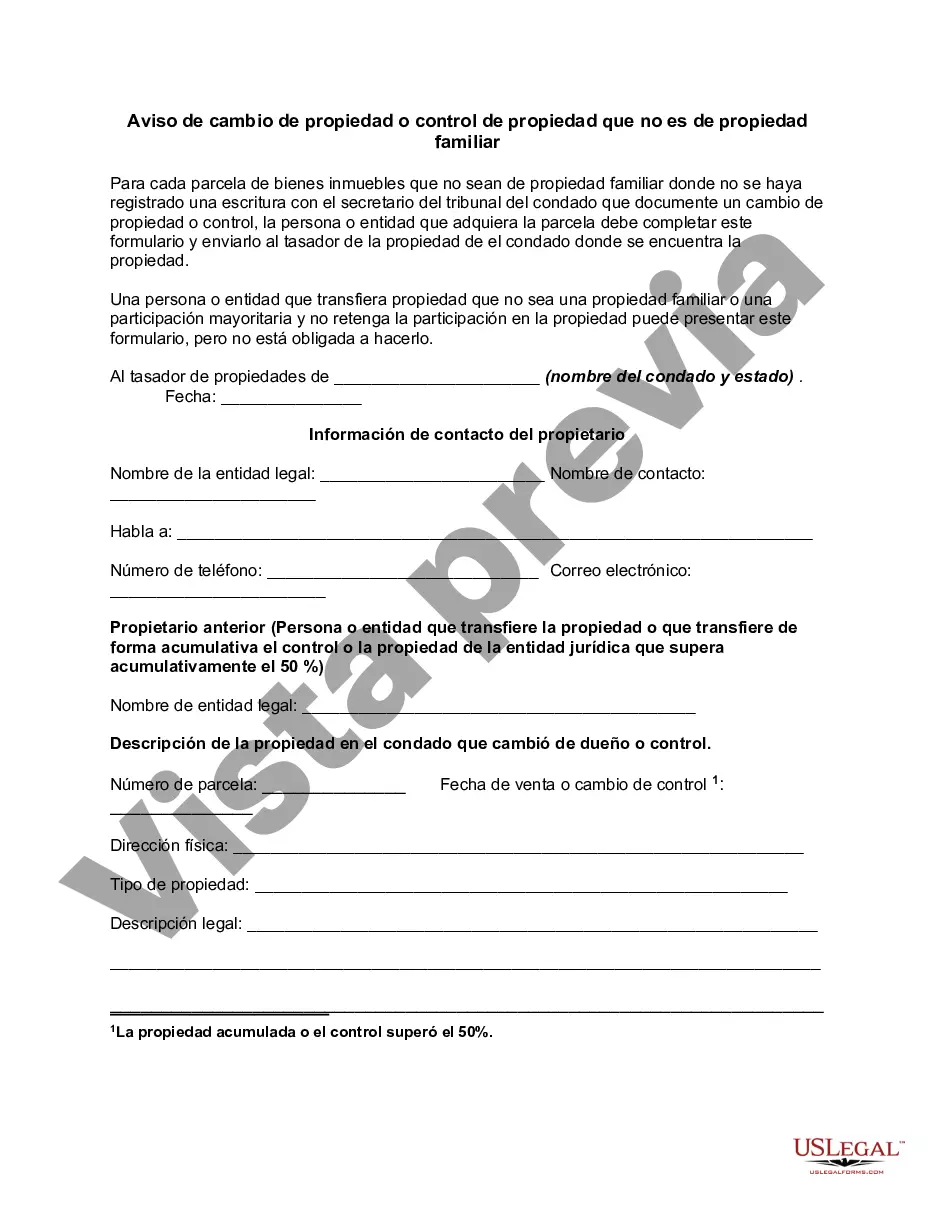

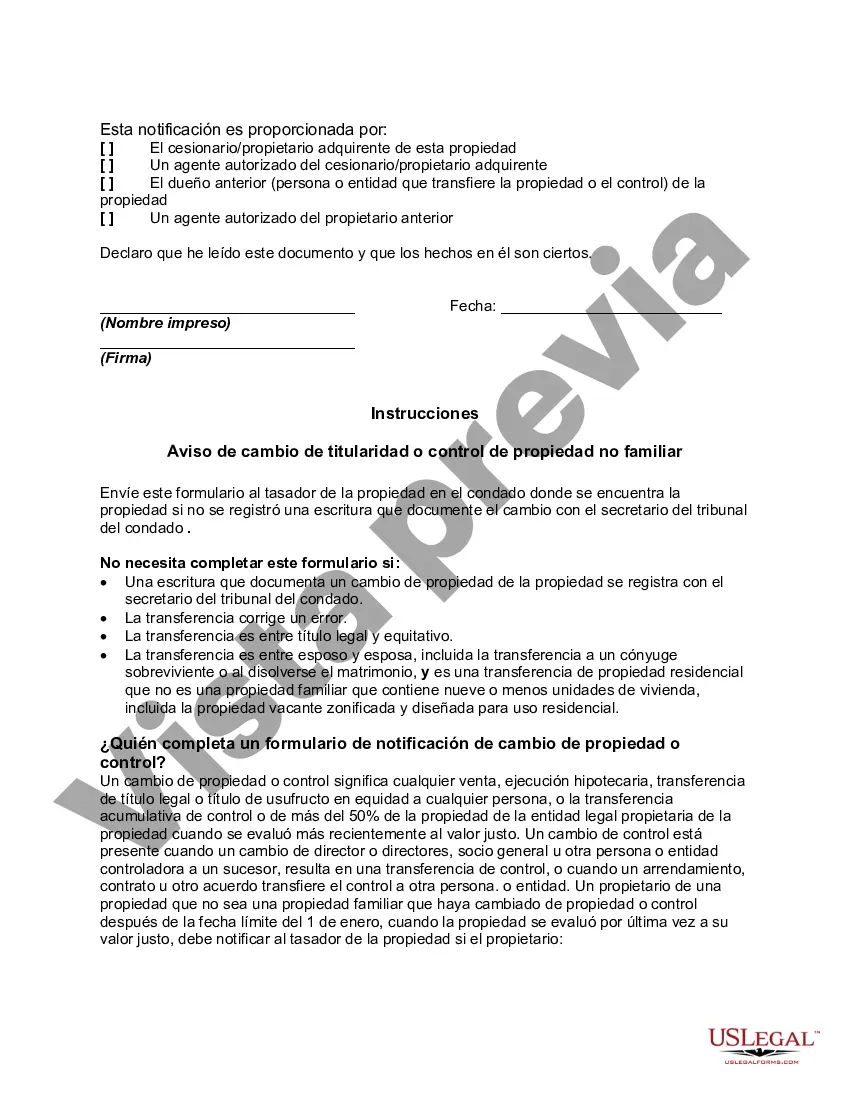

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

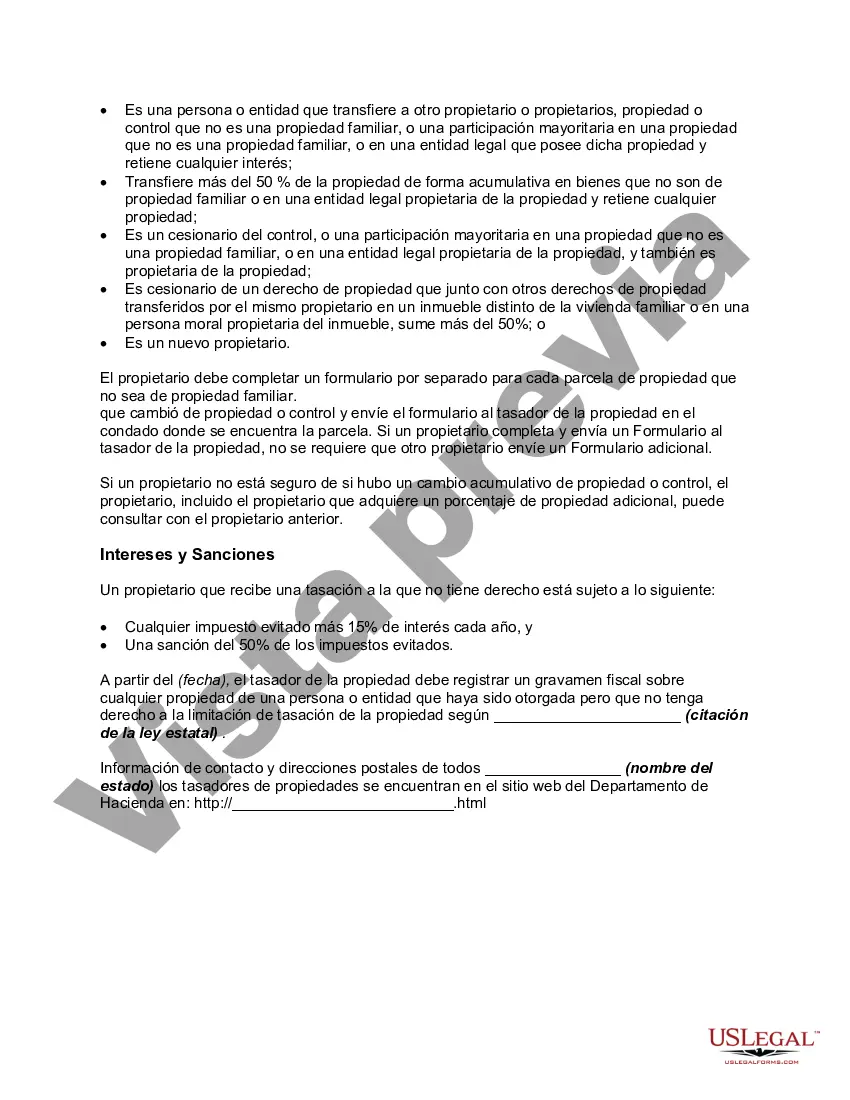

New Hampshire Notice of Change of Ownership or Control Non-Homestead Property A Notice of Change of Ownership or Control Non-Homestead Property in New Hampshire is a legal document that must be filed by individuals or entities when there is a transfer of ownership or control of a non-homestead property. This notice serves to inform the appropriate authorities, such as the county assessor's office, about the change in ownership or control of the property. There are different types of New Hampshire Notice of Change of Ownership or Control Non-Homestead Property, which include: 1. Commercial Property: This type of property refers to any non-residential property used for business or commercial purposes, such as office buildings, retail spaces, warehouses, or industrial complexes. Owners or controllers of commercial properties must file a Notice of Change of Ownership or Control to ensure accurate tax assessment and records. 2. Rental Property: If an individual or entity owns or controls a non-homestead property that is rented out to tenants, a Notice of Change of Ownership or Control must be filed whenever there is a change in ownership or transfer of control. This ensures that the appropriate authorities are aware of the new owner or controller responsible for the property. 3. Vacant Land: Non-homestead properties that consist of undeveloped or vacant land also require a Notice of Change of Ownership or Control to be filed when there is a transfer of ownership or control. This helps the county assessor's office maintain accurate records and assessment information for tax purposes. The New Hampshire Notice of Change of Ownership or Control Non-Homestead Property includes important information, such as the property's address, the name and contact details of the new owner or controller, the date of the change, and any relevant supporting documentation, such as deeds or contracts. Filing this notice is crucial to ensure compliance with state regulations and prevent potential legal issues. Failure to file or inaccurately filing the Notice of Change of Ownership or Control Non-Homestead Property can result in penalties or delays in property tax assessments. It is advisable to consult with a qualified attorney or seek guidance from the county assessor's office to ensure the proper completion and submission of this notice.New Hampshire Notice of Change of Ownership or Control Non-Homestead Property A Notice of Change of Ownership or Control Non-Homestead Property in New Hampshire is a legal document that must be filed by individuals or entities when there is a transfer of ownership or control of a non-homestead property. This notice serves to inform the appropriate authorities, such as the county assessor's office, about the change in ownership or control of the property. There are different types of New Hampshire Notice of Change of Ownership or Control Non-Homestead Property, which include: 1. Commercial Property: This type of property refers to any non-residential property used for business or commercial purposes, such as office buildings, retail spaces, warehouses, or industrial complexes. Owners or controllers of commercial properties must file a Notice of Change of Ownership or Control to ensure accurate tax assessment and records. 2. Rental Property: If an individual or entity owns or controls a non-homestead property that is rented out to tenants, a Notice of Change of Ownership or Control must be filed whenever there is a change in ownership or transfer of control. This ensures that the appropriate authorities are aware of the new owner or controller responsible for the property. 3. Vacant Land: Non-homestead properties that consist of undeveloped or vacant land also require a Notice of Change of Ownership or Control to be filed when there is a transfer of ownership or control. This helps the county assessor's office maintain accurate records and assessment information for tax purposes. The New Hampshire Notice of Change of Ownership or Control Non-Homestead Property includes important information, such as the property's address, the name and contact details of the new owner or controller, the date of the change, and any relevant supporting documentation, such as deeds or contracts. Filing this notice is crucial to ensure compliance with state regulations and prevent potential legal issues. Failure to file or inaccurately filing the Notice of Change of Ownership or Control Non-Homestead Property can result in penalties or delays in property tax assessments. It is advisable to consult with a qualified attorney or seek guidance from the county assessor's office to ensure the proper completion and submission of this notice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.