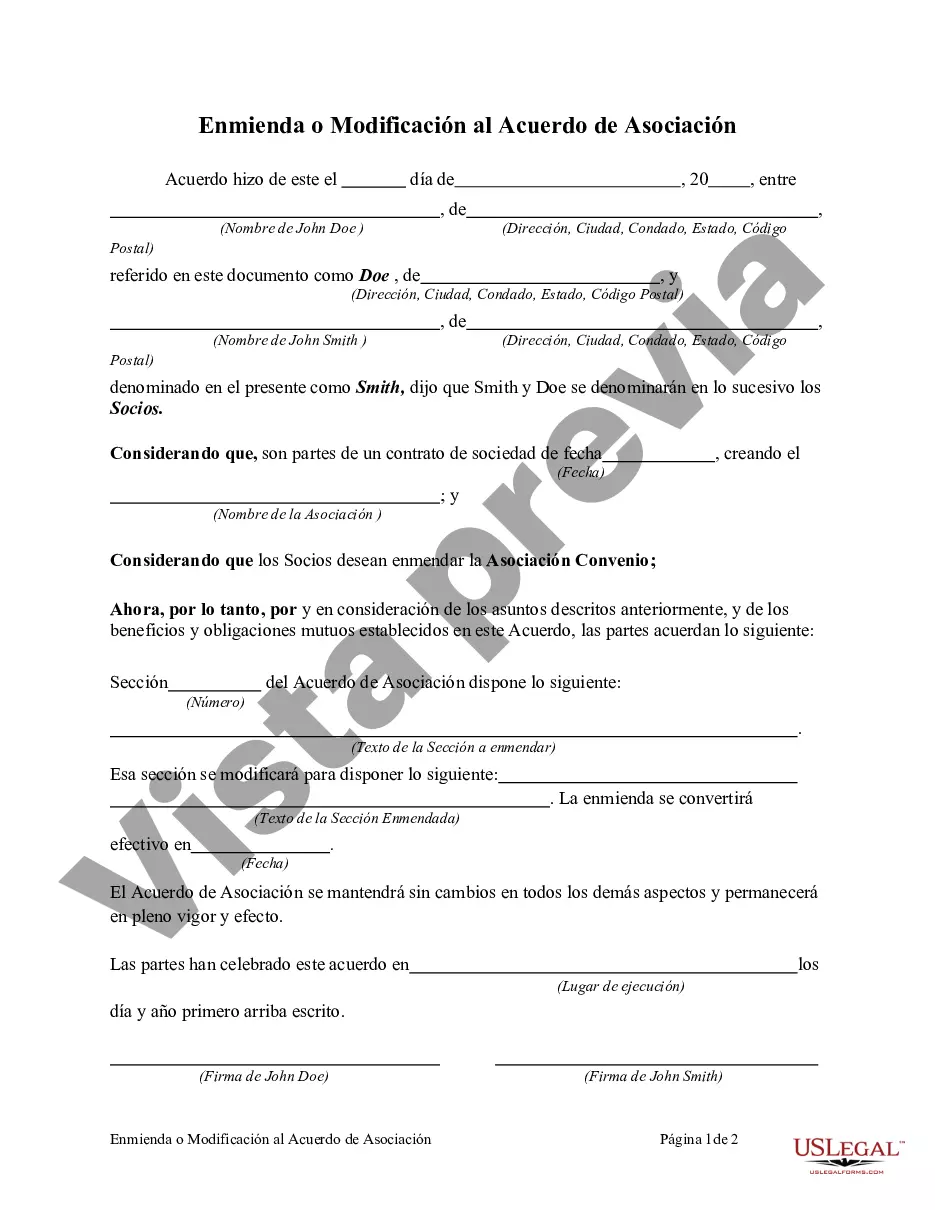

This form is an amendment or modification to a partnership agreement

A New Hampshire Amendment or Modification to Partnership Agreement refers to a legal document used to alter or update the terms and conditions of an existing partnership agreement in the state of New Hampshire. This agreement serves as a vital tool for partnerships to reflect changes in their business operations, ownership structure, or to address any other adjustments necessary for the smooth functioning of the partnership. The New Hampshire Revised Statutes (RSA 304-C:61) provide guidelines and requirements for making amendments or modifications to a partnership agreement. These amendments can typically be categorized into the following types: 1. Business Operation Changes: Partnerships may need to modify their agreement to accommodate changes in their business operations. This could include adding or removing business activities, changing the partnership's official name, or amending clauses related to the partnership's scope of operation. 2. Ownership Structure Changes: Partnerships often experience changes in ownership due to various reasons such as partners retiring, new partners joining, or the transfer of ownership interests. In such cases, an amendment or modification is necessary to reflect the new ownership structure accurately. This includes altering capital contributions, profit sharing ratios, voting rights, and other related provisions. 3. Financial Adjustments: Amendments may also be required to address financial matters, such as revising the distribution of profits and losses, modifying the method of calculating partner loans or interest rates, or adjusting the contribution of partners towards the partnership's capital. 4. Dissolution and Termination: In certain circumstances, partnerships may need to amend their agreement due to the decision to dissolve or terminate the partnership. This includes specifying the process for winding up affairs, distributing assets, and settling liabilities. Partnerships seeking to make amendments or modifications to their partnership agreement in New Hampshire must follow specific procedures. According to RSA 304-C:64, a written amendment must be drafted, signed by all partners, and notarized. This document should clearly identify the section(s) being amended and provide the updated wording or new provisions. Once executed, the amendment should be kept with the original partnership agreement and shared with all partners. It is essential for partnerships to ensure that any amendment or modification adheres to the laws and regulations of New Hampshire. If there are any uncertainties or complexities involved, seeking legal advice is highly recommended ensuring compliance and to protect the interests of all partners involved in the partnership.A New Hampshire Amendment or Modification to Partnership Agreement refers to a legal document used to alter or update the terms and conditions of an existing partnership agreement in the state of New Hampshire. This agreement serves as a vital tool for partnerships to reflect changes in their business operations, ownership structure, or to address any other adjustments necessary for the smooth functioning of the partnership. The New Hampshire Revised Statutes (RSA 304-C:61) provide guidelines and requirements for making amendments or modifications to a partnership agreement. These amendments can typically be categorized into the following types: 1. Business Operation Changes: Partnerships may need to modify their agreement to accommodate changes in their business operations. This could include adding or removing business activities, changing the partnership's official name, or amending clauses related to the partnership's scope of operation. 2. Ownership Structure Changes: Partnerships often experience changes in ownership due to various reasons such as partners retiring, new partners joining, or the transfer of ownership interests. In such cases, an amendment or modification is necessary to reflect the new ownership structure accurately. This includes altering capital contributions, profit sharing ratios, voting rights, and other related provisions. 3. Financial Adjustments: Amendments may also be required to address financial matters, such as revising the distribution of profits and losses, modifying the method of calculating partner loans or interest rates, or adjusting the contribution of partners towards the partnership's capital. 4. Dissolution and Termination: In certain circumstances, partnerships may need to amend their agreement due to the decision to dissolve or terminate the partnership. This includes specifying the process for winding up affairs, distributing assets, and settling liabilities. Partnerships seeking to make amendments or modifications to their partnership agreement in New Hampshire must follow specific procedures. According to RSA 304-C:64, a written amendment must be drafted, signed by all partners, and notarized. This document should clearly identify the section(s) being amended and provide the updated wording or new provisions. Once executed, the amendment should be kept with the original partnership agreement and shared with all partners. It is essential for partnerships to ensure that any amendment or modification adheres to the laws and regulations of New Hampshire. If there are any uncertainties or complexities involved, seeking legal advice is highly recommended ensuring compliance and to protect the interests of all partners involved in the partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.