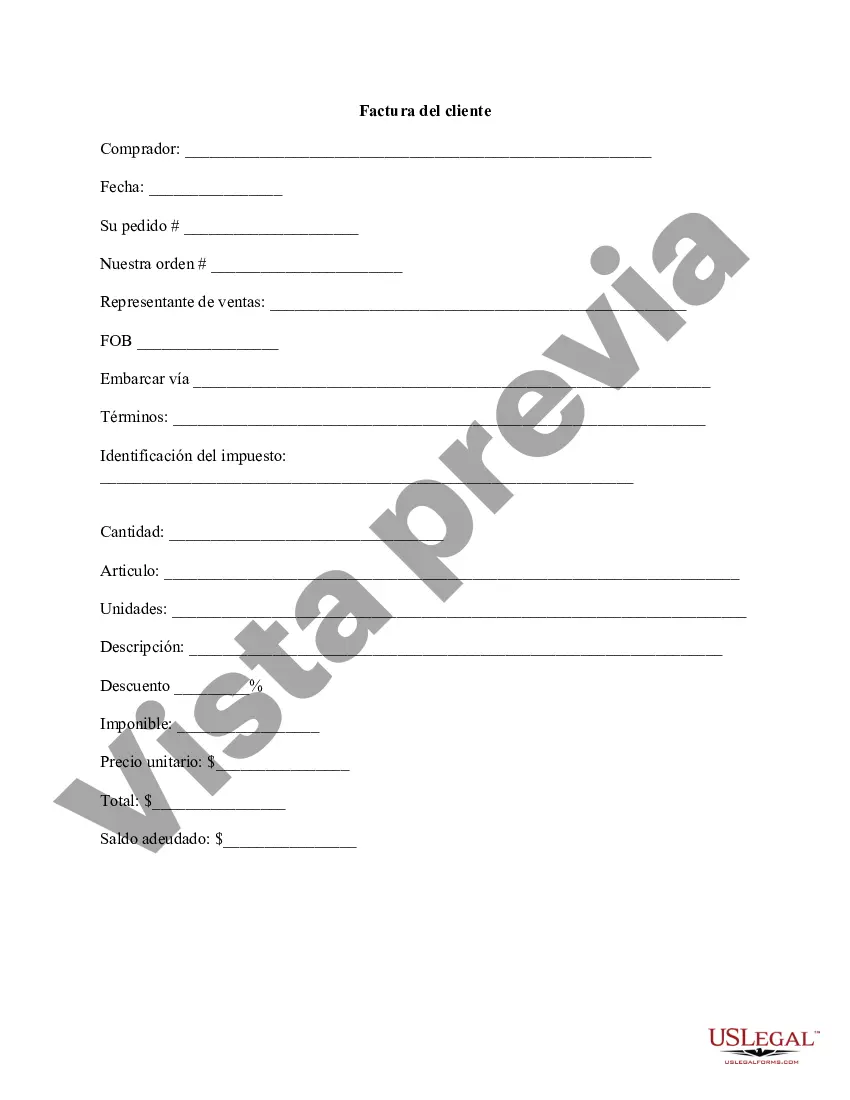

Title: Understanding New Hampshire Customer Invoice — Types and Features Description: A New Hampshire customer invoice is a document that serves as a detailed record of a commercial transaction between a business and its customer. This comprehensive description aims to shed light on different types of New Hampshire customer invoices, highlighting their key aspects and the importance they hold for businesses in the state. Keyword Suggestions: New Hampshire customer invoice, commercial transaction, detailed record, types, key aspects, businesses. 1. Types of New Hampshire Customer Invoices: a) Standard Invoice: A standard customer invoice is the most common type utilized by businesses in New Hampshire. It includes basic information such as the business name, customer details, description of goods or services, quantity, unit price, and total amount due. This type is suitable for businesses engaging in straightforward transactions. b) Proforma Invoice: A proforma invoice is typically used before the actual delivery of goods or services. It acts as a preliminary invoice, providing customers with an estimate of costs and terms, including shipping charges, taxes, and any additional fees. Proforma invoices help customers and businesses to confirm the details before proceeding with the transaction. c) Recurring Invoice: For businesses that provide services on a recurring basis, such as subscriptions or regular maintenance, recurring invoices are crucial. These invoices automate the billing process, automatically generating and sending invoices at predefined intervals, ensuring consistent revenue for the business. d) Credit Memo: Also known as a credit note or credit invoice, this type is issued by a business when there is a need for a refund or credit adjustment due to an overpayment, damaged goods, or other customer-related issues. A credit memo serves as evidence of the refund or credit owed to the customer. 2. Key Aspects of New Hampshire Customer Invoices: a) Business and Customer Information: Each customer invoice includes essential details, such as the name, address, contact details, and tax identification numbers of both the business and the customer. Accurate information ensures effective communication and legal compliance. b) Line Items and Item Descriptions: The invoice lists all goods or services provided, including a description, quantity, unit price, and any applicable taxes or discounts. Clear and concise descriptions avoid confusion and provide transparency on the products or services being billed. c) Payment Due Date and Terms: To ensure prompt payment, an invoice includes the payment due date and any applicable terms, such as discounts for early payment or penalties for late payment. These details encourage timely payments and help maintain healthy financial processes. d) Tax Calculations and Compliance: New Hampshire customer invoices must adhere to local tax regulations. This includes accurately calculating and displaying sales tax and any applicable state-specific taxes. Compliance with tax laws is essential for businesses operating in New Hampshire. In conclusion, New Hampshire customer invoices come in various types to suit different business needs. These invoices serve as crucial records of commercial transactions, ensuring consistent revenue while maintaining legal compliance. By understanding the types and key aspects of New Hampshire customer invoices, businesses can streamline their billing process and manage customer relationships effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Factura del cliente - Customer Invoice

Description

How to fill out New Hampshire Factura Del Cliente?

It is possible to invest hours on the Internet attempting to find the lawful file format which fits the state and federal demands you require. US Legal Forms supplies a huge number of lawful kinds which can be analyzed by professionals. You can actually down load or produce the New Hampshire Customer Invoice from your service.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Acquire key. Afterward, it is possible to full, change, produce, or indication the New Hampshire Customer Invoice. Each and every lawful file format you get is the one you have for a long time. To acquire another copy for any purchased form, check out the My Forms tab and then click the related key.

If you use the US Legal Forms site the first time, stick to the easy instructions under:

- Initially, make sure that you have chosen the best file format for the county/city of your choosing. Look at the form description to make sure you have selected the right form. If offered, take advantage of the Preview key to search throughout the file format as well.

- If you want to find another version in the form, take advantage of the Research area to discover the format that fits your needs and demands.

- Upon having identified the format you would like, simply click Purchase now to move forward.

- Choose the prices prepare you would like, key in your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal accounts to purchase the lawful form.

- Choose the file format in the file and down load it in your gadget.

- Make modifications in your file if required. It is possible to full, change and indication and produce New Hampshire Customer Invoice.

Acquire and produce a huge number of file web templates using the US Legal Forms site, which provides the most important assortment of lawful kinds. Use specialist and condition-certain web templates to take on your company or personal requirements.