New Hampshire Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

Are you presently situated in a position where you require documents for either professional or personal purposes almost every business day.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, such as the New Hampshire Revocable Living Trust for Property, that are designed to meet state and federal regulations.

If you find the suitable form, click on Get now.

Select the pricing plan you desire, provide the necessary information to create your account, and complete the payment using your PayPal or Visa/MasterCard.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the New Hampshire Revocable Living Trust for Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for your specific region/state.

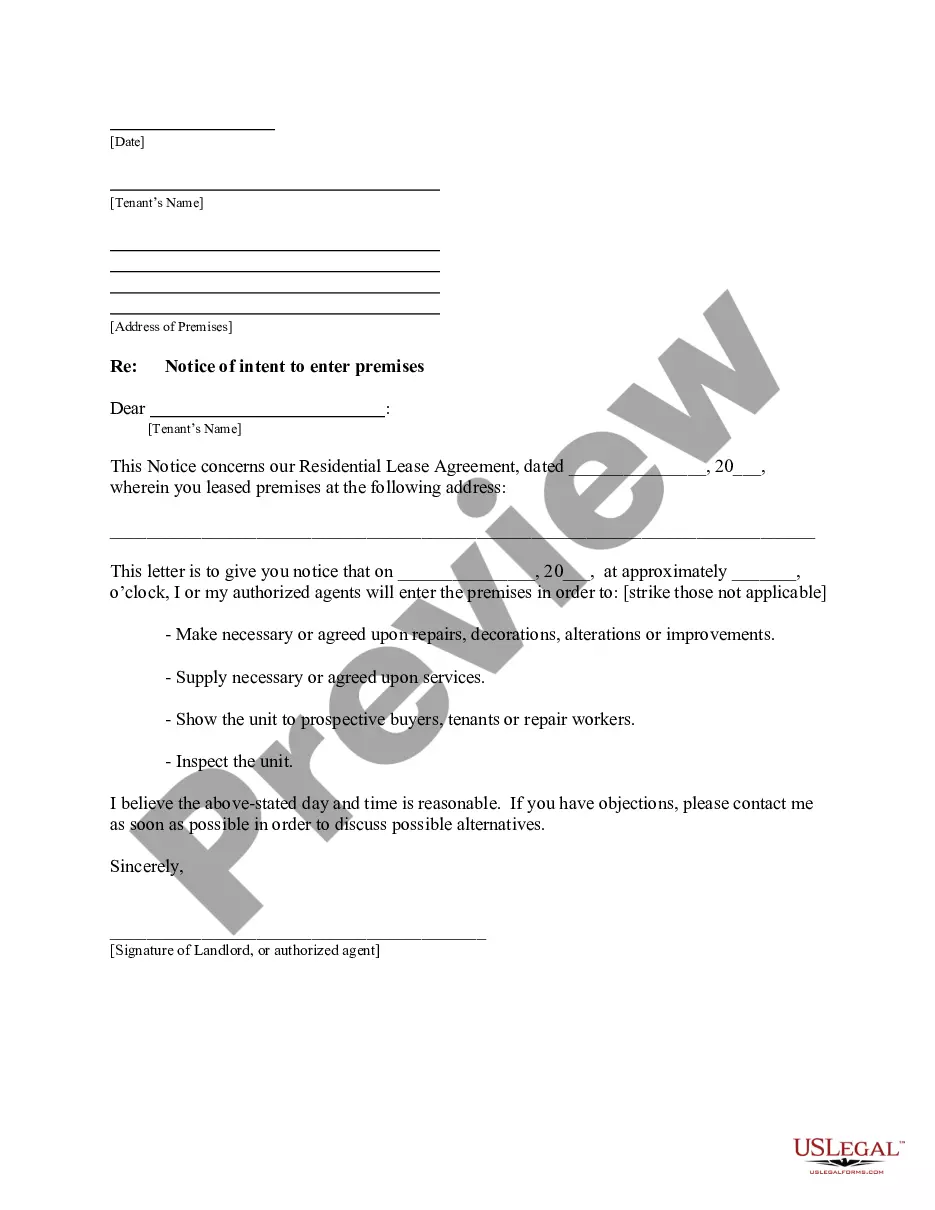

- Utilize the Review button to assess the document.

- Examine the summary to confirm that you have selected the appropriate form.

- If the form is not what you need, use the Search feature to find the form that meets your requirements.

Form popularity

FAQ

Yes, you can place your house in a New Hampshire Revocable Living Trust for House even if it has an existing mortgage. However, be sure to check your mortgage agreement, as some lenders may have specific requirements or restrictions. Generally, your mortgage remains intact, and you will continue to make payments as usual. This strategy can help in managing your asset while enjoying the benefits of the trust.

To place your house in a New Hampshire Revocable Living Trust for House, you need to draft the trust document and clearly state your intentions regarding the property. Next, you must transfer the title of your house into the trust, which typically involves completing a deed and recording it with your local registry of deeds. This process can be straightforward, and utilizing uslegalforms can simplify document creation and ensure compliance with state rules.

A trust, particularly a New Hampshire Revocable Living Trust for House, allows you to transfer ownership of your property while maintaining control over it during your lifetime. You can modify or revoke the trust at any time, ensuring flexibility. After your passing, the trust helps avoid probate, allowing for a smoother transition of your assets to your beneficiaries. This approach simplifies estate planning and provides peace of mind.

Filling out a New Hampshire Revocable Living Trust for House involves several key steps. First, you'll need to gather personal information, including the names of the trustees and beneficiaries. Next, clearly outline how you want your house and other assets managed during your lifetime and what happens after your passing. If you need assistance with this process, uslegalforms can provide valuable resources and templates to guide you through each step smoothly.

In New Hampshire, a New Hampshire Revocable Living Trust for House does not require recording with the state. However, it is important to note that while the trust document itself stays private, any property titled to the trust should be properly documented to ensure smooth transfer and management. This private nature allows you to retain control over your assets while simplifying the estate planning process. For more information on setting up a trust, consider exploring the resources available on the UsLegalForms platform.

One danger of trust funds, including a New Hampshire Revocable Living Trust for House, is that they can be mismanaged if not properly designed. If the trustee does not act in the best interest of the beneficiaries, it could lead to disputes and financial losses. Additionally, if the trust lacks clear terms, it may cause confusion or misinterpretation during asset distribution, so careful planning is crucial.

To put your house in a New Hampshire Revocable Living Trust for House, start by drafting the trust document, which outlines your wishes and the distribution of your property. Once the document is prepared, you will need to transfer the title of your home to the trust. This process may involve filing paperwork with your local registry of deeds to ensure that your house is officially held in the trust.

Yes, you can place a house with a mortgage into a New Hampshire Revocable Living Trust for House. However, it's important to inform your mortgage lender, as the terms of your mortgage may require that you keep the lender updated. Typically, your trust will assume the mortgage, and you can continue making payments as usual without compromising the trust.

Putting your house in a New Hampshire Revocable Living Trust for House can provide significant benefits. It helps you avoid probate, allowing for a quicker transfer of ownership to your heirs. This option also offers flexibility; as the trust is revocable, you can modify or dissolve it at any time during your lifetime, maintaining control over your property.

Your parents should consider placing their assets in a New Hampshire Revocable Living Trust for House if they want to simplify the management and distribution of their estate. A trust can help avoid probate, ensuring that their assets are transferred quickly and privately to their beneficiaries. Moreover, it allows them to retain control over their assets during their lifetime and provide clear instructions for after their passing.