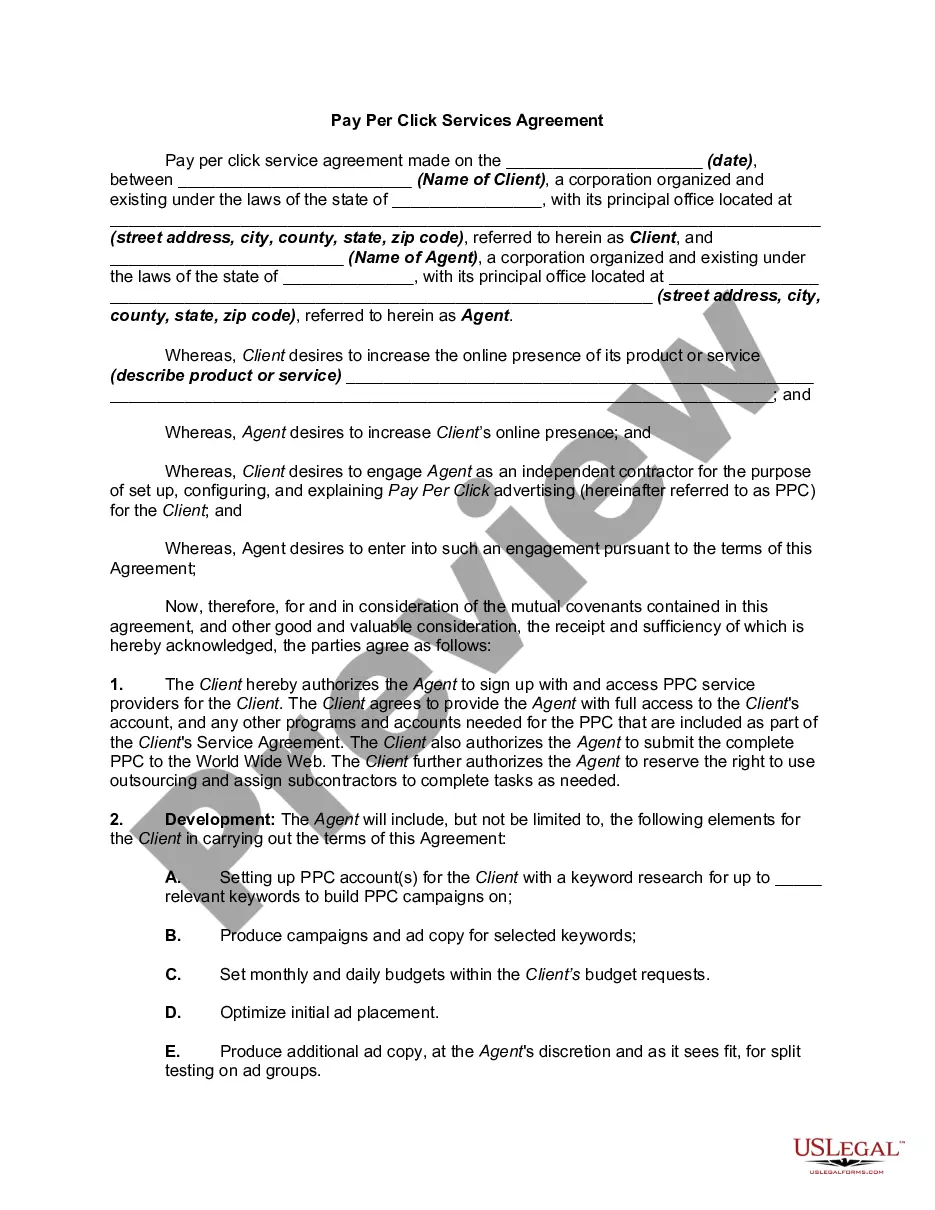

New Hampshire Escrow Agreement and Instructions provide a legally binding framework that ensures secure and trustworthy transactions between parties involved in a real estate or business deal. This agreement acts as a safeguard, holding funds or assets until specific conditions are met. Here are the different types of New Hampshire Escrow Agreements and Instructions commonly used: 1. Real Estate Escrow Agreement: This type of escrow agreement is prevalent in real estate transactions in New Hampshire. It involves the deposit of funds or documents with a neutral third-party, known as an escrow agent, until the terms and conditions of the purchase agreement or contract are fulfilled. The escrow agent ensures that the buyer's funds are held securely and disbursed appropriately upon completion of the transaction. 2. Business Escrow Agreement: Used in business mergers, acquisitions, or related transactions, a business escrow agreement secures funds, assets, or intellectual property rights until all the specified terms are satisfied. This agreement guarantees that the involved parties fulfill their obligations before the release of funds or assets, providing confidence and protection in complex business transactions. 3. Intellectual Property Escrow Agreement: This type of escrow agreement is specific to protecting intellectual property, such as patents, trademarks, or copyrights. It ensures that valuable intellectual property rights are securely held by an impartial escrow agent until the agreed-upon conditions, such as successful patent registration or license approval, are met. 4. Escrow Instructions: Alongside the various escrow agreements, New Hampshire Escrow Instructions are clarity-providing documents that outline the specific terms and conditions governing the escrow process. These instructions typically include important details such as the escrow agent's responsibilities, requirements for disbursement of funds, contingencies, timelines, and instructions regarding the release of documents or assets. New Hampshire Escrow Agreement and Instructions secure parties involved in various types of transactions by providing a transparent process that minimizes risks and ensures the fulfillment of contractual obligations. It is essential to consult legal professionals or trusted escrow agents when creating or executing an Escrow Agreement in New Hampshire to guarantee compliance with state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Acuerdo de depósito en garantía e instrucciones - Escrow Agreement and Instructions

Description

How to fill out New Hampshire Acuerdo De Depósito En Garantía E Instrucciones?

Choosing the right legitimate record format can be a battle. Of course, there are plenty of web templates available online, but how do you find the legitimate form you want? Use the US Legal Forms website. The assistance delivers a large number of web templates, like the New Hampshire Escrow Agreement and Instructions, which can be used for enterprise and private demands. Each of the kinds are inspected by pros and meet up with state and federal requirements.

In case you are previously authorized, log in in your profile and then click the Acquire option to obtain the New Hampshire Escrow Agreement and Instructions. Make use of profile to look through the legitimate kinds you have acquired previously. Visit the My Forms tab of your profile and acquire yet another backup in the record you want.

In case you are a brand new end user of US Legal Forms, allow me to share easy directions that you should adhere to:

- Initial, make certain you have selected the proper form for the city/area. You can check out the form while using Preview option and read the form explanation to guarantee it will be the right one for you.

- In case the form is not going to meet up with your preferences, utilize the Seach area to get the proper form.

- When you are certain the form is suitable, go through the Get now option to obtain the form.

- Choose the pricing program you would like and enter the necessary info. Create your profile and buy the transaction utilizing your PayPal profile or Visa or Mastercard.

- Choose the document file format and acquire the legitimate record format in your product.

- Comprehensive, edit and printing and sign the received New Hampshire Escrow Agreement and Instructions.

US Legal Forms is definitely the biggest collection of legitimate kinds in which you will find a variety of record web templates. Use the service to acquire skillfully-manufactured files that adhere to condition requirements.