The New Hampshire Agreement for Sale of Liquor Store Business, including Liquor License, is a legally binding document that outlines the terms and conditions for the sale and transfer of a liquor store business along with its associated liquor license in the state of New Hampshire. Keywords: New Hampshire Agreement, Sale of Liquor Store Business, Liquor License, terms and conditions, transfer, legally binding, associated, state of New Hampshire. In New Hampshire, there are different types of agreements for the sale of a liquor store business with a liquor license, including: 1. Asset Purchase Agreement: This type of agreement involves the purchase of the liquor store's assets, including inventory, equipment, furniture, fixtures, licenses, and permits. The agreement will explicitly state which assets are included in the sale and their corresponding value. 2. Stock Purchase Agreement: In this type of agreement, the buyer purchases the ownership shares or stocks of the liquor store business. The agreement will specify the percentage of shares being sold, the price per share, and any conditions for the transfer of ownership. 3. Membership Interest Purchase Agreement: If the liquor store business is organized as a limited liability company (LLC), this agreement is used to transfer membership interest from the selling party to the buyer. It outlines the terms and conditions for the sale, including price, representation, warranties, and indemnification. 4. Leasehold Purchase Agreement: If the liquor store business operates on leased premises, this agreement is used to transfer the leasehold interest to the buyer. It includes terms related to the lease agreement, such as the lease term, rent, conditions of assignment, and any required landlord consents. 5. Franchise Sale Agreement: In case the liquor store operates under a franchise system, this specific agreement is used to transfer the ownership of the franchise, including the liquor license. It will outline the franchise fees, royalty payments, brand rights, and any necessary approvals from the franchisor. Regardless of the specific agreement type, a New Hampshire Agreement for Sale of Liquor Store Business will typically cover the following key elements: 1. Parties involved: Identification and contact information of the buyer(s) and seller(s), including their legal names and addresses. 2. Purchase price and payment terms: The agreed purchase price for the liquor store business, including any down payment, financing arrangements, installment plans, or other payment conditions. 3. Assets included: A detailed list of assets being transferred, such as inventory, equipment, licenses, permits, contracts, customer databases, and intellectual property. 4. Liabilities and obligations: Allocation of any outstanding debts, loans, leases, or liabilities related to the liquor store business. 5. Representations and warranties: Statements made by the seller about the accuracy and completeness of information provided regarding the liquor store's financials, tax status, licenses, permits, compliance, and any pending legal matters. 6. Conditions of sale: Any specific conditions that need to be fulfilled before the sale can be completed, such as obtaining necessary approvals from local authorities or landlords. 7. Closing process: Steps and timeline for the closing of the sale, including the transfer of licenses and permits, execution of necessary documents, and the handover of the business to the buyer. 8. Confidentiality and non-compete clauses: Provisions addressing the protection of confidential information and potential limitations on the seller's ability to engage in a similar business within a specified timeframe and geographic area. It is crucial to consult legal professionals or attorneys experienced in the sale of liquor store businesses in New Hampshire to ensure that the agreement complies with all relevant laws and regulations.

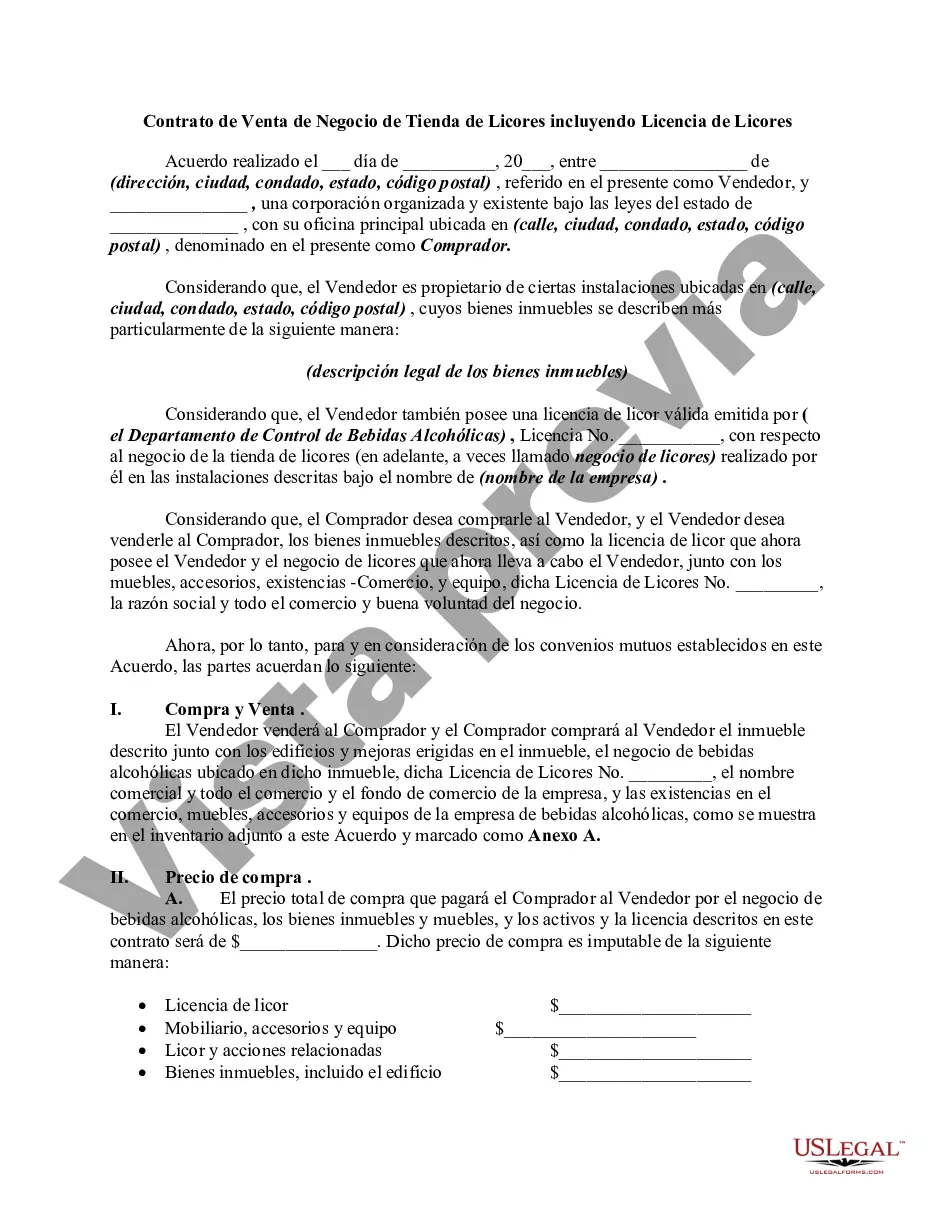

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Contrato de Venta de Negocio de Tienda de Licores incluyendo Licencia de Licores - Agreement for Sale of Liquor Store Business including Liquor License

Description

How to fill out New Hampshire Contrato De Venta De Negocio De Tienda De Licores Incluyendo Licencia De Licores?

If you wish to total, download, or printing lawful file templates, use US Legal Forms, the largest variety of lawful kinds, that can be found on the web. Take advantage of the site`s simple and easy practical look for to get the papers you require. Various templates for organization and specific reasons are sorted by groups and says, or keywords and phrases. Use US Legal Forms to get the New Hampshire Agreement for Sale of Liquor Store Business including Liquor License with a number of click throughs.

If you are previously a US Legal Forms consumer, log in for your profile and then click the Down load key to have the New Hampshire Agreement for Sale of Liquor Store Business including Liquor License. Also you can entry kinds you in the past acquired from the My Forms tab of your respective profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have selected the form for the appropriate town/land.

- Step 2. Make use of the Preview choice to examine the form`s articles. Don`t forget about to read through the information.

- Step 3. If you are not happy with the kind, take advantage of the Look for industry on top of the monitor to discover other models from the lawful kind format.

- Step 4. Upon having discovered the form you require, click the Acquire now key. Choose the prices program you favor and put your references to register for the profile.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Find the structure from the lawful kind and download it on your own device.

- Step 7. Complete, change and printing or indication the New Hampshire Agreement for Sale of Liquor Store Business including Liquor License.

Each lawful file format you acquire is yours permanently. You possess acces to each kind you acquired inside your acccount. Click the My Forms segment and decide on a kind to printing or download again.

Compete and download, and printing the New Hampshire Agreement for Sale of Liquor Store Business including Liquor License with US Legal Forms. There are many expert and express-particular kinds you can utilize for your organization or specific requires.