As a small business owner you may hire people as independent contractors or as employees. There are rules that will help you determine how to classify the people you hire. This will affect how much you pay in taxes, whether you need to withhold from your workers paychecks and what tax documents you need to file.

Here are some things every business owner should know about hiring people as independent contractors versus hiring them as employees:

1. The IRS uses three characteristics to determine the relationship between businesses and workers:

" Behavioral Control covers facts that show whether the business has a right to direct or control how the work is done through instructions, training or other means.

" Financial Control covers facts that show whether the business has a right to direct or control the financial and business aspects of the worker's job.

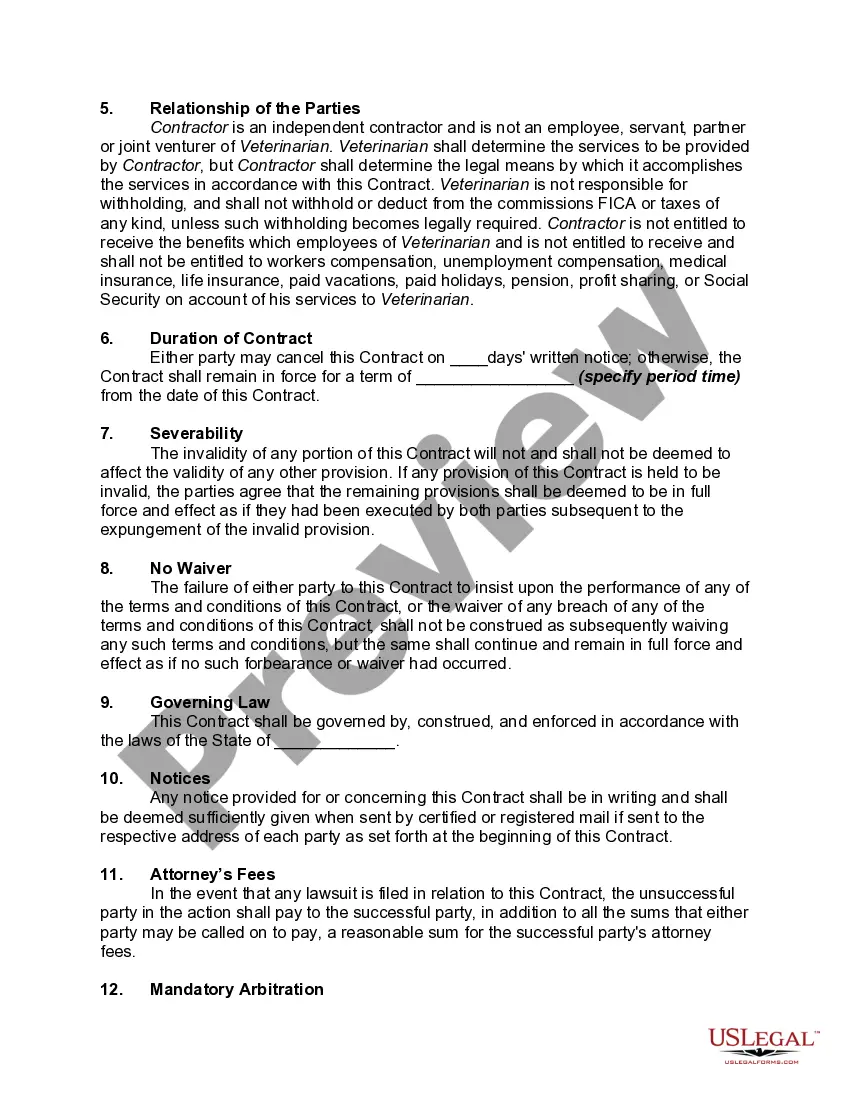

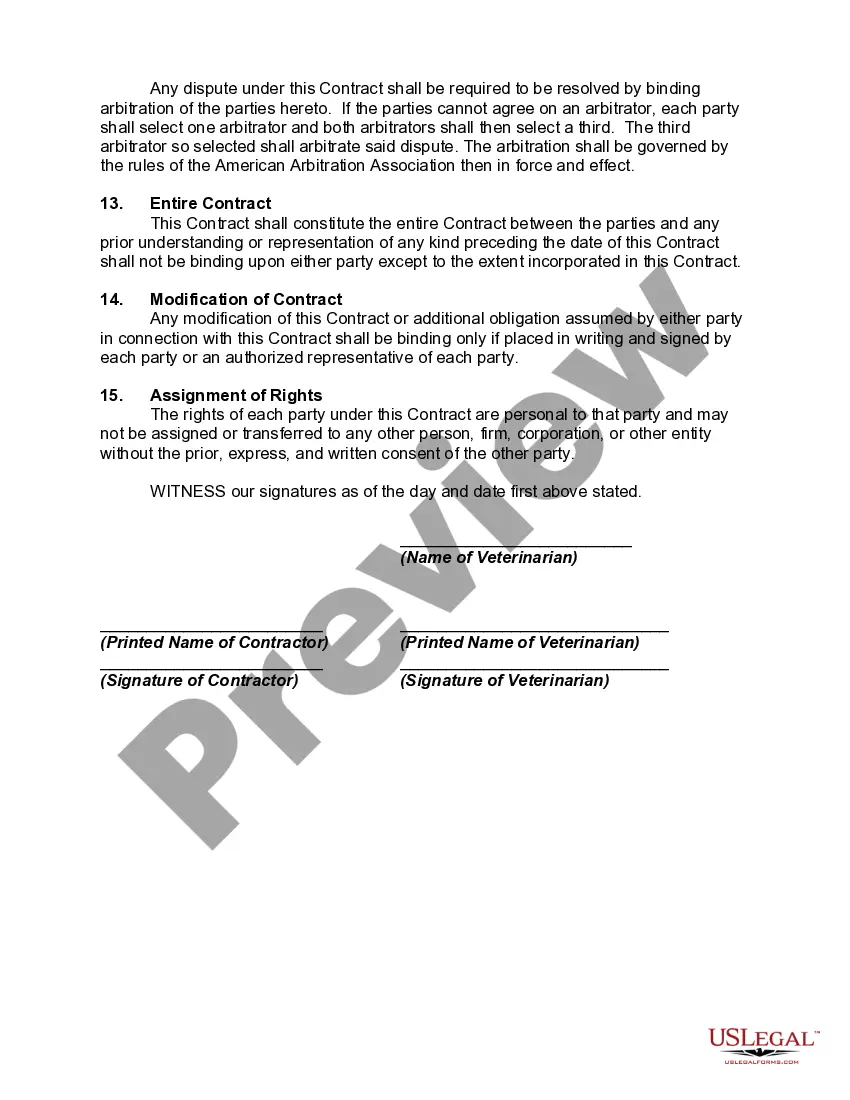

" Type of Relationship factor relates to how the workers and the business owner perceive their relationship.

If you have the right to control or direct not only what is to be done, but also how it is to be done, then your workers are most likely employees.

2. If you can direct or control only the result of the work done -- and not the means and methods of accomplishing the result -- then your workers are probably independent contractors.

3. Employers who misclassify workers as independent contractors can end up with substantial tax bills. Additionally, they can face penalties for failing to pay employment taxes and for failing to file required tax forms.

4. Workers can avoid higher tax bills and lost benefits if they know their proper status.

5. Both employers and workers can ask the IRS to make a determination on whether a specific individual is an independent contractor or an employee by filing a Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, with the IRS.