This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

Discovering the right lawful record web template might be a have a problem. Of course, there are a variety of web templates available online, but how do you find the lawful form you require? Use the US Legal Forms website. The assistance delivers 1000s of web templates, such as the New Hampshire Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, that can be used for organization and personal requirements. Each of the kinds are checked by pros and meet state and federal specifications.

When you are previously registered, log in to your bank account and click the Acquire key to have the New Hampshire Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. Utilize your bank account to check with the lawful kinds you might have bought formerly. Proceed to the My Forms tab of your respective bank account and acquire one more version of the record you require.

When you are a whole new consumer of US Legal Forms, here are simple instructions so that you can adhere to:

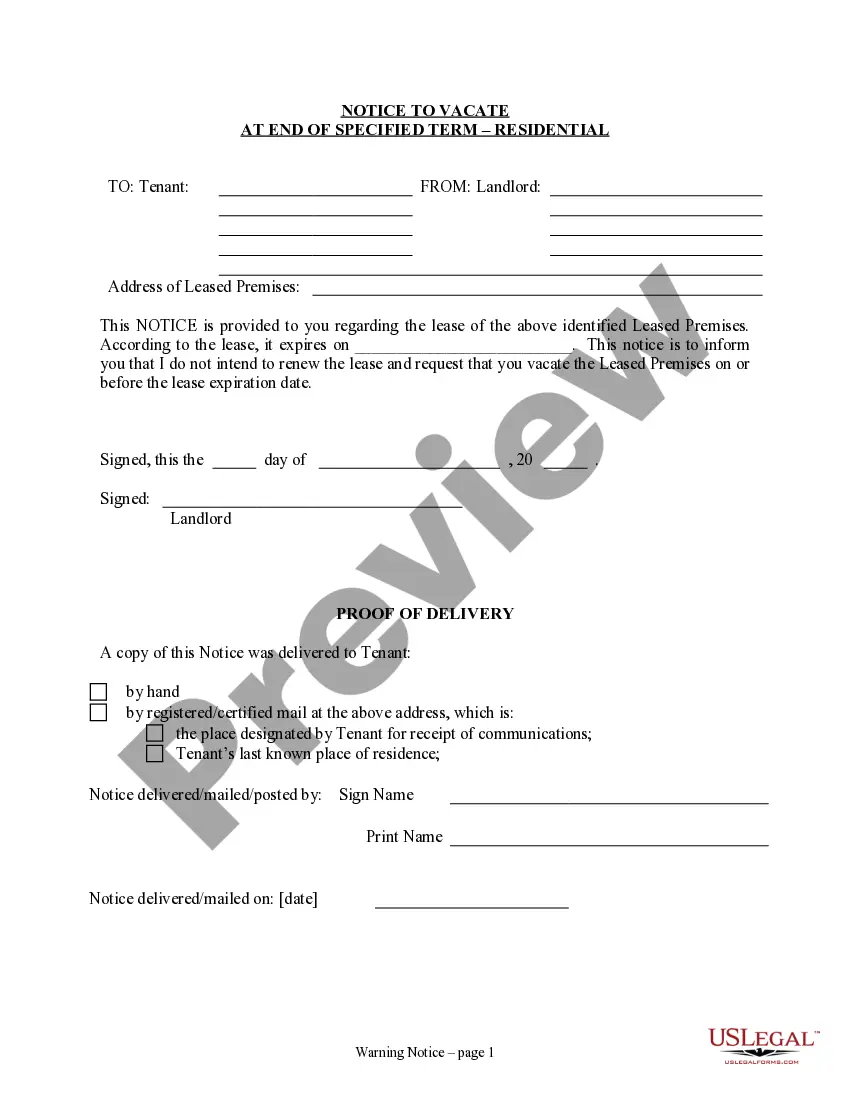

- First, be sure you have selected the right form for your city/state. You may check out the form while using Review key and study the form outline to make certain this is the right one for you.

- If the form will not meet your preferences, make use of the Seach field to discover the right form.

- Once you are certain the form is proper, click the Get now key to have the form.

- Select the costs prepare you desire and enter the required details. Make your bank account and buy an order utilizing your PayPal bank account or Visa or Mastercard.

- Select the file structure and acquire the lawful record web template to your system.

- Total, revise and print out and signal the received New Hampshire Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness.

US Legal Forms may be the largest collection of lawful kinds where you will find different record web templates. Use the service to acquire skillfully-manufactured papers that adhere to express specifications.

Form popularity

FAQ

Hear this out loud PauseEvery estate is different and can take a different length of time to administer depending on its complexity. There is a general expectation that an executor or administrator should try to complete the estate administration within a year of the death, and this is referred to as the executor's year.

The Estate Settlement Timeline: There is no specific deadline for this in New Hampshire law, but it is generally best to do so within 30 days to prevent unnecessary delays in the probate process.

STATUS REPORTS - Estates Opened Solely to Pursue a Cause of Action. In estates opened solely to pursue a cause of action, a Fiduciary may file a motion to postpone the filing of annual accounts while the underlying legal action is pending.

Assignments, however, almost never apply to a beneficiary's interests in a trust. Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

Hear this out loud PauseIn New Hampshire, probate can take at least six months to allow creditors to file claims against the estate. On average, the probate process can take up to a year and a half.

Hear this out loud PauseSimple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

Hear this out loud PauseUnder New Hampshire law, Executors, Administrators and their attorneys are allowed reasonable fees; these fees are determined by the nature of the estate. Fees are always subject to the approval of the court.

Creditors have a certain time frame, typically six months from the date of appointment of the executor or administrator, to file their claims for payment. If the estate has enough assets, the debts are paid. If not, creditors are generally paid on a pro-rata basis.