Title: Understanding New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories 1. Introduction to New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories In the state of New Hampshire, a resolution selecting a depository bank for a corporation and designating authorized account signatories is a crucial document that outlines the process of choosing a financial institution and determining individuals authorized to sign on behalf of the corporation. This resolution helps establish a secure banking relationship and facilitates efficient financial operations. 2. Key Components of a New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories a) Resolution Purpose: The resolution clearly states the purpose of selecting a depository bank, which includes establishing a banking relationship, ensuring the safety and security of funds, and enabling day-to-day financial transactions. b) Corporation Information: This section includes detailed information about the corporation, such as its legal name, business address, identification number, and any other relevant details necessary for banking purposes. c) Selection of Depository Bank: The resolution outlines the criteria used for selecting a depository bank, including factors like reputation, financial stability, range of services offered, convenience, and location. It may also mention any specific requirements or preferences concerning the type of bank (e.g., commercial bank, credit union). d) Account Signatories: This component specifies the individuals authorized to sign on behalf of the corporation. It includes their names, titles, and contact information. The resolution should also address any restrictions or conditions related to the signing authority, such as requiring dual signatures for transactions above a certain threshold. e) Account Access and Administration: This section covers administrative details concerning the creation, modification, and closure of bank accounts. It may also specify any additional requirements or procedures for account management, such as reporting obligations, periodic audits, or internal control mechanisms. f) Effective Date and Board Approval: The resolution should include the intended effective date, and it must be duly approved by the corporation's board of directors or relevant decision-making body. This ensures the resolution's validity and compliance with internal corporate governance procedures. 3. Types of New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories a) General Resolution: A general resolution is the most common type and is used to authorize the selection of a depository bank and designate account signatories. It encompasses all necessary aspects of the resolution in a comprehensive manner. b) Specific Resolution: A specific resolution is used when the corporation requires additional specificity or customization, such as opting for a particular type of account (e.g., checking, savings) or designating a specific official as the primary account signatory. c) Amended Resolution: An amended resolution is utilized when there is a need to modify an existing resolution due to changes in account signatories, bank selection, or any other relevant details. It ensures that the resolution remains up-to-date and accurately reflects the corporation's current banking arrangements. In conclusion, a New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories is a critical document that formalizes the process of selecting a banking partner and designating authorized signatories for a corporation. By adhering to the resolution's guidelines, a corporation can establish a strong financial foundation and streamline its banking operations for efficient business management.

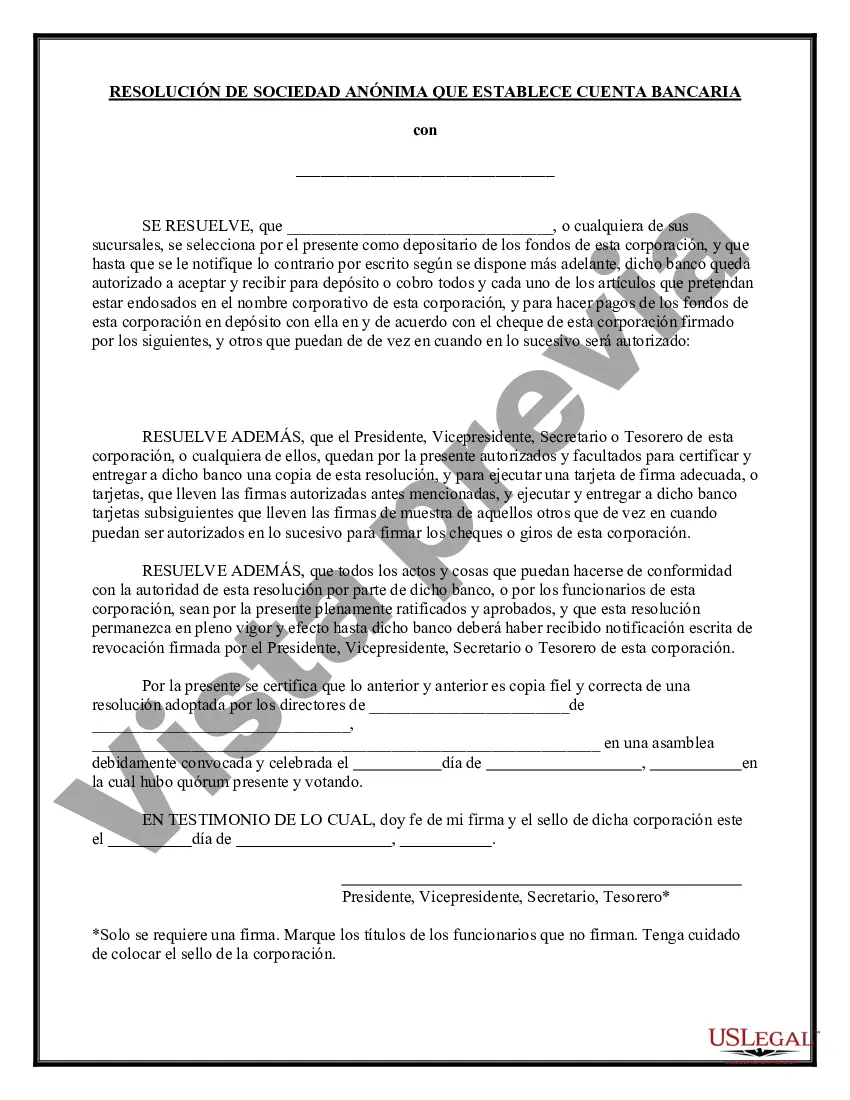

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out New Hampshire Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

Discovering the right lawful record web template can be quite a have a problem. Needless to say, there are tons of layouts available online, but how can you get the lawful form you require? Take advantage of the US Legal Forms internet site. The services offers thousands of layouts, for example the New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories, which you can use for organization and personal requirements. Each of the forms are checked out by professionals and fulfill federal and state requirements.

When you are presently authorized, log in to your bank account and click the Download key to get the New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories. Use your bank account to search from the lawful forms you might have purchased previously. Check out the My Forms tab of your own bank account and have one more duplicate of the record you require.

When you are a brand new end user of US Legal Forms, allow me to share easy instructions that you can adhere to:

- Very first, make sure you have selected the right form for your personal town/area. It is possible to look over the form while using Preview key and study the form description to ensure it is the right one for you.

- When the form fails to fulfill your expectations, take advantage of the Seach area to obtain the right form.

- When you are certain that the form is acceptable, select the Buy now key to get the form.

- Select the costs program you desire and type in the needed information. Create your bank account and pay money for the transaction utilizing your PayPal bank account or bank card.

- Choose the submit formatting and download the lawful record web template to your device.

- Comprehensive, revise and printing and signal the obtained New Hampshire Resolution Selecting Depository Bank for Corporation and Account Signatories.

US Legal Forms will be the biggest collection of lawful forms where you can discover various record layouts. Take advantage of the service to download skillfully-made paperwork that adhere to state requirements.