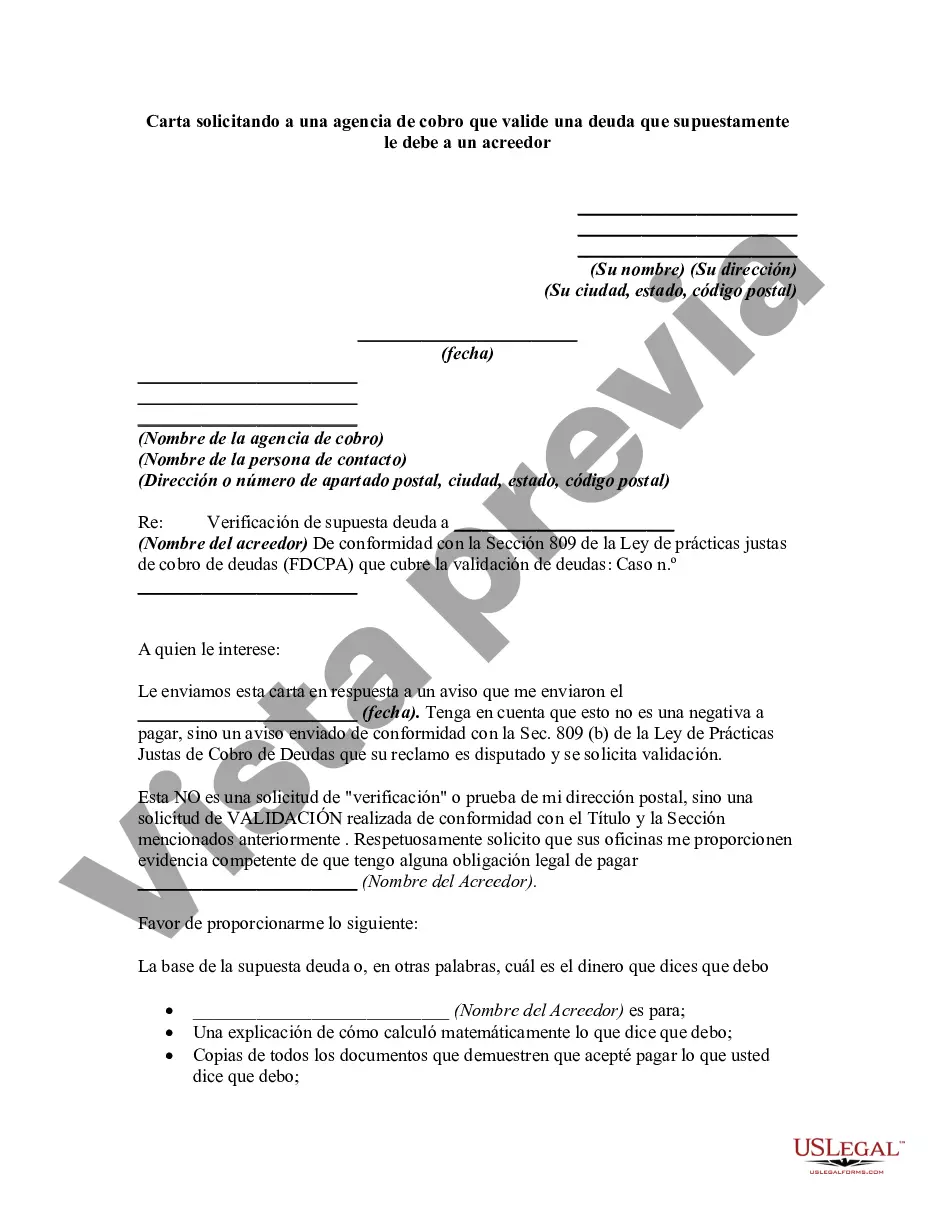

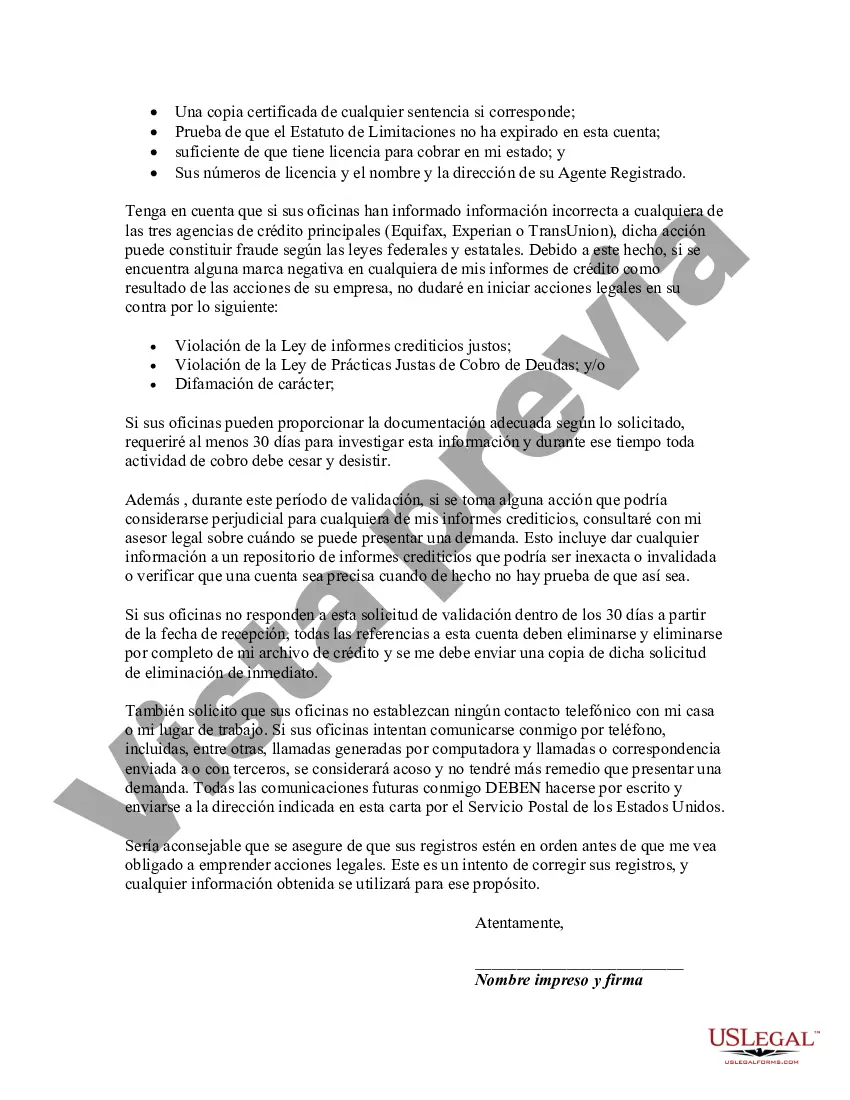

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nebraska Carta solicitando a una agencia de cobro que valide una deuda que supuestamente le debe a un acreedor - Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out Nebraska Carta Solicitando A Una Agencia De Cobro Que Valide Una Deuda Que Supuestamente Le Debe A Un Acreedor?

Choosing the right authorized file web template could be a struggle. Of course, there are a lot of templates accessible on the Internet, but how can you obtain the authorized kind you will need? Use the US Legal Forms internet site. The support provides a huge number of templates, such as the Nebraska Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, which you can use for company and personal needs. All the forms are examined by pros and meet state and federal demands.

If you are currently signed up, log in for your profile and click on the Download option to find the Nebraska Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. Make use of your profile to look throughout the authorized forms you may have purchased formerly. Check out the My Forms tab of your profile and get one more backup of your file you will need.

If you are a whole new end user of US Legal Forms, listed below are easy directions for you to follow:

- Very first, make certain you have selected the right kind to your city/area. You are able to look over the form making use of the Preview option and read the form description to make certain this is the best for you.

- When the kind does not meet your preferences, make use of the Seach industry to get the appropriate kind.

- When you are positive that the form would work, select the Purchase now option to find the kind.

- Pick the rates program you want and enter in the required information and facts. Make your profile and buy your order utilizing your PayPal profile or credit card.

- Choose the file file format and obtain the authorized file web template for your gadget.

- Comprehensive, change and produce and signal the attained Nebraska Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor.

US Legal Forms is definitely the biggest local library of authorized forms where you can discover various file templates. Use the service to obtain professionally-produced documents that follow condition demands.