New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant: Explained A New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant is a legal contract that allows individuals to transfer assets while receiving regular income payments for the duration of their life. Private annuities are commonly used as estate planning tools, helping individuals effectively manage their wealth while minimizing tax implications. By entering into a New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant, the annuitant (the party transferring assets) transfers ownership of certain assets, such as real estate or investments, to the buyer (usually a family member or a trust) in exchange for a promise to receive regular payments until their death. These agreements are governed by the laws of New Hampshire. Unlike traditional annuities offered by insurance companies, private annuities are not regulated or guaranteed by the government. Instead, they are private agreements between two parties, allowing for more flexibility and customization. These agreements are particularly attractive to individuals with significant assets who wish to maintain control and flexibility over their financial future. The New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant has several advantages. Firstly, it allows the annuitant to transfer assets to the buyer while avoiding immediate capital gains taxes on the appreciated value of the assets. Instead, the tax liability is spread over the annuitant's life expectancy. This can result in significant tax savings, particularly when dealing with highly appreciated assets. Furthermore, the annuitant can continue to receive income payments for the entirety of their life, providing a regular and predictable source of income. This can be particularly beneficial for retirees or individuals seeking income stability in their later years. It also ensures that the annuitant will not outlive their assets. It is important to note that there are variations and alternative options for New Hampshire Private Annuity Agreements with Payments to Last for Life of Annuitant. Some common types include: 1. Deferred Payment Annuity: Under this arrangement, the annuitant enters into an agreement where the payments to the annuitant begin at a future date. This could be advantageous in cases where the annuitant wants to receive income upon retirement, allowing for continued growth of the assets until that time. 2. Joint and Survivor Annuity: In this type of agreement, the annuity payments continue for the life of the annuitant and their designated beneficiary (often a spouse). This ensures that the surviving spouse receives the income stream even after the annuitant's death. 3. Life with Period Certain Annuity: This arrangement guarantees income payments for the annuitant's lifetime but also ensures that a minimum number of payments are made, regardless of the annuitant's lifespan. If the annuitant passes away before the specified period ends, the remaining payments are made to a designated beneficiary. In conclusion, a New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant is a powerful estate planning tool that allows individuals to transfer assets while ensuring a predictable stream of income for life. Considered alongside different variations such as deferred payment annuities, joint and survivor annuities, and life with period certain annuities, individuals can tailor their agreements to meet their specific financial goals and objectives.

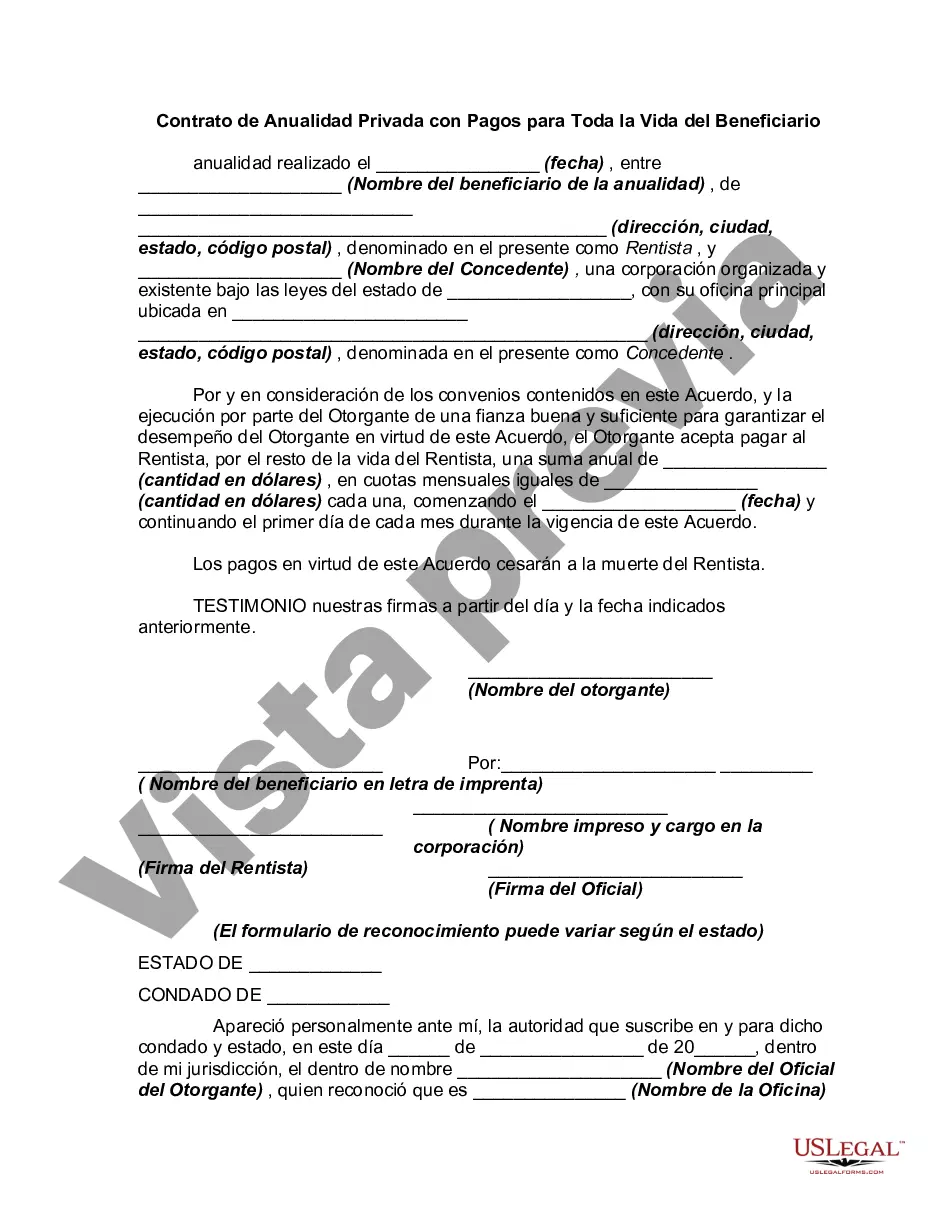

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Contrato de Anualidad Privada con Pagos para Toda la Vida del Beneficiario - Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out New Hampshire Contrato De Anualidad Privada Con Pagos Para Toda La Vida Del Beneficiario?

Discovering the right legal document design might be a have a problem. Obviously, there are a lot of layouts available on the net, but how would you get the legal kind you will need? Utilize the US Legal Forms internet site. The support offers a large number of layouts, including the New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant, which you can use for business and private needs. Every one of the forms are inspected by professionals and fulfill federal and state specifications.

When you are previously listed, log in for your accounts and click the Acquire key to obtain the New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant. Use your accounts to check through the legal forms you may have bought earlier. Go to the My Forms tab of the accounts and get another version of the document you will need.

When you are a new user of US Legal Forms, here are basic recommendations for you to comply with:

- Initially, make certain you have selected the correct kind for your personal area/area. You can check out the form using the Review key and look at the form outline to guarantee this is the right one for you.

- In case the kind does not fulfill your needs, make use of the Seach discipline to get the correct kind.

- Once you are certain the form is proper, go through the Acquire now key to obtain the kind.

- Select the pricing strategy you need and type in the necessary information. Design your accounts and buy the order making use of your PayPal accounts or charge card.

- Choose the submit file format and download the legal document design for your device.

- Full, edit and print and signal the obtained New Hampshire Private Annuity Agreement with Payments to Last for Life of Annuitant.

US Legal Forms is the largest library of legal forms for which you can discover numerous document layouts. Utilize the company to download expertly-produced files that comply with express specifications.