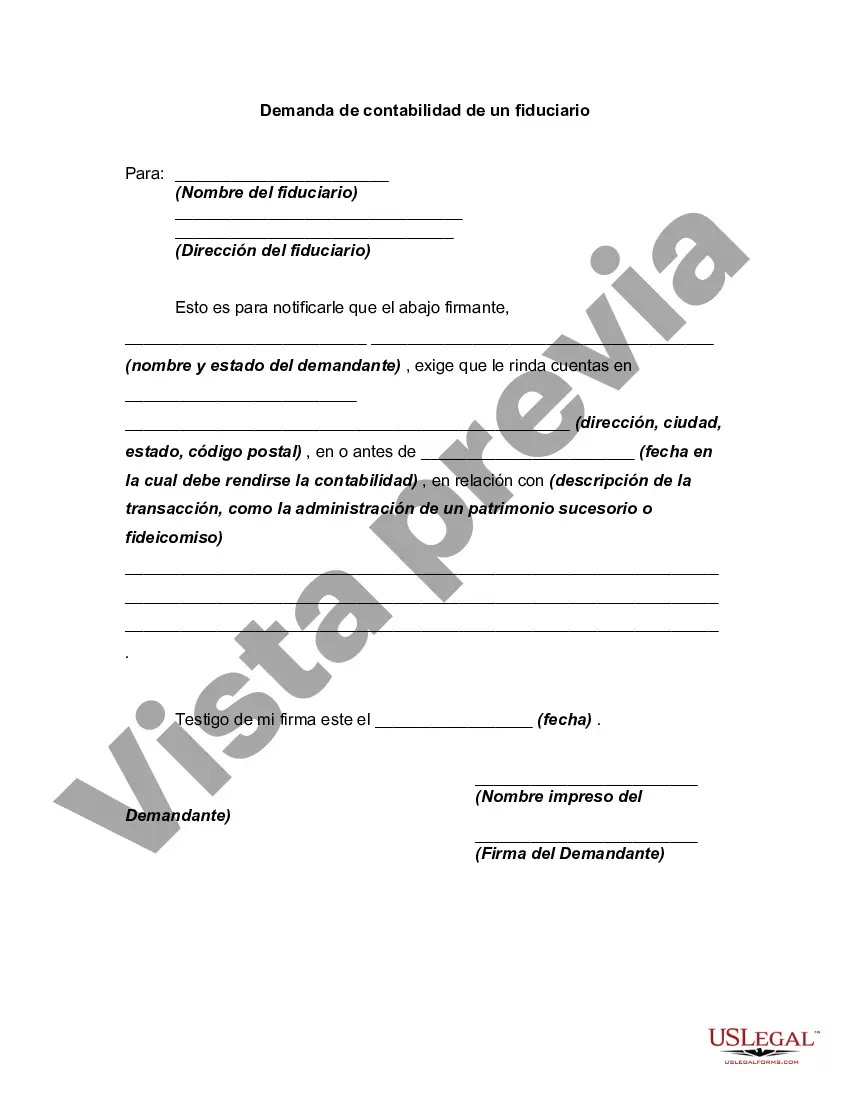

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Demand for Accounting from a Fiduciary: Understanding the Accountability Process Keywords: New Hampshire, Demand for Accounting, Fiduciary, Types, Process, Accountability. Introduction: A New Hampshire Demand for Accounting from a Fiduciary refers to the legal process in which beneficiaries or interested parties require a fiduciary to provide a detailed account of their activities and financial transactions. This mechanism ensures transparency, prevents any potential misuse of assets, and ensures the fiduciary fulfills their duties. Let's explore the different types of New Hampshire Demand for Accounting from a Fiduciary. 1. Executors: When an individual passes away, their estate enters a probate process, during which an executor is appointed to manage their affairs. Beneficiaries of the estate have the right to demand accounting from the executor to ensure that the estate is being administered properly. The New Hampshire probate court oversees this demand to secure the interests of the beneficiaries. 2. Trustees: Trustees are appointed to manage and administer trusts, ensuring the trust's assets are used for the beneficiaries' best interest. Beneficiaries of a trust can file a demand for accounting to ensure the trustee is fulfilling their fiduciary duties, including managing investments, distributing income, and accurately reporting financial transactions. 3. Guardians: In cases involving minors or incapacitated adults, guardians are appointed to protect their interests. Interested parties can demand accounting from the guardian to guarantee the proper management of the ward's finances, approve expenditures, verify asset management, and ensure no financial abuses occur. Process of New Hampshire Demand for Accounting from a Fiduciary: a. Drafting the Demand: Interested parties must draft a formal demand letter stating their request for accounting, detailing their relationship to the fiduciary, and providing supporting reasons for requesting the accounting. b. Serving the Demand: The demand letter must be properly served to the fiduciary, which often requires adhering to specific legal procedures, depending on the type of fiduciary and the court overseeing the matter. c. Fiduciary's Responsiveness: The fiduciary must respond to the demand within a set period, typically determined by the court, by providing a comprehensive and accurate account of their activities, including financial statements, transactions, and any necessary supporting documentation. d. Review and Challenge: Beneficiaries or interested parties have the right to review the provided accounting records and raise objections if they find any irregularities, discrepancies, or potential breaches of fiduciary duty. The court oversees this review process and may schedule hearings to address any disputes. e. Court Intervention: In situations where the fiduciary fails to respond to the demand or provides insufficient or false information, interested parties may seek court intervention to ensure the fiduciary's compliance or to remove them from their position if necessary. Conclusion: New Hampshire Demand for Accounting from a Fiduciary empowers beneficiaries and interested parties to monitor the actions of executors, trustees, and guardians to ensure the proper management of assets under their care. This process promotes transparency, holds fiduciaries accountable, and protects the interests of those involved. By understanding the different types and the process involved, beneficiaries can safeguard their rights and ensure fiduciaries fulfill their legal obligations.New Hampshire Demand for Accounting from a Fiduciary: Understanding the Accountability Process Keywords: New Hampshire, Demand for Accounting, Fiduciary, Types, Process, Accountability. Introduction: A New Hampshire Demand for Accounting from a Fiduciary refers to the legal process in which beneficiaries or interested parties require a fiduciary to provide a detailed account of their activities and financial transactions. This mechanism ensures transparency, prevents any potential misuse of assets, and ensures the fiduciary fulfills their duties. Let's explore the different types of New Hampshire Demand for Accounting from a Fiduciary. 1. Executors: When an individual passes away, their estate enters a probate process, during which an executor is appointed to manage their affairs. Beneficiaries of the estate have the right to demand accounting from the executor to ensure that the estate is being administered properly. The New Hampshire probate court oversees this demand to secure the interests of the beneficiaries. 2. Trustees: Trustees are appointed to manage and administer trusts, ensuring the trust's assets are used for the beneficiaries' best interest. Beneficiaries of a trust can file a demand for accounting to ensure the trustee is fulfilling their fiduciary duties, including managing investments, distributing income, and accurately reporting financial transactions. 3. Guardians: In cases involving minors or incapacitated adults, guardians are appointed to protect their interests. Interested parties can demand accounting from the guardian to guarantee the proper management of the ward's finances, approve expenditures, verify asset management, and ensure no financial abuses occur. Process of New Hampshire Demand for Accounting from a Fiduciary: a. Drafting the Demand: Interested parties must draft a formal demand letter stating their request for accounting, detailing their relationship to the fiduciary, and providing supporting reasons for requesting the accounting. b. Serving the Demand: The demand letter must be properly served to the fiduciary, which often requires adhering to specific legal procedures, depending on the type of fiduciary and the court overseeing the matter. c. Fiduciary's Responsiveness: The fiduciary must respond to the demand within a set period, typically determined by the court, by providing a comprehensive and accurate account of their activities, including financial statements, transactions, and any necessary supporting documentation. d. Review and Challenge: Beneficiaries or interested parties have the right to review the provided accounting records and raise objections if they find any irregularities, discrepancies, or potential breaches of fiduciary duty. The court oversees this review process and may schedule hearings to address any disputes. e. Court Intervention: In situations where the fiduciary fails to respond to the demand or provides insufficient or false information, interested parties may seek court intervention to ensure the fiduciary's compliance or to remove them from their position if necessary. Conclusion: New Hampshire Demand for Accounting from a Fiduciary empowers beneficiaries and interested parties to monitor the actions of executors, trustees, and guardians to ensure the proper management of assets under their care. This process promotes transparency, holds fiduciaries accountable, and protects the interests of those involved. By understanding the different types and the process involved, beneficiaries can safeguard their rights and ensure fiduciaries fulfill their legal obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.