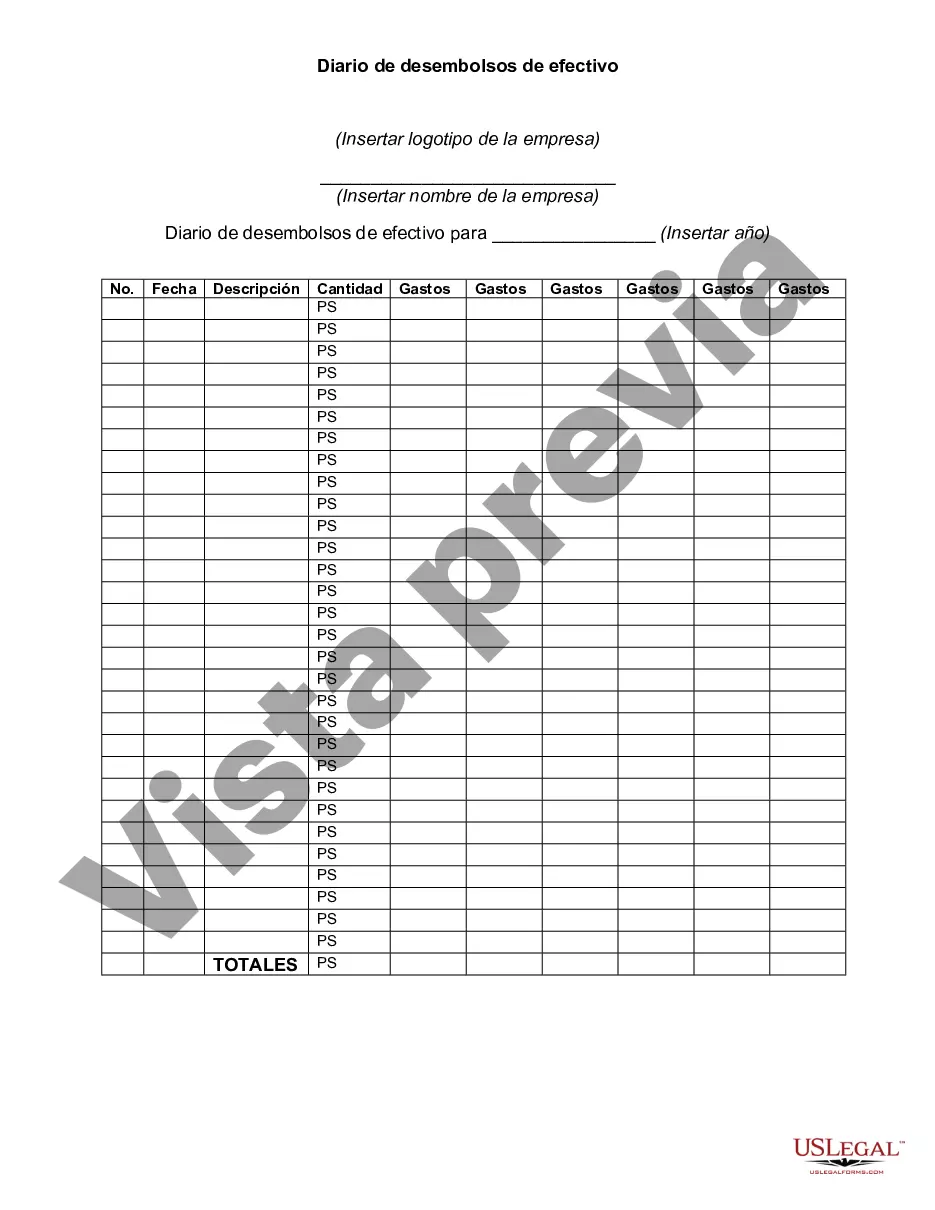

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

New Hampshire Check Disbursements Journal serves as a crucial financial document that records all check disbursements made by an organization or individual based in New Hampshire. This comprehensive journal is designed to maintain accurate and organized records of all outgoing payments, providing transparency and accountability. The journal includes detailed information such as the date of disbursement, check number, payee name, payment amount, purpose of payment, and any relevant notes. It serves as a reliable source for tracking financial transactions, facilitating easy audits, and ensuring compliance with financial regulations. Within the realm of New Hampshire Check Disbursements Journals, there are different types that cater to specific purposes or industries. Some of these types may include: 1. Business Check Disbursements Journal: This type of journal is utilized by businesses operating in New Hampshire to document all outgoing payments related to various business expenses such as rent, utilities, employee wages, supplier payments, advertising costs, and other operational expenditures. 2. Non-profit Check Disbursements Journal: Non-profit organizations operating in New Hampshire often maintain a specialized journal to record check disbursements for specific purposes like program expenses, fundraising costs, grants, volunteer reimbursements, and other activities related to their charitable work. 3. Government Check Disbursements Journal: Government entities in New Hampshire, including municipal corporations, state agencies, and educational institutions, might maintain their distinct check disbursements journal to document expenditures related to public services, infrastructure, salaries, contracts, and other government-funded operations. 4. Personal Check Disbursements Journal: Individuals residing in New Hampshire may prefer to maintain a personal check disbursements journal for tracking personal expenses like mortgage or rent payments, utility bills, insurance premiums, healthcare expenses, and other personal financial transactions. By accurately recording and maintaining a New Hampshire Check Disbursements Journal, individuals and organizations can avoid duplicate payments, detect potential errors, ensure proper financial management, and simplify their tax-filing processes. It serves as an indispensable tool in gaining insights into spending patterns, saving money, and maintaining a clear overview of financial activities within the state of New Hampshire.New Hampshire Check Disbursements Journal serves as a crucial financial document that records all check disbursements made by an organization or individual based in New Hampshire. This comprehensive journal is designed to maintain accurate and organized records of all outgoing payments, providing transparency and accountability. The journal includes detailed information such as the date of disbursement, check number, payee name, payment amount, purpose of payment, and any relevant notes. It serves as a reliable source for tracking financial transactions, facilitating easy audits, and ensuring compliance with financial regulations. Within the realm of New Hampshire Check Disbursements Journals, there are different types that cater to specific purposes or industries. Some of these types may include: 1. Business Check Disbursements Journal: This type of journal is utilized by businesses operating in New Hampshire to document all outgoing payments related to various business expenses such as rent, utilities, employee wages, supplier payments, advertising costs, and other operational expenditures. 2. Non-profit Check Disbursements Journal: Non-profit organizations operating in New Hampshire often maintain a specialized journal to record check disbursements for specific purposes like program expenses, fundraising costs, grants, volunteer reimbursements, and other activities related to their charitable work. 3. Government Check Disbursements Journal: Government entities in New Hampshire, including municipal corporations, state agencies, and educational institutions, might maintain their distinct check disbursements journal to document expenditures related to public services, infrastructure, salaries, contracts, and other government-funded operations. 4. Personal Check Disbursements Journal: Individuals residing in New Hampshire may prefer to maintain a personal check disbursements journal for tracking personal expenses like mortgage or rent payments, utility bills, insurance premiums, healthcare expenses, and other personal financial transactions. By accurately recording and maintaining a New Hampshire Check Disbursements Journal, individuals and organizations can avoid duplicate payments, detect potential errors, ensure proper financial management, and simplify their tax-filing processes. It serves as an indispensable tool in gaining insights into spending patterns, saving money, and maintaining a clear overview of financial activities within the state of New Hampshire.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.