The New Hampshire Personnel Payroll Associate Checklist is an essential tool used by HR professionals and payroll associates in the state of New Hampshire to ensure accurate and compliant payroll processing and personnel management. This comprehensive checklist encompasses various key aspects necessary to organize employee payroll information, maintain legal compliance, and streamline HR operations. It primarily aids in tracking and verifying employee data, maintaining payroll records, and adhering to state and federal regulations related to taxes, deductions, and wage laws. Some crucial elements covered within the New Hampshire Personnel Payroll Associate Checklist include: 1. Employee Information Management: — Collecting and maintaining accurate employee data such as names, addresses, contact details, social security numbers, and employment eligibility verification (I-9 forms). — Updating employee records promptly for any changes in personal information, tax withholding, banking details, or benefit plans. — Securing confidential employee information to maintain data privacy and comply with data protection regulations. 2. Wage and Hour Compliance: — Ensuring compliance with New Hampshire and federal wage laws, including minimum wage and overtime regulations. — Monitoring and recording hours worked by employees accurately, including regular hours, overtime hours, and any applicable shift differentials. — Calculating and facilitating payroll adjustments for vacation time, sick leave, personal days, and other absences. 3. Benefits Administration: — Managing and tracking employee benefits, such as health insurance, retirement plans, flexible spending accounts, and any other additional benefits offered. — Coordinating with benefit providers and keeping accurate records of employee enrollments, changes, and terminations. — Deducting benefit costs from employees' paychecks and remitting them to the appropriate vendors or programs. 4. Payroll Tax Compliance: — Ensuring accurate withholding of federal, state, and local income taxes from employees' wages. — Calculating and deducting various payroll taxes, including Social Security and Medicare taxes. — Filing quarterly and annual payroll tax reports within the specified deadlines and remitting withheld taxes to the relevant tax authorities. 5. Record keeping and Reporting: — Maintaining well-organized and easily accessible payroll records, including pay stubs, time sheets, employee earnings summaries, tax forms, and benefit documentation. — Generating and distributing accurate and timely pay statements to employees. — Preparing and submitting required reports to government agencies, such as unemployment insurance reports, new hire reports, and tax filings. Different types of New Hampshire Personnel Payroll Associate Checklists may exist depending on the specific needs and preferences of different organizations or industries. For instance, some companies may have additional modules or requirements related to union contracts, cost accounting, or specific industry regulations to be incorporated into their checklists. It is essential for every New Hampshire business to have a well-defined and tailored Personnel Payroll Associate Checklist to ensure adherence to legal requirements, accurate compensation of employees, efficient payroll operations, and smooth employee management.

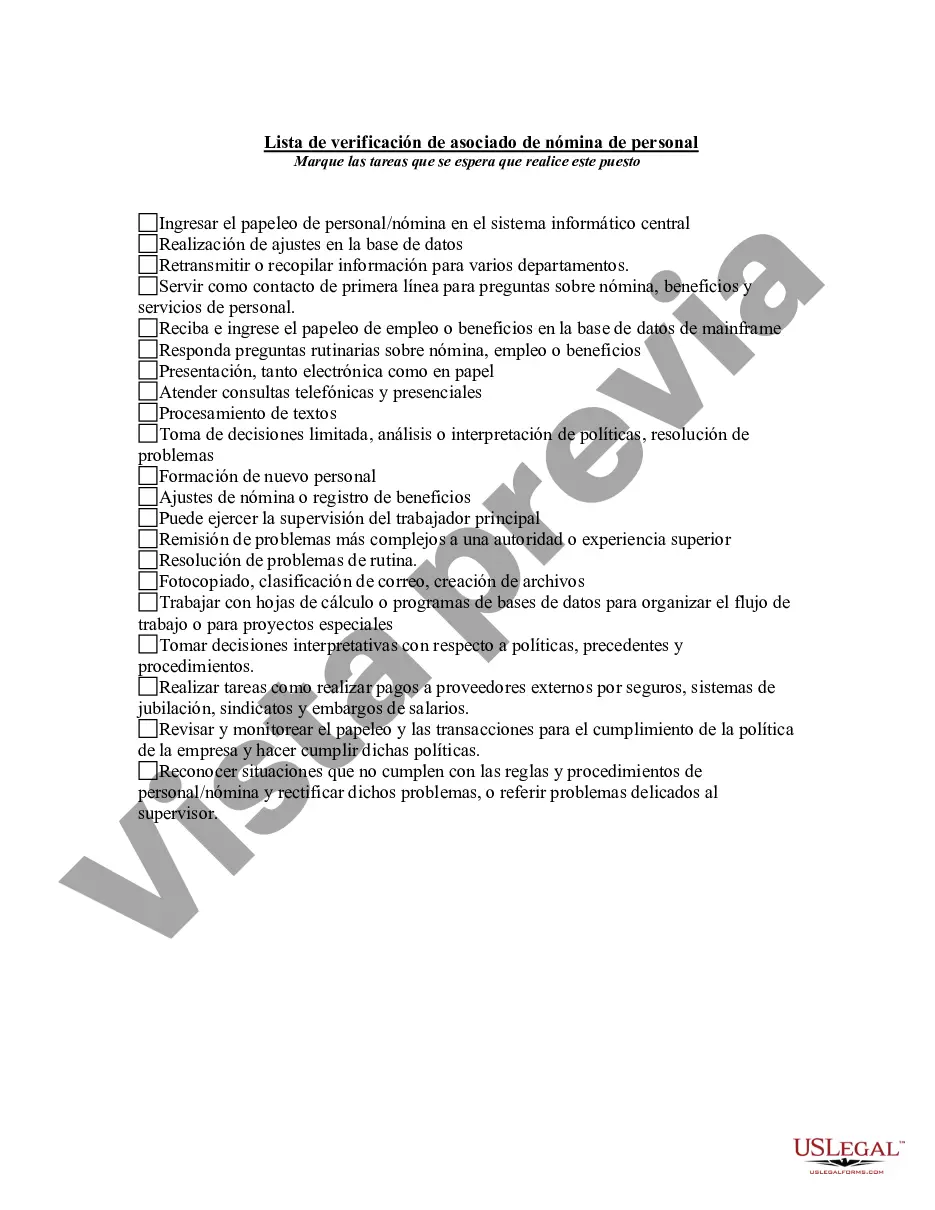

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out New Hampshire Lista De Verificación De Asociado De Nómina De Personal?

Have you been inside a placement in which you need files for either enterprise or specific uses almost every working day? There are tons of legitimate record web templates available on the net, but discovering versions you can depend on is not easy. US Legal Forms delivers thousands of develop web templates, such as the New Hampshire Personnel Payroll Associate Checklist, that happen to be composed in order to meet state and federal specifications.

If you are presently knowledgeable about US Legal Forms website and get a merchant account, just log in. Next, you can acquire the New Hampshire Personnel Payroll Associate Checklist template.

If you do not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for your right town/county.

- Utilize the Preview key to check the shape.

- Browse the outline to ensure that you have selected the proper develop.

- In the event the develop is not what you`re searching for, utilize the Research industry to find the develop that meets your needs and specifications.

- Whenever you get the right develop, click on Acquire now.

- Pick the prices plan you want, submit the required information and facts to make your bank account, and purchase an order with your PayPal or bank card.

- Select a hassle-free paper formatting and acquire your backup.

Find each of the record web templates you may have bought in the My Forms menus. You may get a extra backup of New Hampshire Personnel Payroll Associate Checklist any time, if required. Just go through the necessary develop to acquire or printing the record template.

Use US Legal Forms, by far the most extensive variety of legitimate types, to save lots of some time and steer clear of errors. The service delivers professionally produced legitimate record web templates that can be used for an array of uses. Make a merchant account on US Legal Forms and begin producing your lifestyle easier.