New Hampshire Salary Adjustment Request

Description

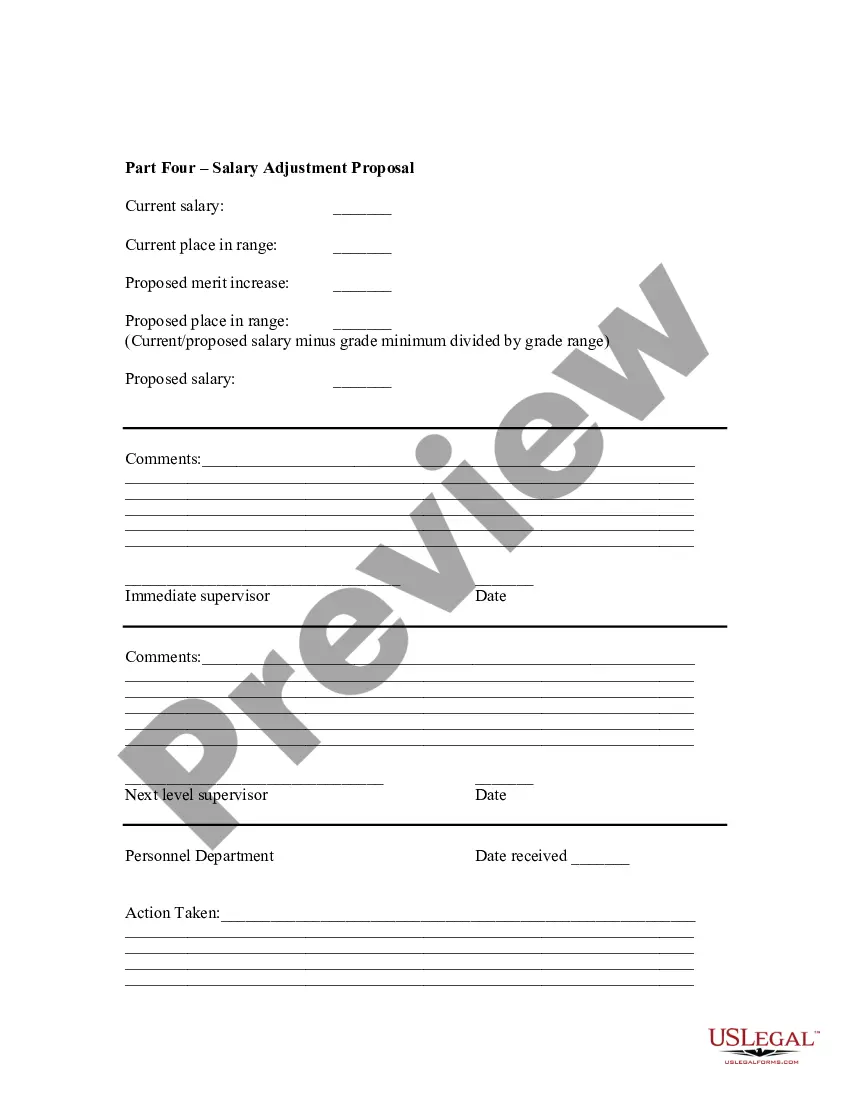

How to fill out Salary Adjustment Request?

It is feasible to dedicate hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers numerous legal documents that can be reviewed by professionals.

It is easy to obtain or print the New Hampshire Salary Adjustment Request from our services.

If available, use the Preview button to view the document template as well. If you wish to find another version of the form, utilize the Search field to discover the template that fits your requirements and specifications. Once you find the template you need, click Purchase now to proceed. Select the pricing plan you wish to use, enter your credentials, and create an account on US Legal Forms. Complete the payment process. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, modify, sign, and print the New Hampshire Salary Adjustment Request. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Afterwards, you can complete, modify, print, or sign the New Hampshire Salary Adjustment Request.

- Every legal document template you receive is yours to keep forever.

- To acquire another copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you're accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/city of your choice.

- Review the form description to confirm you have selected the correct template.

Form popularity

FAQ

In New Hampshire, the new employer SUI (state unemployment insurance) rate is 2.3% on the first $14,000 of wages for each employee. Employers are also charged a surcharge tax called the Administrative Contribution (AC) rate, which is 0.4% for a total contribution of 2.7%.

California's ban prohibits private and public employers from seeking a candidate's pay history. Even if an employer already has that information or an applicant volunteers it, it still can't be used in determining a new hire's pay.

What Should You Put in Your Salary Increase Letter?Personal information about you and your employment history within the company.Detail of how much more money you want or what kind of salary raise you are hoping for.Reasons why you deserve a salary increase such as praise from clients, co-workers, and managers.More items...

An employer cannot usually impose a pay cut unilaterally on employees. However, there are situations where this may be possible for example, the right to reduce their remuneration package may be covered in the employment contract.

It's illegal to ask for salary history in several states including California, Connecticut, Delaware, Hawaii, Massachusetts, Oregon and Vermont, which all have some form of ban for private employers.

The minimum earnings required for eligibility are $2800 ($1400 each in 2 separate quarters), which would result in a $32 weekly benefit amount. The more earnings in your base period, the higher your weekly benefit amount, to a maximum of $427 for $41,500 or more in earnings.

Section 432.3 prohibits an employer from (1) relying on salary history information of an applicant in determining whether to offer employment or what salary to offer and (2) seeking, personally or through an agent, salary history information about an applicant.

Moreover, New Hampshire also has separate, state-based payroll taxes of 1.7%. Unemployment insurance (1.5%) and administrative contribution (0.2%, also known as the AC rate) comprise this New Hampshire payroll tax.

A. The New Hampshire new employer tax rate is 2.7% (UI Rate: 2.3% / AC Rate: 0.4%).

California Governor Jerry Brown signed Assembly Bill 168 into law in October of 2017. The new law goes into effect on January 1, 2018. Assembly Bill 168 prohibits California employers from asking about an applicant's prior salary. If an applicant asks, employers are also required to provide a pay range for the job.