New Hampshire Annual Expense Report

Description

How to fill out Annual Expense Report?

If you aim to be thorough, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's straightforward and convenient search function to find the documents you require.

Numerous templates for both business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You can access every form you have downloaded from your account.

Go to the My documents section and select a form to print or download again. Complete and download, and print the New Hampshire Annual Expense Report with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the New Hampshire Annual Expense Report in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to locate the New Hampshire Annual Expense Report.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

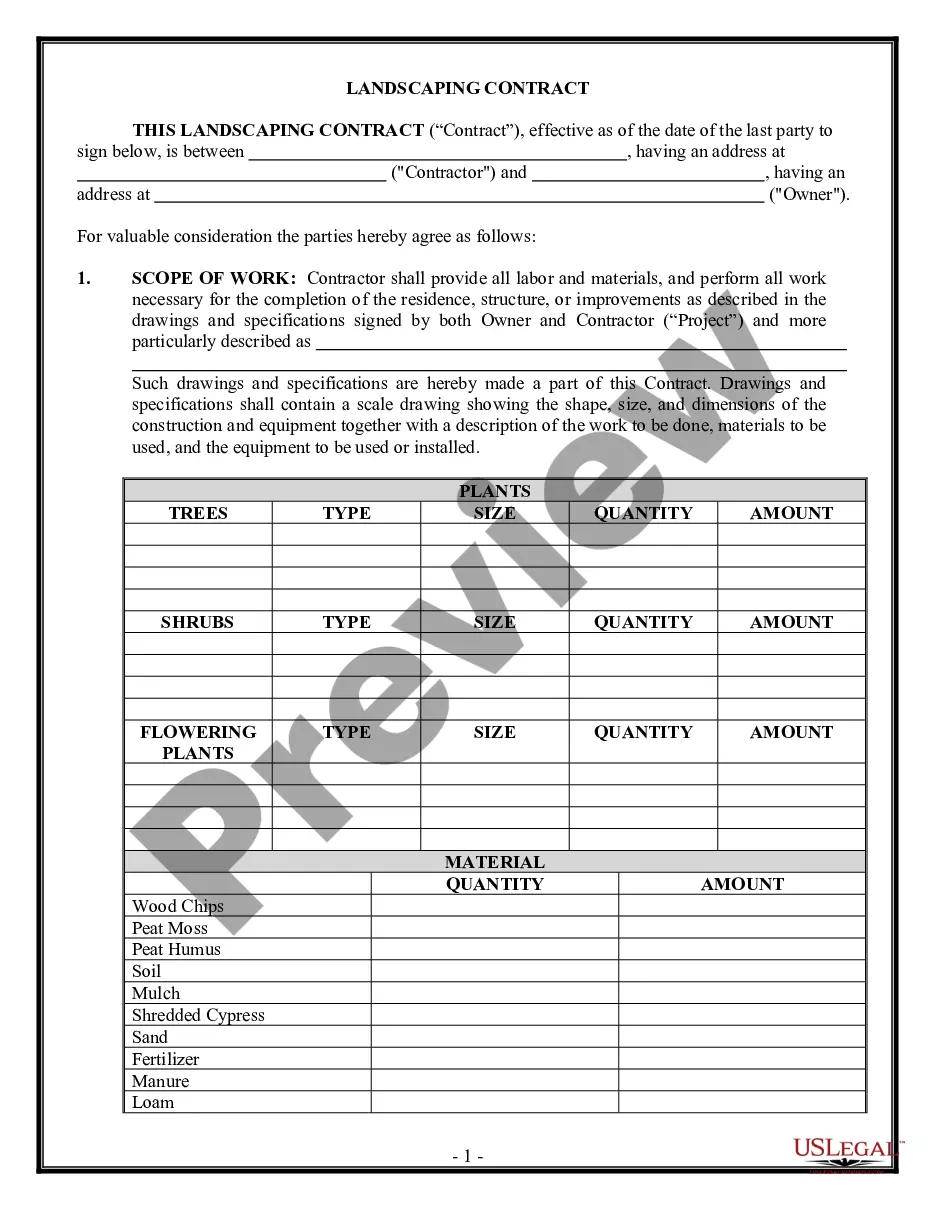

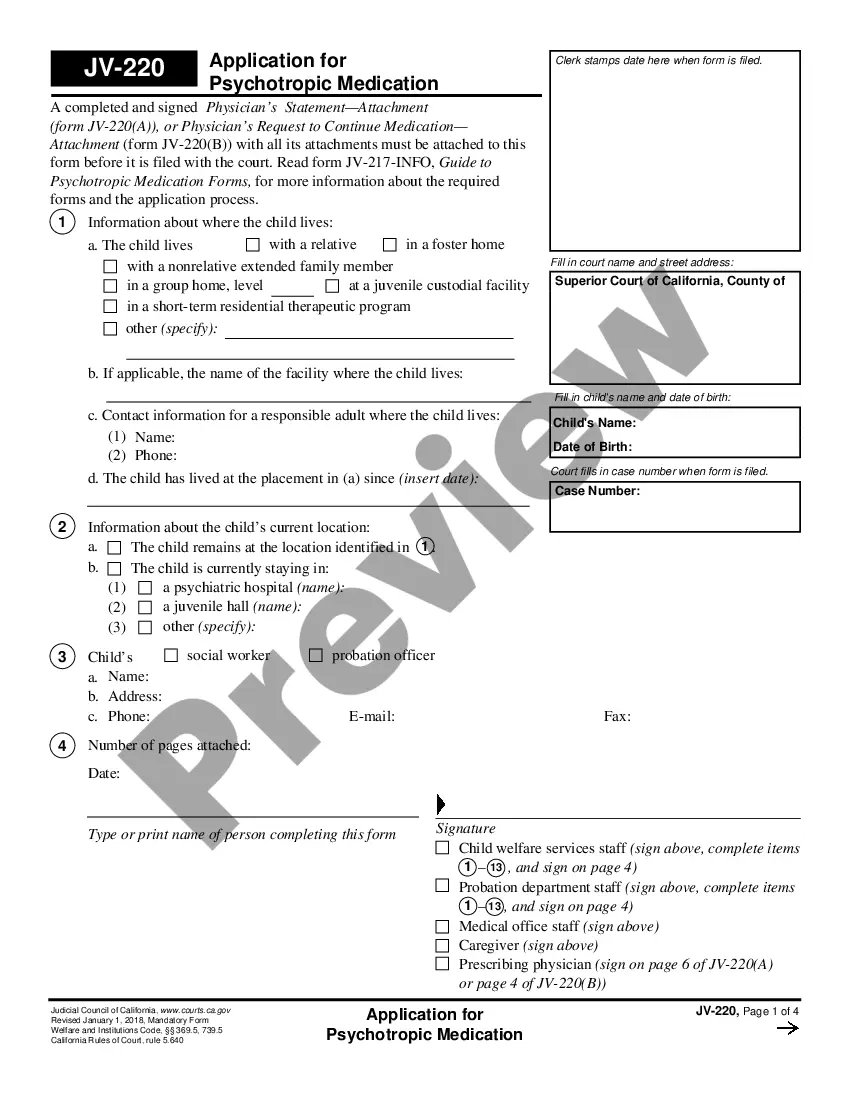

- Step 2. Utilize the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to look for alternate versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your information to create an account.

- Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the New Hampshire Annual Expense Report.

Form popularity

FAQ

Not every business is required to file an annual report, but many must adhere to such regulations depending on their state. Exceptions might include some sole proprietorships or informal entities. In New Hampshire, however, businesses typically need to submit the Annual Expense Report to remain compliant and avoid penalties.

Yes, you can file the NH DP 10 (Annual Expense Report) online, making the process more convenient. Submitting your report digitally simplifies tracking and record-keeping for your business. Utilize online platforms to ensure a smooth filing experience and to stay in compliance with New Hampshire regulations.

Whether it's mandatory to prepare an annual report depends on the state where your business operates. In many states, such a report is essential for compliance and good standing. For New Hampshire, filing the Annual Expense Report is not just beneficial but usually required for corporations and LLCs.

Several states require annual reports for businesses, including but not limited to California, Texas, and Florida. These requirements ensure that companies maintain transparency and comply with state laws. Always check the specific regulations of your state for any unique filing needs. In New Hampshire, the Annual Expense Report serves as your primary reporting tool.

Not every state mandates annual reports from businesses. However, many states do have some form of reporting requirement to maintain good standing. It is crucial to familiarize yourself with your state’s rules concerning annual reports. In New Hampshire, the Annual Expense Report is an essential aspect of this process.

Various states in the U.S. require businesses to submit statements of information. Each state has its own specific guidelines, and the requirements can differ significantly. Therefore, checking your state’s official business guidelines is key to understanding what is necessary. For New Hampshire, submitting an Annual Expense Report helps fulfill similar requirements.

To complete an annual report, start by gathering your business’s financial data, operational changes, and contact information. After compiling this information, you can fill out the necessary forms, either online or through a service like USLegalForms, which makes the process easier and helps you avoid missing important details. Completing your New Hampshire Annual Expense Report on time ensures your business remains in good standing.

Failing to file your annual report for an LLC in New Hampshire can lead to administrative dissolution of your business. This means you could lose your business rights and face penalties. To avoid these consequences, it’s crucial to stay informed and compliant, and USLegalForms can help you with timely reminders and filing assistance for your New Hampshire Annual Expense Report.

Filing a Business Organization Information (BOI) report in New Hampshire is quite straightforward. You can do this online via the New Hampshire Secretary of State's website or by using services like USLegalForms, which provide templates and guidance. Ensure that you gather your business details and follow the instructions carefully to complete your New Hampshire Annual Expense Report efficiently.

To file a New Hampshire Annual Expense Report, you'll typically need specific business information, such as your business name, identification number, and any changes in your business structure. It’s also helpful to have your financial statements ready to ensure accurate reporting. Using a reliable platform like USLegalForms can simplify this process, guiding you through the requirements for a smooth filing.