Dear [Recipient's Name], We hope this letter finds you well. As part of our effort to maintain updated and accurate records, we are reaching out to you regarding your dormant account with us. This letter aims to provide you with important information about the status of your account and the necessary steps to reactivate it. Firstly, let us clarify what a dormant account means. A dormant account refers to an account that has had no customer-initiated activity, such as deposits, withdrawals, or transactions, for a specified period of time. In the case of our institution, New Hampshire Bank, this period is one year. We have noticed that you have not made any transactions or contacted us regarding your account for the past twelve months. Consequently, your account qualifies as dormant under our policy. It is important for you to understand the implications of having a dormant account, such as the following: 1. Service and Transactional Limitations: With a dormant account, certain services may be restricted or temporarily unavailable, including online banking, issuing checks, or making electronic transfers. These measures are in place to ensure the security and integrity of your account. 2. Communication and Updates: Due to the lack of recent activity, we might not possess your up-to-date contact information. Therefore, we kindly request you to review the information we currently have on file for you and inform us of any necessary changes. This will enable us to keep you informed about important updates, policy changes, and promotions via regular correspondence. 3. Safekeeping and Accessibility: Rest assured that the funds in your dormant account are still intact and accessible to you. Our primary concern is maintaining the security of your funds. However, we urge you to review your account periodically and assess whether you need to reactivate it to regain full access and benefits. To reactivate your dormant account, it is necessary to follow our reactivation process. We offer various options for your convenience: 1. In-Person Visit: You may visit any of our New Hampshire Bank branches and present your identification documents to a customer service representative. They will guide you through the reactivation process and provide you with any further assistance. 2. Phone Call: If visiting in person is inconvenient, you can contact our customer support team at [customer support number]. Our dedicated representatives will guide you through the necessary steps and address any concerns you may have. 3. Online Reactivation: For a more streamlined and convenient option, you can reactivate your dormant account online. Simply visit our website at [website address] and follow the instructions provided there. Online reactivation will require your login credentials or registration if you don't have an online banking account. We understand that life can become hectic, and sometimes certain accounts slip into a dormant state unintentionally. However, we encourage you to take prompt action to reactivate your account to regain full access to our wide range of banking services and benefits. If you have any queries or require further clarification, please do not hesitate to contact our customer support team. We are dedicated to providing you with the assistance you deserve. Thank you for your attention to this matter, and we look forward to serving you promptly. Sincerely, [Your Name] [Your Title/Position] New Hampshire Bank Keywords: Dormant account, New Hampshire Bank, reactivation process, dormant letter, online banking, account accessibility, customer support, dormant status, transaction limitations, communication updates.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Carta de muestra para carta inactiva - Sample Letter for Dormant Letter

Description

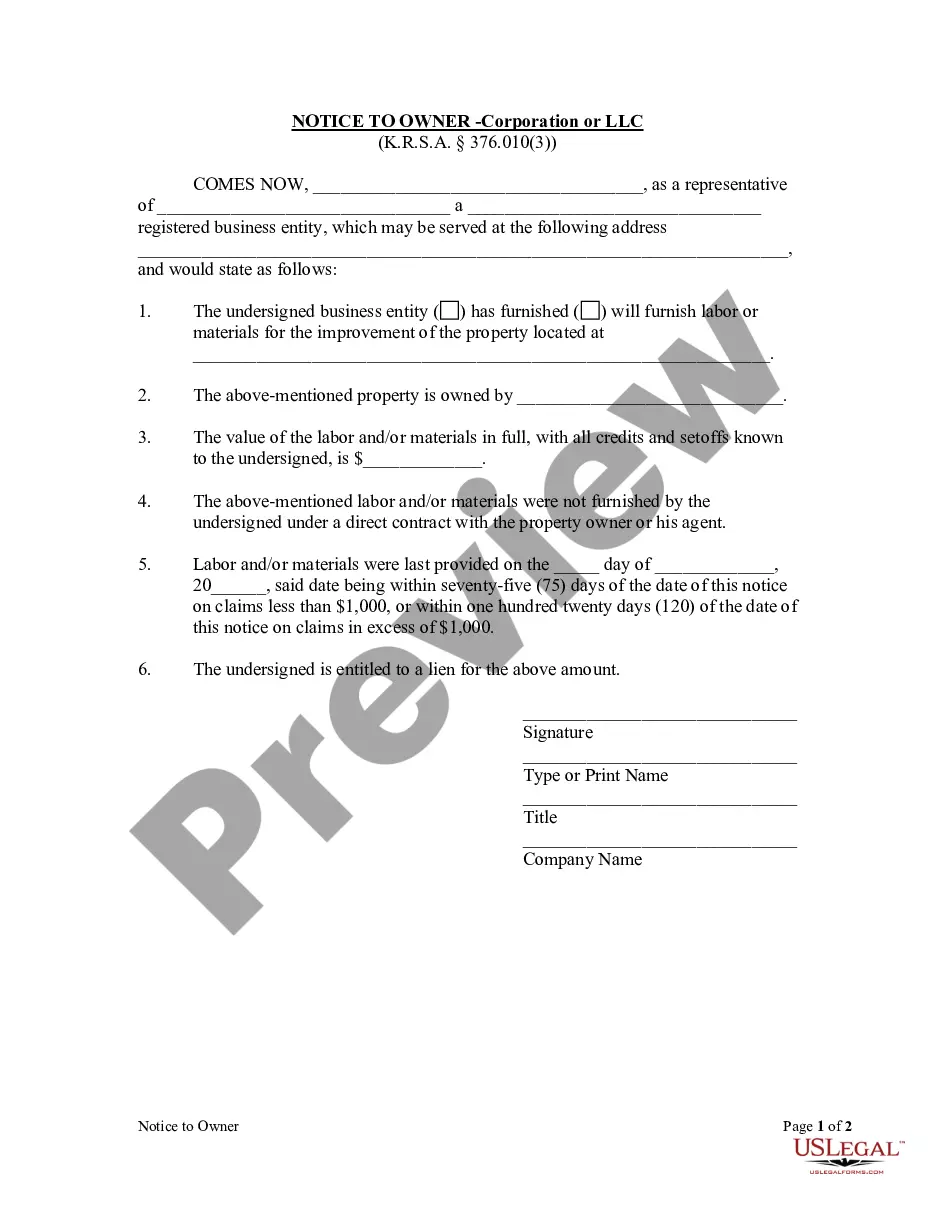

How to fill out New Hampshire Carta De Muestra Para Carta Inactiva?

It is feasible to spend hours online attempting to locate the legal document template that satisfies the federal and state criteria you need.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

You can download or print the New Hampshire Sample Letter for Dormant Letter from my service.

If available, utilize the Review option to examine the document template as well.

- If you possess a US Legal Forms account, you may Log In and then click the Download option.

- Following that, you can complete, edit, print, or sign the New Hampshire Sample Letter for Dormant Letter.

- Every legal document template you purchase is yours forever.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/region of your choice.

- Review the form outline to ensure you have chosen the right form.

Form popularity

FAQ

A letter of abandonment signifies that a tenant has vacated the property without notice, and it serves as a formal announcement of this status. This letter details the reasons for classifying the property as abandoned, which can have legal implications. It is advisable to document these events carefully. For clarity and professionalism, a New Hampshire Sample Letter for Dormant Letter can be helpful in crafting this document.

Statute 540 in New Hampshire addresses landlord-tenant relations, focusing on eviction processes and tenant rights. It outlines the legal framework required to remove a tenant from a rental property effectively. Understanding these statutes is crucial for both landlords and tenants to protect their rights. A New Hampshire Sample Letter for Dormant Letter can be created to address situations as defined in this statute.

No, eviction and abandonment are not the same. Eviction is a legal process initiated by a landlord to remove a tenant from a property due to lease violations. Abandonment refers to a tenant leaving the property without any further intention to return. Understanding the differences can help you manage rental situations effectively, and a New Hampshire Sample Letter for Dormant Letter can assist you in documenting either situation.

A letter of abandonment serves as legal documentation stating that a tenant has left a rental property without notice. This letter outlines the circumstances under which the property is deemed abandoned. It protects the landlord's rights while also notifying the tenant of potential consequences. Using a New Hampshire Sample Letter for Dormant Letter can help you format this letter appropriately.

A 30 day notice to vacate is a formal notification to a tenant in New Hampshire to leave the rental property within 30 days. This written notice is typically issued by the landlord when they decide to terminate the tenancy. It is vital to follow the correct procedures to ensure compliance with local laws. You could use a New Hampshire Sample Letter for Dormant Letter to draft this notice effectively.

Yes, New Hampshire does require partnership tax returns. Partnerships must file an annual tax return called the Business Profits Tax (BPT). Each partner must report their share of the partnership income on their individual returns. For more detailed guidance, you may consider using a New Hampshire Sample Letter for Dormant Letter to communicate with your partners.

A 30-day notice is a formal communication from a tenant to their landlord expressing the intent to move out in 30 days. This notice provides the landlord time to prepare for the vacancy, search for a new tenant, or finalize any necessary paperwork. Utilizing a New Hampshire Sample Letter for Dormant Letter can assist you in crafting this notice correctly, ensuring it meets legal standards.

In New Hampshire, a landlord generally cannot evict you without a court order. They must follow the legal process, which includes serving you with a notice and filing for eviction in court. To safeguard your rights, it's wise to have a solid understanding of the law and consider drafting a New Hampshire Sample Letter for Dormant Letter, affirming your position.

To write a dormant account letter, begin by clearly identifying the type of account and your intent to reactivate or inquire about its status. Include essential details such as your account number, name, and contact information. You can refer to a New Hampshire Sample Letter for Dormant Letter for a well-structured format that simplifies the process and ensures effective communication with your financial institution.

A dormant account typically refers to a financial account that has been inactive for a prolonged period, usually one year or more. This could include savings accounts, checking accounts, or investment accounts where no transactions have occurred. If you need assistance managing a dormant account, a New Hampshire Sample Letter for Dormant Letter can help you communicate effectively with your bank or financial institution.

More info

NC ERP Papers are the basic course work paper for the course. NC ERP Papers Classes The NC ERP are intended to be a set of problem-solving and analysis problems which are to be solved by the students during the Course. Classical Problems The classical problems are intended to be solved in a classroom setting over the course of the entire course. Classical Problems Students are to solve the classical problems. The purpose of the problems in this class is to make students familiar with the major theoretical concepts which form the basic foundation of Physics. This course is also a prerequisite for the Physics and Chemistry Prerequisites and a prerequisite for students who want to enroll in the upper level classes.