A New Hampshire Limited Liability Partnership (LLP) Agreement is a legal document that outlines the rights, responsibilities, and obligations of partners in a limited liability partnership in the state of New Hampshire. This agreement plays a crucial role in establishing the operational and financial structure of the LLP, as well as protecting the interests of all partners involved. The New Hampshire LLP Agreement typically includes various key provisions related to the formation, management, and dissolution of the partnership. It also addresses important aspects such as capital contributions, profit and loss distribution, decision-making procedures, partner withdrawal or retirement, dispute resolution mechanisms, and the admission of new partners. An essential component of the New Hampshire LLP Agreement is the limited liability protection it provides. In an LLP, each partner's liability is limited to their own acts, omissions, and misconduct, protecting individual partners from personal liability for the partnership's debts or obligations incurred by other partners. This liability protection is an attractive feature for professionals such as lawyers, accountants, architects, and engineers who wish to form a partnership while safeguarding their personal assets. While there is only one type of New Hampshire Limited Liability Partnership Agreement, the content of the agreement may vary depending on the specific needs and requirements of the partners. Some Laps may choose to include additional provisions tailored to the nature of their business or profession. To form an LLP in New Hampshire, partners must file a registration document called a "Statement of Qualification" with the New Hampshire Secretary of State, along with the required filing fee. It is also strongly recommended for partners to draft and execute a comprehensive Limited Liability Partnership Agreement to establish clear guidelines and avoid potential disputes down the line. In conclusion, a New Hampshire Limited Liability Partnership Agreement is a crucial legal document that defines the rights, responsibilities, and liability protections of partners in an LLP. By outlining the operational and financial aspects of the partnership, this agreement helps ensure a smooth and efficient partnership while safeguarding the personal assets of individual partners. It is important for partners to consult with legal professionals to draft a tailored agreement that fulfills their unique needs and complies with New Hampshire laws and regulations.

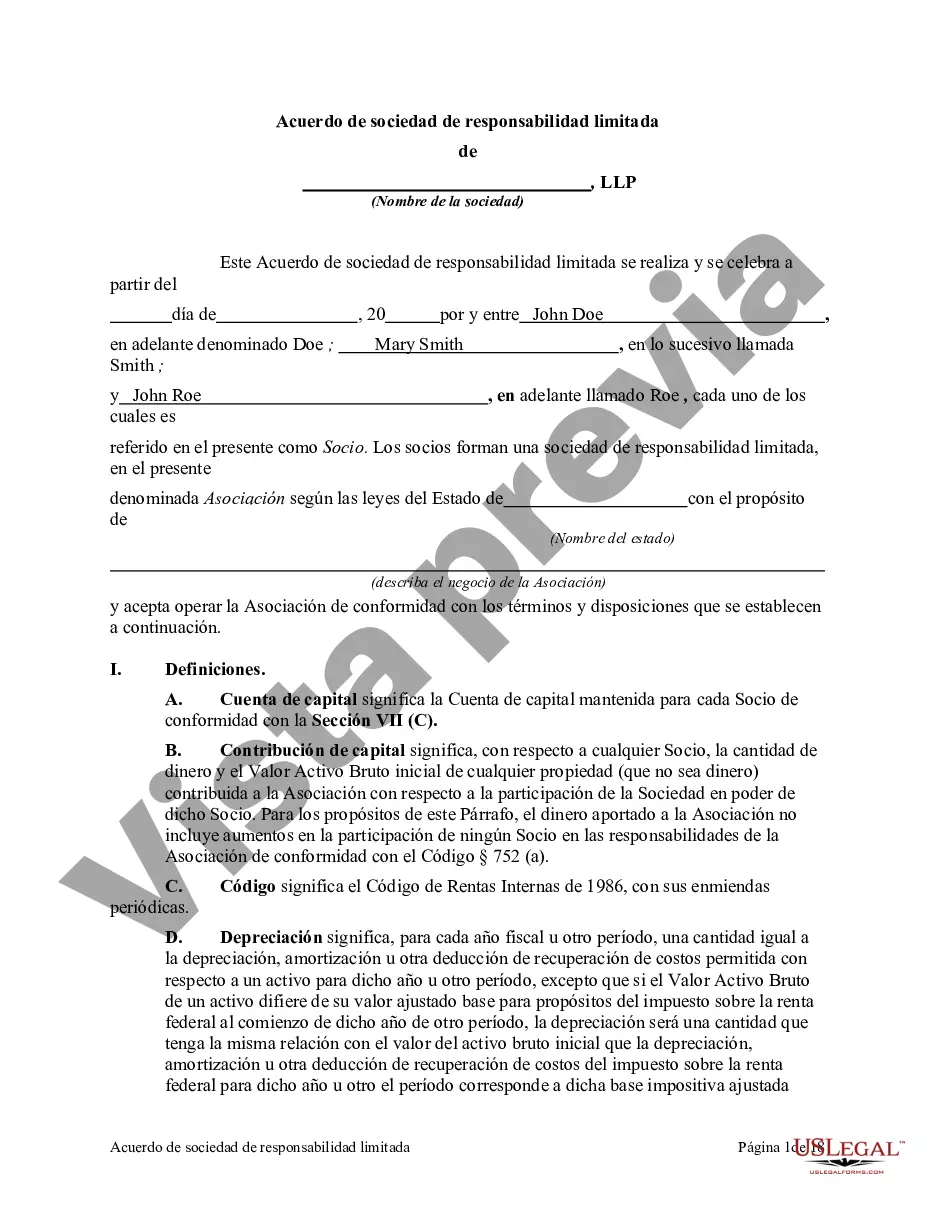

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Acuerdo de sociedad de responsabilidad limitada - Limited Liability Partnership Agreement

Description

How to fill out New Hampshire Acuerdo De Sociedad De Responsabilidad Limitada?

It is possible to commit several hours online looking for the lawful document template that fits the state and federal specifications you need. US Legal Forms gives 1000s of lawful forms which are examined by professionals. You can actually acquire or print the New Hampshire Limited Liability Partnership Agreement from our services.

If you already possess a US Legal Forms bank account, you may log in and click on the Download switch. After that, you may complete, change, print, or indication the New Hampshire Limited Liability Partnership Agreement. Each lawful document template you acquire is your own forever. To obtain yet another duplicate for any purchased develop, visit the My Forms tab and click on the related switch.

If you use the US Legal Forms site initially, stick to the basic instructions under:

- Initially, ensure that you have chosen the proper document template for that county/metropolis that you pick. See the develop description to ensure you have picked out the appropriate develop. If readily available, utilize the Review switch to look with the document template as well.

- If you want to get yet another version from the develop, utilize the Look for field to get the template that meets your needs and specifications.

- When you have discovered the template you desire, click on Purchase now to continue.

- Pick the prices plan you desire, type your accreditations, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can use your Visa or Mastercard or PayPal bank account to fund the lawful develop.

- Pick the file format from the document and acquire it to the product.

- Make alterations to the document if possible. It is possible to complete, change and indication and print New Hampshire Limited Liability Partnership Agreement.

Download and print 1000s of document layouts while using US Legal Forms site, that provides the most important assortment of lawful forms. Use professional and express-distinct layouts to take on your company or personal requires.