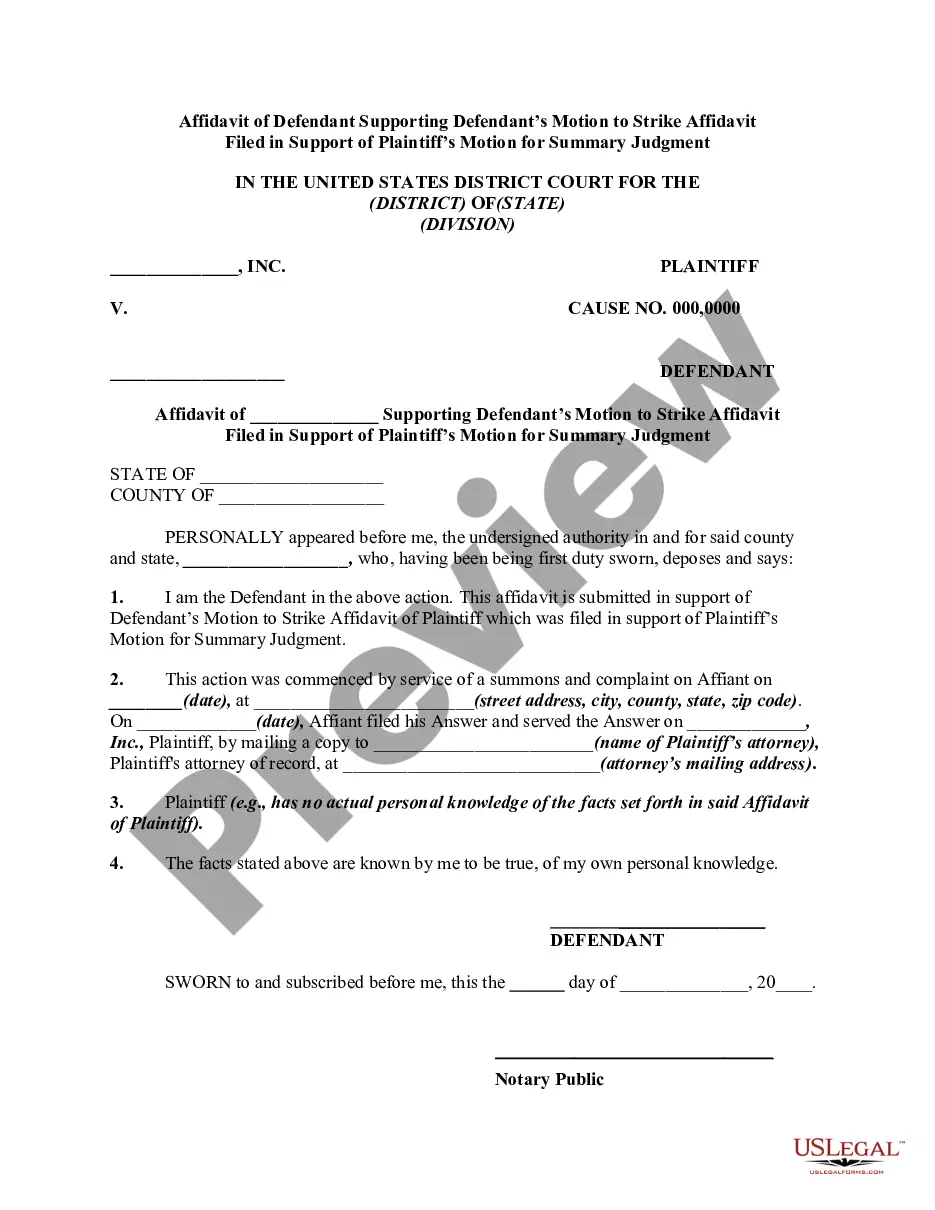

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the appropriate form.

- If the form isn’t what you want, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Getting Additional Contractor's Licenses It's easy to fill out the application online. If you have questions, call the Nebraska State Electrical Division at 402-471-3507. Any contractor who works on asbestos projects in Nebraska needs to get a contractor's license with the Department of Health and Human Services.

To register as a contractor, you will need to log into your profile at dol.nebraska.gov/conreg. If you have not created a profile on the website, you will be required to do so before registering your business.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Some of the common characteristics of an independent contractor include:Furnishes equipment and has control over that equipment.Submits bids for jobs, contracts, or fixes the price in advance.Has the capacity to accept or refuse an assignment or work.Pay relates more to completion of a job.More items...

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.