Title: Understanding New Hampshire's Simple Promissory Note for School Expenses Description: A New Hampshire Simple Promissory Note for School enables individuals to legally document a promise or agreement to repay borrowed money for educational purposes. This comprehensive guide provides a detailed description of what this note entails, including its different types, key elements, and legal aspects. Keywords: 1. New Hampshire Simple Promissory Note for School 2. Promissory note for educational expenses 3. NH school loan agreement 4. Understanding promissory notes in New Hampshire 5. Types of promissory notes for school expenses in NH Types of New Hampshire Simple Promissory Note for School: 1. Fixed-Term Promissory Note: This type of promissory note involves a specific repayment period, stating the start and end date, as well as the agreed-upon repayment terms and conditions. It sets a fixed timeline to recompense borrowed funds for school-related costs. 2. Demand Promissory Note: Unlike the fixed-term note, this promissory agreement allows the lender to request repayment at any time. The borrower should be prepared to pay back the borrowed funds upon receipt of a written demand by the lender. Key Elements of a New Hampshire Simple Promissory Note for School: 1. Parties Involved: The promissory note identifies the lender and the borrower, including their legal names, addresses, and contact information. 2. Principal Amount: This specifies the total amount borrowed for educational expenses, which includes tuition fees, books, supplies, and other directly related costs. 3. Repayment Terms: The note outlines the agreed-upon terms, such as the interest rate (if applicable), installment amount or payment schedule, and the due dates for each payment. 4. Late Payment Penalties: It's important to mention the consequences of missed or late payments, including any additional fees or interest charges that may apply. 5. Default and Remedies: This section outlines the consequences of defaulting on the loan, which might include legal actions, collection fees, and potential damage to the borrower's credit score. Legal Aspects: — New Hampshire state laws govern the validity and enforcement of promissory notes within the state. — The note must be signed by both the lender and the borrower to be legally binding. — It is advisable to seek legal advice or assistance while drafting or signing the promissory note to ensure compliance with New Hampshire laws. By understanding the types, key elements, and legal aspects associated with the New Hampshire Simple Promissory Note for School, borrowers and lenders can protect their interests and establish clear terms for repayment of educational expenses in the state of New Hampshire.

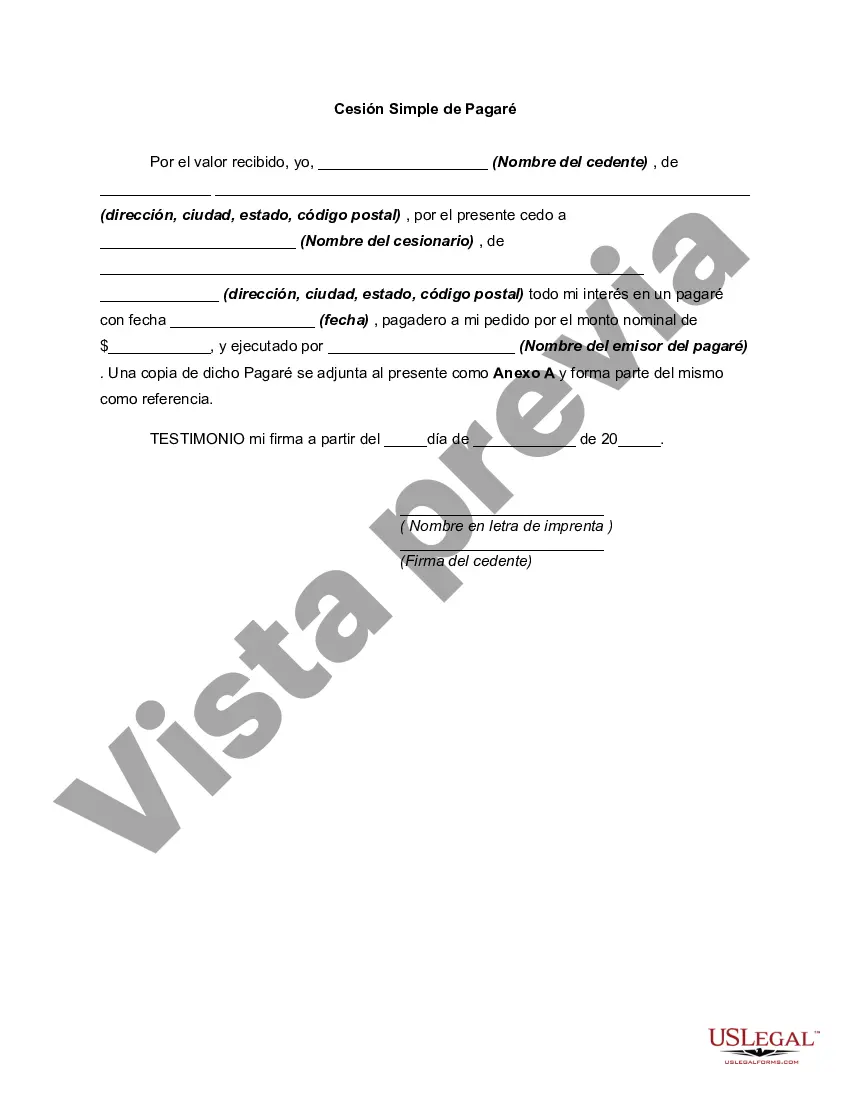

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out New Hampshire Pagaré Simple Para La Escuela?

If you have to total, down load, or produce legitimate papers templates, use US Legal Forms, the biggest assortment of legitimate varieties, which can be found online. Use the site`s easy and handy look for to get the documents you want. A variety of templates for company and individual reasons are sorted by classes and suggests, or search phrases. Use US Legal Forms to get the New Hampshire Simple Promissory Note for School in just a couple of mouse clicks.

In case you are previously a US Legal Forms consumer, log in in your bank account and then click the Obtain button to have the New Hampshire Simple Promissory Note for School. Also you can accessibility varieties you formerly downloaded from the My Forms tab of your bank account.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the form to the right town/land.

- Step 2. Make use of the Preview option to look over the form`s content material. Do not forget to read through the information.

- Step 3. In case you are unsatisfied using the form, use the Research discipline at the top of the display screen to discover other versions of the legitimate form format.

- Step 4. Upon having found the form you want, click on the Get now button. Opt for the pricing plan you prefer and put your qualifications to register for an bank account.

- Step 5. Approach the transaction. You can use your credit card or PayPal bank account to finish the transaction.

- Step 6. Select the formatting of the legitimate form and down load it on the gadget.

- Step 7. Complete, change and produce or signal the New Hampshire Simple Promissory Note for School.

Each legitimate papers format you acquire is your own property permanently. You may have acces to each form you downloaded within your acccount. Click on the My Forms portion and select a form to produce or down load again.

Contend and down load, and produce the New Hampshire Simple Promissory Note for School with US Legal Forms. There are many professional and status-certain varieties you can utilize to your company or individual requires.