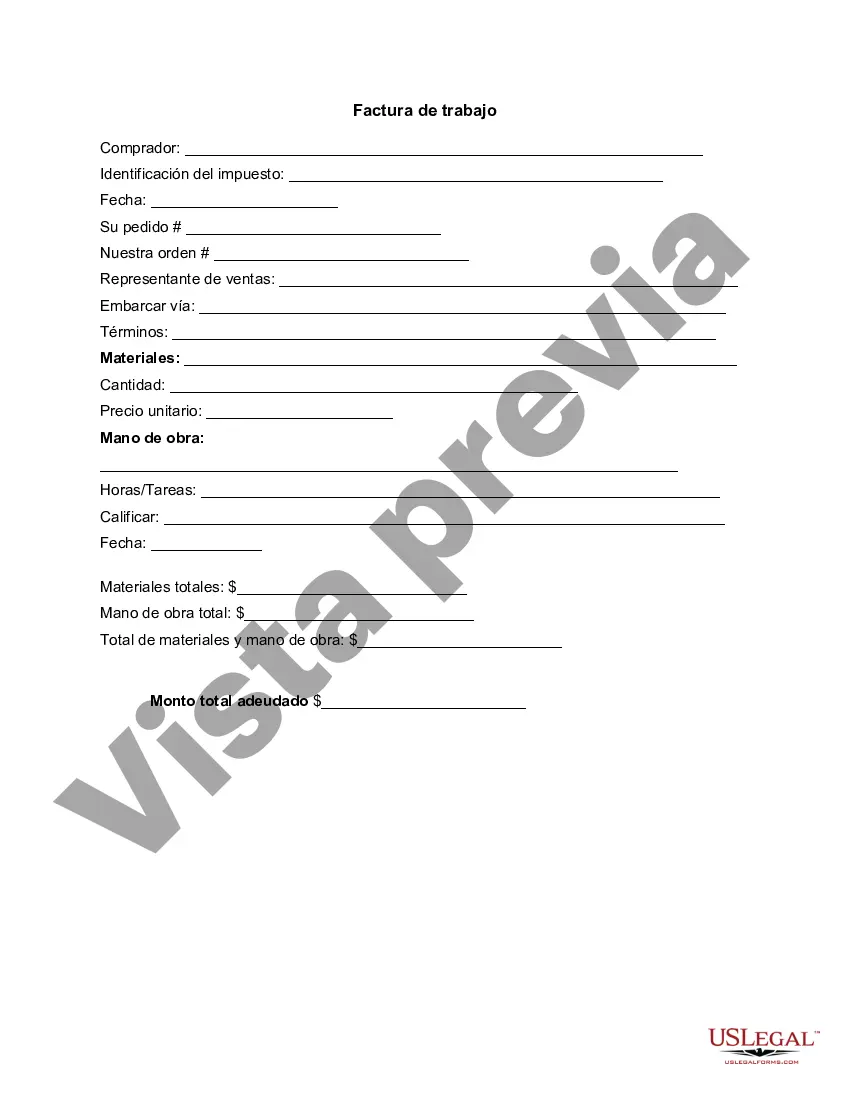

New Hampshire Invoice Template for Receptionist: A Comprehensive Guide Are you a receptionist working in New Hampshire and looking for a professional way to invoice your clients? Look no further! In this article, we will provide a detailed description of what a New Hampshire Invoice Template for Receptionist is, and list a few different types that you can consider using. The role of a receptionist is vital in managing and coordinating various administrative tasks, such as scheduling appointments, answering phone calls, and providing customer service. Invoicing clients for services rendered is also a crucial aspect of this role. An invoice is a legal document that outlines the services provided, the quantity, and the prices associated with them. Invoices help receptionists maintain a record of transactions and facilitate timely payment processing. A New Hampshire Invoice Template for Receptionist is a pre-designed document that includes all necessary details to create professional invoices quickly and efficiently. These templates are specifically tailored to meet the unique invoicing requirements in New Hampshire, including compliance with local tax regulations. By utilizing a template, receptionists can save valuable time and ensure accuracy when generating invoices. Here are a few different types of New Hampshire Invoice Templates for Receptionists that you can consider: 1. Basic New Hampshire Invoice Template: This template includes essential components such as business name, address, client details, description of services, costs, and payment terms. It provides a clean and simple layout suitable for any receptionist invoicing needs. 2. Hourly Rate Invoice Template: If you charge clients based on hourly rates, this template is perfect for you. It allows you to track hours worked and easily calculate the total amount due, ensuring accurate billing for your receptionist services. 3. Service-Specific Invoice Template: For receptionists offering various services with different pricing structures, this template allows you to customize the invoice based on the specific service provided. You can include service descriptions, rates, quantities, and total costs per item, providing transparency to your clients. 4. Tax-Compliant Invoice Template: New Hampshire has specific tax requirements that receptionists should adhere to. This template incorporates the necessary tax elements, such as tax identification numbers and tax rates, enabling you to meet the legal obligations while invoicing clients. Utilizing a New Hampshire Invoice Template for Receptionist offers numerous benefits. It streamlines your invoicing process, enhances professionalism, ensures accuracy, and saves you valuable time. You can access these templates through various online platforms or use accounting software specifically designed for invoicing purposes. In conclusion, a New Hampshire Invoice Template for Receptionist is an essential tool for efficient invoicing in a receptionist role. By utilizing these templates, you can ensure compliance with local tax regulations while simplifying your invoicing process. Choose the template that best suits your needs and start invoicing your clients with confidence and professionalism.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Plantilla de factura para recepcionista - Invoice Template for Receptionist

Description

How to fill out New Hampshire Plantilla De Factura Para Recepcionista?

Choosing the right lawful document design could be a have a problem. Obviously, there are plenty of layouts accessible on the Internet, but how would you find the lawful form you require? Utilize the US Legal Forms web site. The service provides a huge number of layouts, like the New Hampshire Invoice Template for Receptionist, which you can use for company and private needs. Every one of the varieties are checked out by specialists and fulfill federal and state needs.

When you are presently listed, log in for your accounts and click on the Download option to obtain the New Hampshire Invoice Template for Receptionist. Make use of your accounts to appear from the lawful varieties you possess purchased previously. Check out the My Forms tab of your respective accounts and acquire one more version of the document you require.

When you are a whole new user of US Legal Forms, listed here are basic recommendations that you should comply with:

- Initially, make sure you have chosen the right form for the metropolis/area. You are able to look through the form using the Preview option and study the form outline to ensure this is the right one for you.

- If the form fails to fulfill your preferences, take advantage of the Seach field to obtain the correct form.

- Once you are positive that the form is suitable, click the Get now option to obtain the form.

- Choose the rates strategy you want and type in the required info. Create your accounts and buy your order making use of your PayPal accounts or Visa or Mastercard.

- Opt for the document structure and down load the lawful document design for your system.

- Total, revise and produce and sign the acquired New Hampshire Invoice Template for Receptionist.

US Legal Forms will be the greatest catalogue of lawful varieties that you can find different document layouts. Utilize the company to down load expertly-made papers that comply with express needs.