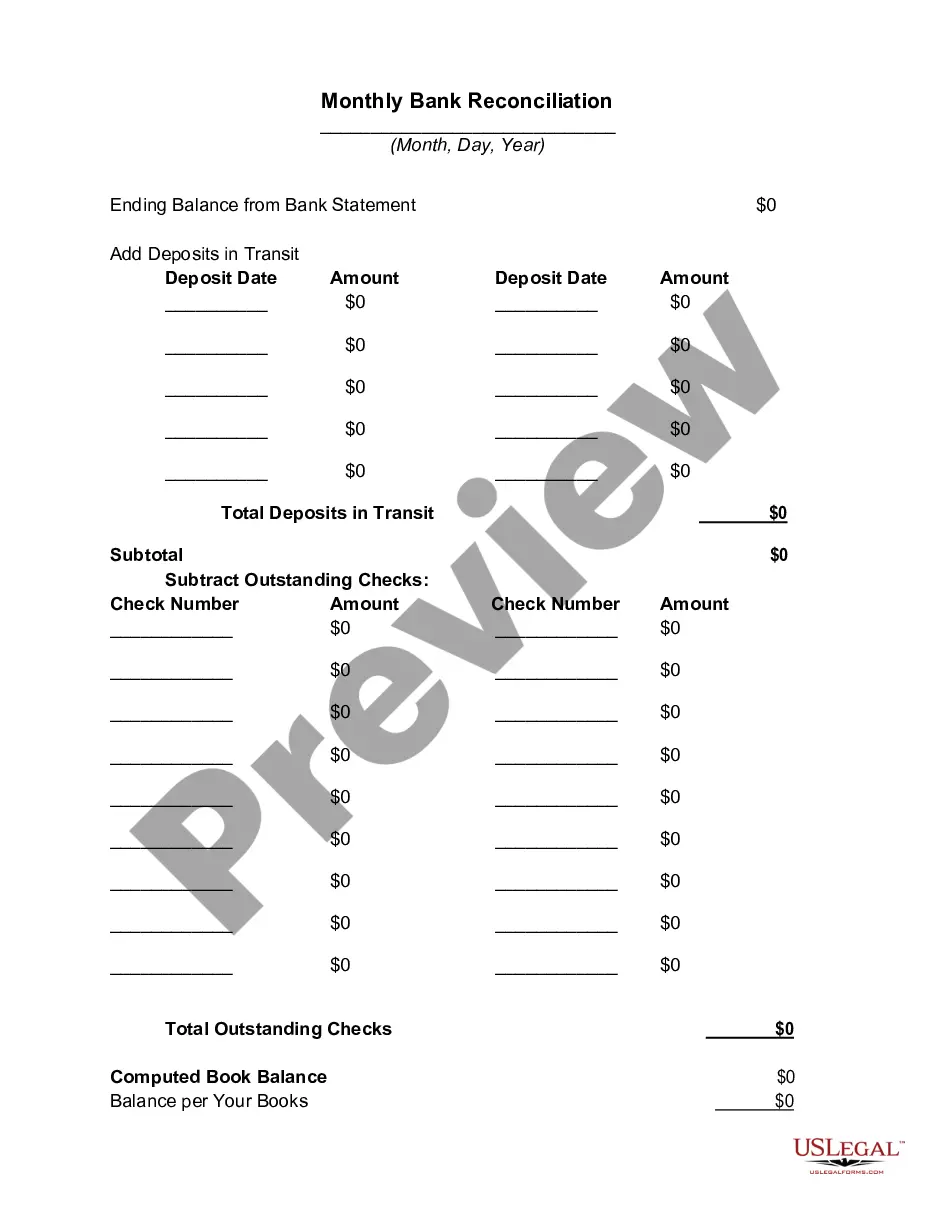

If you find yourself spending lots of time every month reconciling your bank statement and still are not able to nail it down to the penny, this monthly bank reconciliation form might be able to help you.

New Hampshire Monthly Bank Reconciliation Worksheet

Description

How to fill out Monthly Bank Reconciliation Worksheet?

Have you ever been in a situation where you need documents for either business or personal purposes nearly every day? There are many legitimate form templates available online, but finding ones you can trust isn’t simple.

US Legal Forms offers thousands of form templates, including the New Hampshire Monthly Bank Reconciliation Worksheet, that are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New Hampshire Monthly Bank Reconciliation Worksheet template.

Locate all the form templates you have purchased in the My documents section. You can acquire another copy of the New Hampshire Monthly Bank Reconciliation Worksheet at any time, if necessary. Click on the desired form to download or print the document template.

Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Obtain the form you need and ensure it is for the correct city/region.

- Use the Preview option to review the document.

- Examine the details to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Lookup area to find the form that suits your requirements and needs.

- Once you find the appropriate form, click on Get now.

- Select the pricing plan you desire, fill in the required information to create your account, and pay for your request using your PayPal or Visa or Mastercard.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

To complete a month-end reconciliation using the New Hampshire Monthly Bank Reconciliation Worksheet, start by gathering your bank statements and financial records. Next, compare each transaction on your worksheet with these statements, noting any discrepancies. This process ensures accuracy in your accounts and helps identify any errors or fraud. Consider using uslegalforms to access resources that simplify your reconciliation process and enhance your financial management.

To get a bank reconciliation statement, simply visit your bank's website and access your account. Look for the option to download or request statements. Alternatively, using the New Hampshire Monthly Bank Reconciliation Worksheet can empower you to generate your own statement, ensuring you have a clear understanding of your finances.

You can obtain a bank reconciliation statement by logging into your online banking portal, or by requesting one from your bank. This statement summarizes your transactions and helps keep your financial records up to date. The New Hampshire Monthly Bank Reconciliation Worksheet can assist you in matching this with your records for thorough reviews.

To find a reconciliation statement, you can check with your bank or your accounting software. Most platforms will allow you to generate this document easily. If you're using the New Hampshire Monthly Bank Reconciliation Worksheet, it provides a clear path to create and maintain your own reconciliation statements.

The easiest way to reconcile a bank statement is to use a systematic approach with a reconciliation worksheet. By employing the New Hampshire Monthly Bank Reconciliation Worksheet, you can systematically track your income and expenses, allowing you to quickly identify any discrepancies between your records and your bank statement.

For effective bank reconciliation, you will need your bank statements and your ledger or accounting records. Additionally, gather any receipts or invoices relevant to your transactions. Utilizing the New Hampshire Monthly Bank Reconciliation Worksheet can streamline this process, providing a structured way to compile and compare these documents.

To complete a bank reconciliation sheet, start by gathering your bank statements and your accounting records. Next, compare the two sets of information to find discrepancies. With the New Hampshire Monthly Bank Reconciliation Worksheet, you can clearly outline all transactions, making it easier to identify mismatches and correct them efficiently.

To complete a month-end bank reconciliation, start by reconciling each transaction recorded in your accounting software with those on your bank statement. Carefully review and correct any inconsistencies you find during this process. Document your findings and finalize the reconciliation for your records. Using a New Hampshire Monthly Bank Reconciliation Worksheet can assist you in maintaining clear and accurate financial statements throughout the month.

Filing a bank reconciliation statement involves summarizing the differences between your bank statement and your accounting records. Begin by detailing each item that causes a difference, such as fees or errors. Once everything is accounted for, submit the statement alongside your financial reports. A good practice is to rely on tools like the New Hampshire Monthly Bank Reconciliation Worksheet for a structured approach.

To perform monthly bank reconciliation, start by gathering your bank statement and your account records. Compare the transactions listed on both documents to identify discrepancies. Make adjustments for any differences, such as outstanding checks or deposits in transit. Utilizing the New Hampshire Monthly Bank Reconciliation Worksheet can simplify this process and help ensure accuracy.