The New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause refers to a provision included in rental agreements or leases in the state of New Hampshire. This clause allows landlords or property owners to make adjustments to the rent based on changes in operating expenses related to the rental property. The purpose of this clause is to ensure that landlords can cover any increased operating costs associated with the property, such as taxes, insurance, repairs, maintenance, utilities, and other expenses. By including this clause in the lease agreement, landlords can maintain profitability and ensure that the rental income aligns with the ongoing expenses and market conditions. There are different types of New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause, including: 1. Fixed Percentage: In this type of clause, the landlord can increase the rent by a fixed percentage annually or at regular intervals to account for rising operating expenses. For example, the landlord may include a 3% annual increase to cover any anticipated inflation or increased costs. 2. Actual Expense Pass-Through: This type of clause allows the landlord to pass on the actual increase in operating expenses to the tenants. The landlord would provide documentation of the increased costs and distribute the burden proportionally among all tenants based on their rental shares or other predetermined factors. 3. Consumer Price Index (CPI) Adjustment: Some leases may include a clause that links the adjustment of rent to changes in the Consumer Price Index. The CPI reflects the average change in prices paid by urban consumers for a basket of goods and services, and this type of clause ensures that rent adjustments are in line with inflation rates. It is important for landlords and tenants to carefully review the New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause and understand its implications. Tenants should be aware of the specific terms and conditions regarding rent adjustments, the method of calculation, frequency of adjustments, and any limitations or exceptions that may apply. In conclusion, the New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause provides a mechanism for landlords to adjust rent based on changes in operating expenses. Various types of clauses, such as fixed percentage, actual expense pass-through, and CPI adjustment, offer different approaches to ensure that both landlords and tenants are fairly represented in rent adjustments.

The New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause refers to a provision included in rental agreements or leases in the state of New Hampshire. This clause allows landlords or property owners to make adjustments to the rent based on changes in operating expenses related to the rental property. The purpose of this clause is to ensure that landlords can cover any increased operating costs associated with the property, such as taxes, insurance, repairs, maintenance, utilities, and other expenses. By including this clause in the lease agreement, landlords can maintain profitability and ensure that the rental income aligns with the ongoing expenses and market conditions. There are different types of New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause, including: 1. Fixed Percentage: In this type of clause, the landlord can increase the rent by a fixed percentage annually or at regular intervals to account for rising operating expenses. For example, the landlord may include a 3% annual increase to cover any anticipated inflation or increased costs. 2. Actual Expense Pass-Through: This type of clause allows the landlord to pass on the actual increase in operating expenses to the tenants. The landlord would provide documentation of the increased costs and distribute the burden proportionally among all tenants based on their rental shares or other predetermined factors. 3. Consumer Price Index (CPI) Adjustment: Some leases may include a clause that links the adjustment of rent to changes in the Consumer Price Index. The CPI reflects the average change in prices paid by urban consumers for a basket of goods and services, and this type of clause ensures that rent adjustments are in line with inflation rates. It is important for landlords and tenants to carefully review the New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause and understand its implications. Tenants should be aware of the specific terms and conditions regarding rent adjustments, the method of calculation, frequency of adjustments, and any limitations or exceptions that may apply. In conclusion, the New Hampshire Adjustments of Rent Complex Operating Expense Escalations Clause provides a mechanism for landlords to adjust rent based on changes in operating expenses. Various types of clauses, such as fixed percentage, actual expense pass-through, and CPI adjustment, offer different approaches to ensure that both landlords and tenants are fairly represented in rent adjustments.

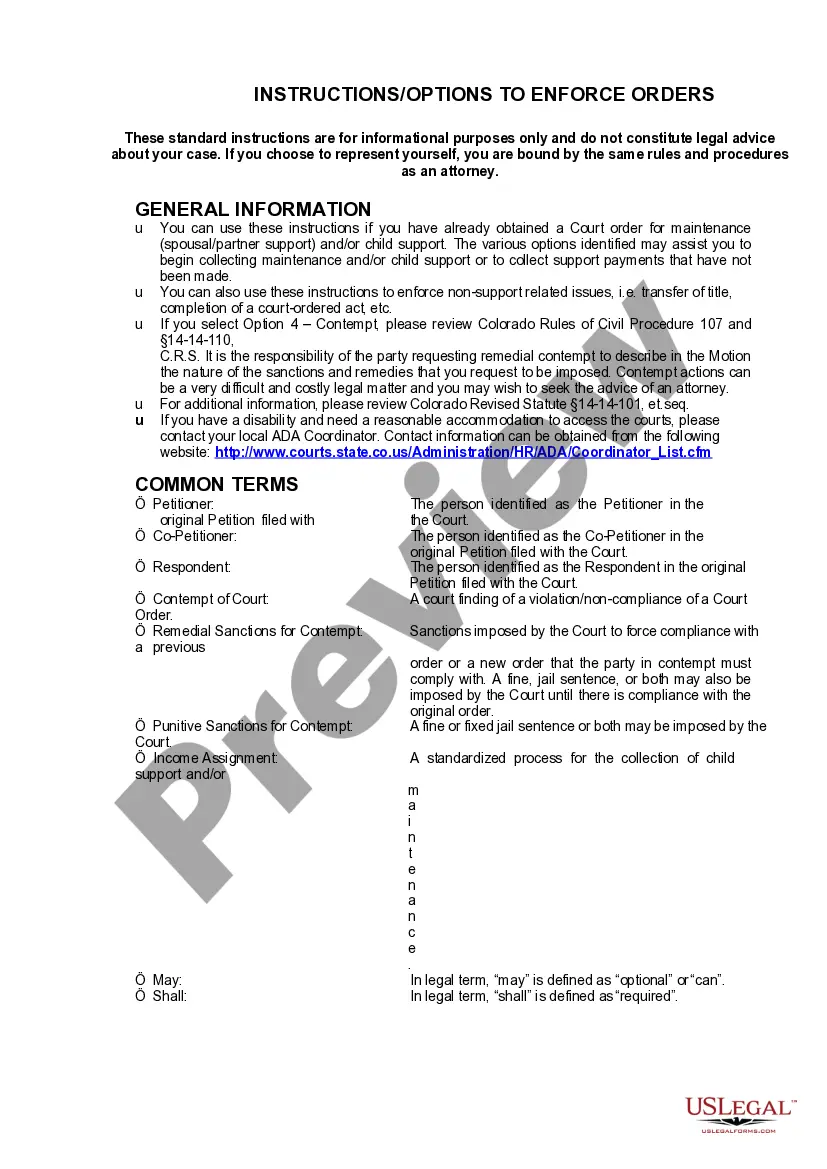

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.