New Hampshire Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a legally binding contract that outlines the terms and conditions for the sale of a business and retention of employees in the state of New Hampshire. This agreement is specifically designed for asset purchase transactions where the buyer wants to retain certain employees after acquiring the business. In a Sale of Business — Retained Employees Agreement, the buyer and seller outline the specifics of the asset purchase transaction, including the purchase price, allocation of assets, and liabilities. The agreement also addresses the retention of specific employees by the buyer, ensuring a smooth transition of the business operations. Keywords: New Hampshire, sale of business, retained employees' agreement, asset purchase transaction, buyer, seller, purchase price, asset allocation, liabilities, business operations. There are no specific variations or types of New Hampshire Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction mentioned in the query. However, it is important to note that the agreement can be customized and tailored to meet the unique needs and circumstances of each transaction. The parties involved may need to modify the agreement's provisions to address any specific requirements or considerations that arise during the negotiation process. Seeking legal advice and guidance is crucial to ensure compliance with New Hampshire laws and regulations and to protect the interests of both the buyer and seller.

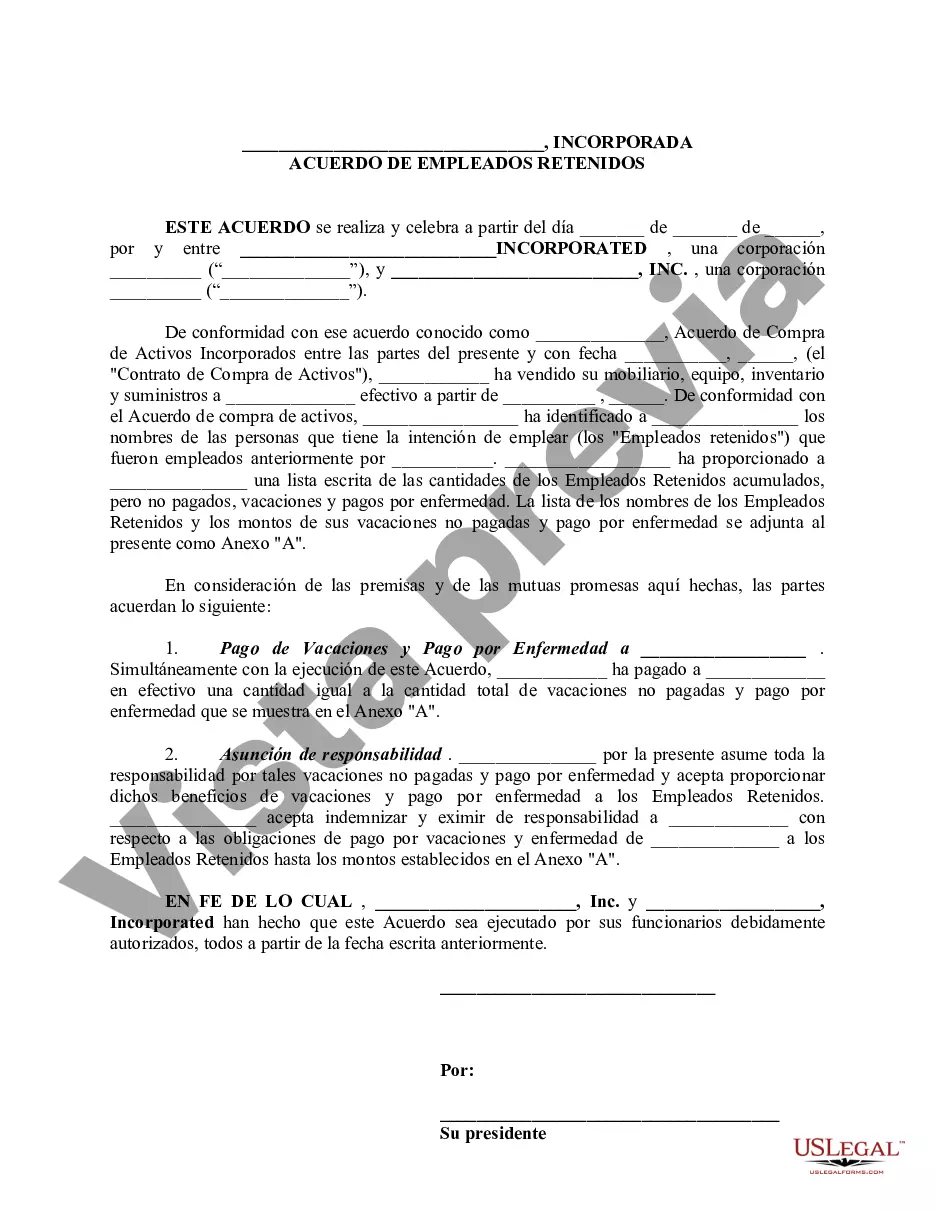

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Venta de negocio - Acuerdo de empleados retenidos - Transacción de compra de activos - Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out New Hampshire Venta De Negocio - Acuerdo De Empleados Retenidos - Transacción De Compra De Activos?

If you want to complete, acquire, or print out legal papers layouts, use US Legal Forms, the greatest collection of legal varieties, which can be found on the web. Make use of the site`s basic and handy research to obtain the papers you require. Various layouts for enterprise and individual functions are sorted by types and says, or search phrases. Use US Legal Forms to obtain the New Hampshire Sale of Business - Retained Employees Agreement - Asset Purchase Transaction with a number of clicks.

Should you be previously a US Legal Forms customer, log in in your profile and then click the Obtain button to have the New Hampshire Sale of Business - Retained Employees Agreement - Asset Purchase Transaction. You may also accessibility varieties you formerly delivered electronically inside the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for your right metropolis/nation.

- Step 2. Make use of the Preview solution to examine the form`s content material. Never neglect to read the outline.

- Step 3. Should you be not satisfied together with the type, make use of the Look for area at the top of the monitor to find other variations of your legal type web template.

- Step 4. Upon having identified the shape you require, click the Purchase now button. Opt for the pricing prepare you prefer and add your credentials to register for the profile.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal profile to complete the financial transaction.

- Step 6. Choose the structure of your legal type and acquire it in your device.

- Step 7. Comprehensive, change and print out or sign the New Hampshire Sale of Business - Retained Employees Agreement - Asset Purchase Transaction.

Each and every legal papers web template you acquire is your own for a long time. You may have acces to every single type you delivered electronically in your acccount. Select the My Forms portion and pick a type to print out or acquire again.

Contend and acquire, and print out the New Hampshire Sale of Business - Retained Employees Agreement - Asset Purchase Transaction with US Legal Forms. There are thousands of skilled and status-distinct varieties you may use for your personal enterprise or individual requires.