Title: New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default — Everything You Need to Know Introduction: A New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default is a legal document used when a borrower defaults on a loan secured by non-consumer goods, such as business assets or commercial property. This notice serves as a formal notification to the borrower, informing them of the lender's intention to sell the collateral through a private sale to recover the outstanding debt. In this detailed description, we will delve deep into the purpose, requirements, and types of this notice in New Hampshire. Keywords: New Hampshire, Notice of Private Sale of Collateral, Non-consumer Goods, Default, legal document, borrower, loan, secured, business assets, commercial property, formal notification, lender, outstanding debt, private sale. I. Purpose of a New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default: 1. Recover Outstanding Debt: The primary purpose of this notice is to inform the borrower that the lender intends to sell the collateral in order to recover the unpaid debt resulting from the defaulted loan. 2. Legal Protection for the Lender: By serving this notice, the lender ensures transparency in the sale process and grants the borrower a final opportunity to redeem or settle the debt before initiating the sale. It also protects the lender from potential legal disputes that may arise in the future. II. Requirements for a New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default: 1. Written Form: The notice must be in writing and clearly state that it is a Notice of Private Sale of Collateral (Non-consumer Goods) on Default. 2. Accurate Information: The notice should contain accurate contact information for both the lender and borrower, including their names, addresses, and phone numbers. 3. Detailed Description of Collateral: A comprehensive description of the collateral being sold should be included, including its nature, identification numbers (if applicable), and any unique features that may contribute to its value. 4. Outstanding Debt: The notice should specify the total outstanding debt, including any interest and late fees accrued up to the date of the notice. It should also mention any additional costs related to the sale, such as storage or auction fees. 5. Redemption Period: New Hampshire law requires a minimum of ten (10) days' notice period, allowing the borrower to repay the debt, redeem the collateral, and prevent the sale. III. Types of New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default: 1. General Notice: A standard notice used for default on loans secured by non-consumer goods, providing the borrower with the necessary information about the sale and redemption period. 2. Notice of Specific Collateral: This type of notice focuses on a particular type of collateral, such as machinery, vehicles, or intellectual property, and provides specific details for the interested parties. Conclusion: A New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default is a crucial document that protects the rights of both lenders and borrowers. It ensures transparency in the sale process and grants the borrower one last opportunity to settle the debt or redeem the collateral. Adhering to the legal requirements and serving a comprehensive notice helps maintain clarity and mitigate any potential disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Aviso de venta privada de garantía (bienes que no son de consumo) por incumplimiento - Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

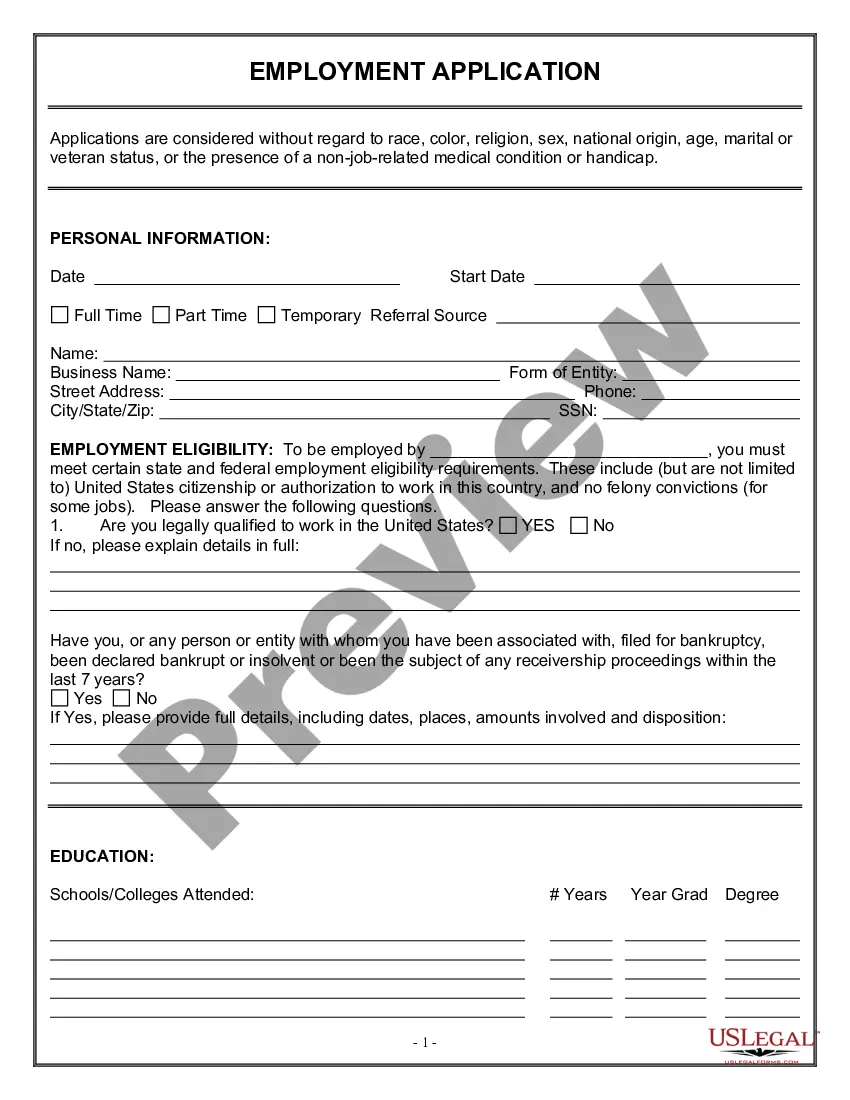

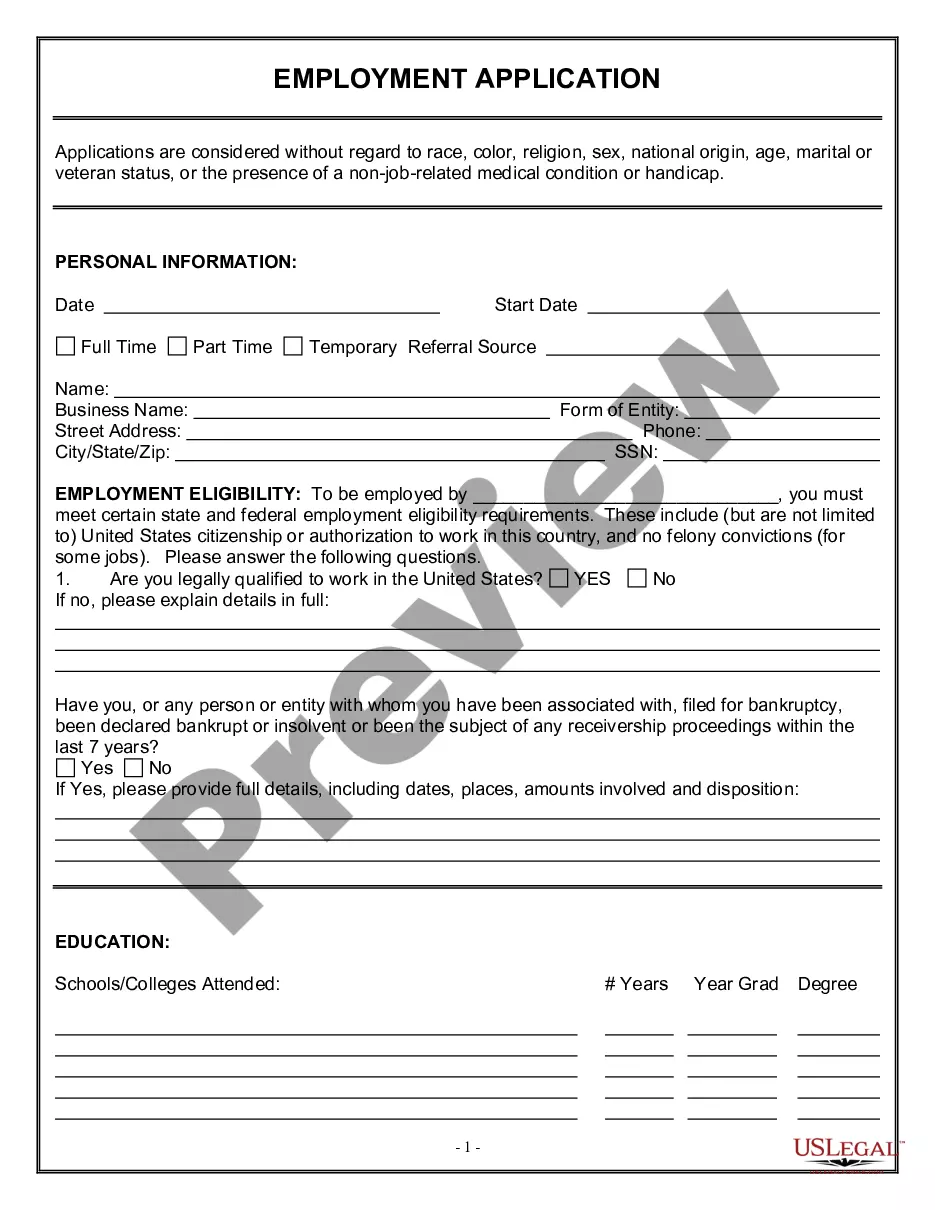

How to fill out New Hampshire Aviso De Venta Privada De Garantía (bienes Que No Son De Consumo) Por Incumplimiento?

Choosing the right lawful file web template could be a struggle. Needless to say, there are tons of templates accessible on the Internet, but how would you obtain the lawful develop you need? Utilize the US Legal Forms site. The support delivers a huge number of templates, such as the New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default, that you can use for organization and private requirements. All of the types are examined by experts and meet federal and state specifications.

In case you are currently signed up, log in in your account and click the Acquire switch to have the New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default. Make use of your account to search throughout the lawful types you might have ordered in the past. Check out the My Forms tab of the account and have one more copy of the file you need.

In case you are a brand new end user of US Legal Forms, allow me to share straightforward recommendations that you can follow:

- Initial, be sure you have selected the correct develop for the town/county. You may check out the form making use of the Review switch and browse the form information to ensure it will be the best for you.

- In case the develop is not going to meet your expectations, make use of the Seach industry to discover the appropriate develop.

- When you are positive that the form would work, select the Get now switch to have the develop.

- Choose the rates program you need and type in the needed information. Build your account and pay money for an order making use of your PayPal account or charge card.

- Choose the submit file format and acquire the lawful file web template in your system.

- Full, change and produce and sign the received New Hampshire Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

US Legal Forms will be the greatest collection of lawful types in which you can find different file templates. Utilize the service to acquire appropriately-manufactured paperwork that follow express specifications.