[Title]: Understanding New Hampshire Separation Notice for 1099 Employees: Explained in Detail [Meta Description]: Learn everything you need to know about the New Hampshire Separation Notice for 1099 employees, including its purpose, requirements, and potential types of notices. [Keywords]: New Hampshire, Separation Notice, 1099 Employees, 1099 Independent Contractor, types, requirements, termination, unemployment benefits, employment status [Header]: New Hampshire Separation Notice for 1099 Employees: Explained in Detail [Paragraph 1]: The New Hampshire Separation Notice for 1099 employees is a crucial document that employers use to officially terminate their working relationship with an independent contractor. Unlike traditional employees, 1099 employees are self-employed individuals who work on a contract basis. The separation notice serves to notify the state's labor department regarding the termination and provides necessary information for the contractor to apply for unemployment benefits if eligible. [Paragraph 2]: To ensure compliance with state regulations, New Hampshire separates the Separation Notice based on the reason for the termination. There are various types of Separation Notices for 1099 employees, including: 1. Voluntary Termination: This notice type is used when the independent contractor voluntarily ends their working relationship with the employer due to personal reasons, finding alternative employment opportunities, or any other non-employer initiated causes. 2. Involuntary Termination: In cases where the employer decides to terminate the contract with a 1099 employee, an Involuntary Termination notice is used. This could result from factors such as poor performance, breach of contract, or change in business needs. 3. Contract Completion: If a project or contract is completed successfully, the employer may issue a Contract Completion notice. This type of separation notice states that the working relationship was for a specific project or period, and it has now concluded as agreed upon. [Paragraph 3]: In addition to the categorization of separation notices, there are certain key requirements that employers must meet when filling out the New Hampshire Separation Notice for 1099 Employees. These include providing accurate details of the independent contractor, termination date, reason for separation, verification of contract status, and any other relevant information requested by the state's labor department. [Paragraph 4]: It is important for both employers and 1099 employees to understand that, unlike traditional employees, independent contractors may not always be eligible for unemployment benefits. However, by providing complete and accurate information on the separation notice, the contractor may have supporting documentation necessary to potentially qualify for unemployment benefits. [Conclusion]: The New Hampshire Separation Notice for 1099 Employees is an essential document that helps facilitate the termination process for independent contractors. With various types of notices available depending on the nature of separation, it is crucial for employers to provide accurate information to ensure compliance with state regulations. By understanding the requirements and potential eligibility for unemployment benefits, both employers and 1099 employees can effectively handle the separation process within the boundaries of New Hampshire labor laws.

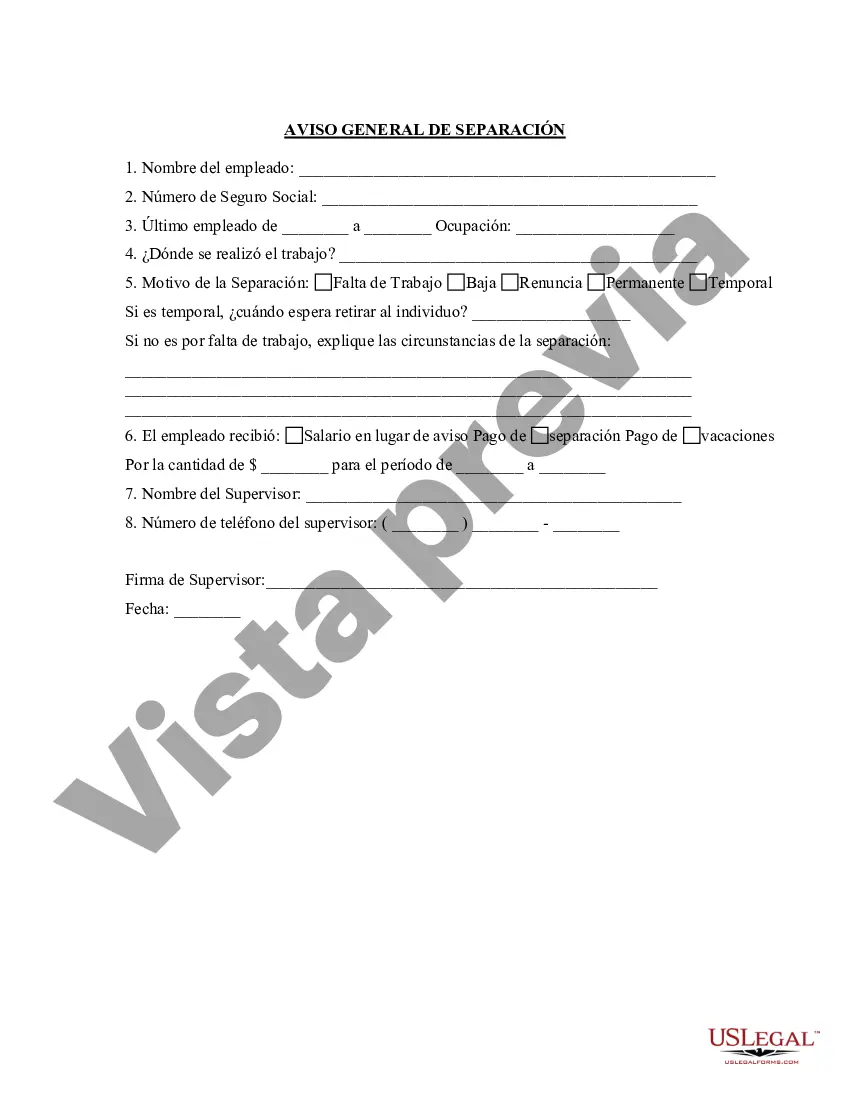

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Aviso de separación para el empleado 1099 - Separation Notice for 1099 Employee

Description

How to fill out New Hampshire Aviso De Separación Para El Empleado 1099?

US Legal Forms - one of many largest libraries of authorized forms in the USA - offers a wide range of authorized papers themes it is possible to obtain or print. Utilizing the internet site, you can find a large number of forms for business and specific functions, sorted by groups, suggests, or keywords.You will discover the newest models of forms such as the New Hampshire Separation Notice for 1099 Employee in seconds.

If you already possess a membership, log in and obtain New Hampshire Separation Notice for 1099 Employee through the US Legal Forms local library. The Download option will appear on every single type you see. You get access to all in the past delivered electronically forms within the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, allow me to share basic instructions to obtain started off:

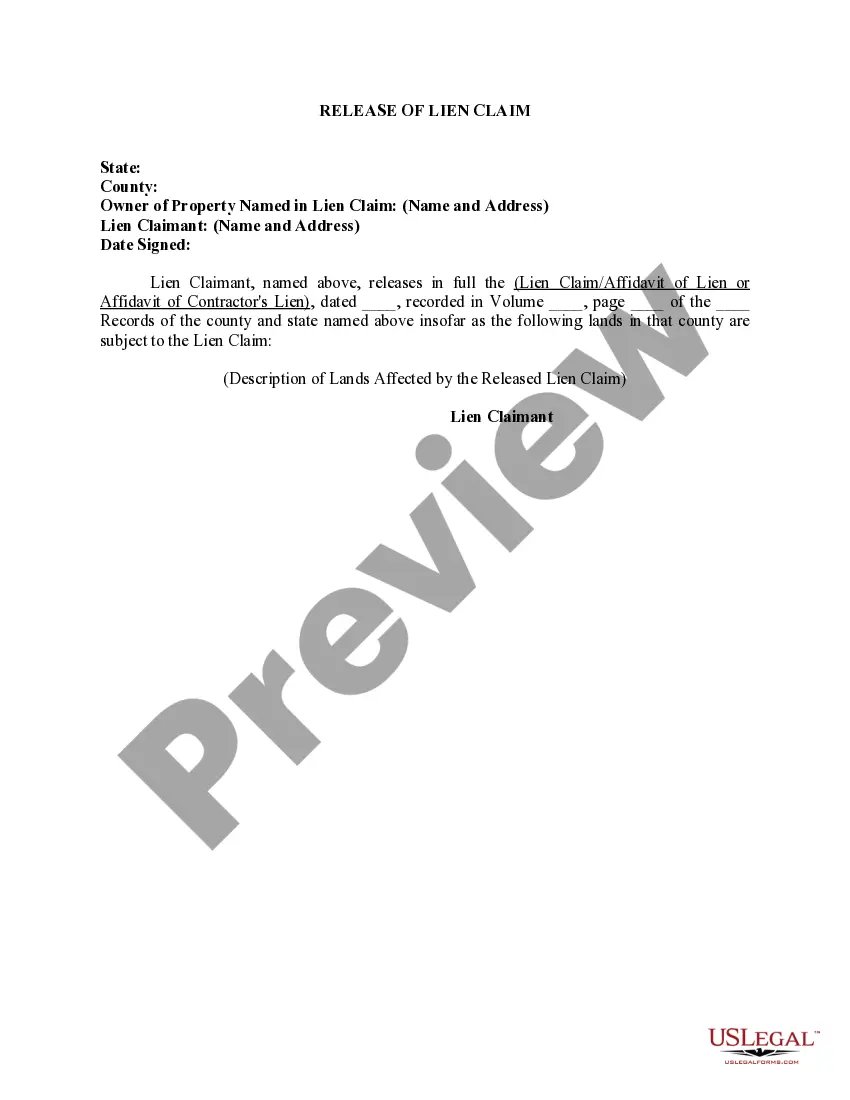

- Make sure you have picked out the correct type for your personal metropolis/area. Click on the Preview option to review the form`s information. Look at the type description to ensure that you have selected the correct type.

- In case the type does not suit your requirements, take advantage of the Research industry near the top of the display to get the one who does.

- When you are pleased with the form, verify your selection by clicking the Purchase now option. Then, opt for the pricing prepare you favor and supply your qualifications to register on an account.

- Process the transaction. Make use of bank card or PayPal account to accomplish the transaction.

- Select the format and obtain the form in your product.

- Make modifications. Load, edit and print and signal the delivered electronically New Hampshire Separation Notice for 1099 Employee.

Each web template you included with your account lacks an expiration particular date which is your own property permanently. So, if you wish to obtain or print yet another backup, just proceed to the My Forms area and click on about the type you will need.

Get access to the New Hampshire Separation Notice for 1099 Employee with US Legal Forms, the most comprehensive local library of authorized papers themes. Use a large number of professional and status-certain themes that satisfy your company or specific requires and requirements.