New Hampshire Joint and Several Guaranty of Performance and Obligations is a legal concept that ensures the parties involved in a contract or agreement are held responsible for their performance and obligations in a collective and individual manner. It is a crucial provision often utilized in business contracts, financial transactions, and commercial agreements to protect the interests of all parties involved. Under this guaranty, if multiple parties guarantee the performance of a contractual obligation, they are jointly and severally liable for fulfilling the terms of the agreement. This means that each guarantor is individually responsible for the full performance or satisfaction of the obligations, regardless of the contributions or involvement of other guarantors. In case of default or non-performance by one guarantor, the other guarantors can be held liable for the entire obligation. The New Hampshire Joint and Several Guaranty of Performance and Obligations provides an added layer of protection to creditors and other beneficiaries involved in the agreement. It ensures that they have multiple avenues to seek compensation or performance fulfillment in case one party fails to meet their contractual obligations. This provision allows creditors to pursue any or all guarantors without being limited to a specific party, thereby increasing the likelihood of recovering their rightful claims. In New Hampshire, there are different types of Joint and Several Guaranty of Performance and Obligations employed based on the nature and complexity of the agreement. Some common types include: 1. Commercial Guaranty: This type of guaranty is commonly seen in commercial and business transactions where a third party guarantees the performance of a borrower's obligations to a lender. The guarantor becomes jointly liable with the borrower concerning the repayment of loans or fulfillment of contractual obligations. 2. Lease Guaranty: In lease agreements, a guaranty may be required to ensure the tenant's performance concerning rent payments and adherence to lease terms. The guarantor becomes jointly and severally liable for the lease obligations, offering financial security to the landlord. 3. Construction Contract Guaranty: This type of guaranty is often utilized in construction projects, where contractors or subcontractors assure the project's completion as per the contractual terms. If a contractor fails to meet the requirements, the guarantor(s) can be held accountable for the project's completion or financial compensation. 4. Performance Bond Guaranty: Performance bonds are commonly used to guarantee the completion of a project as agreed upon. In case the principal party (e.g., contractor) defaults, the guarantor(s) become jointly and severally liable to complete the project or compensate for the financial losses incurred. The New Hampshire Joint and Several Guaranty of Performance and Obligations is a legally enforceable provision that ensures the collective and individual responsibility of parties involved in a contract. It offers crucial protection to creditors, lenders, landlords, and other beneficiaries, increasing their chances of receiving proper performance and fulfillment of obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Hampshire Garantía Solidaria de Cumplimiento y Obligaciones - Joint and Several Guaranty of Performance and Obligations

Description

How to fill out New Hampshire Garantía Solidaria De Cumplimiento Y Obligaciones?

US Legal Forms - among the biggest libraries of authorized kinds in the USA - offers an array of authorized document web templates you may download or produce. Making use of the website, you will get a huge number of kinds for enterprise and specific purposes, categorized by groups, suggests, or keywords.You will find the most up-to-date models of kinds just like the New Hampshire Joint and Several Guaranty of Performance and Obligations in seconds.

If you have a registration, log in and download New Hampshire Joint and Several Guaranty of Performance and Obligations from the US Legal Forms local library. The Obtain key will appear on each kind you perspective. You have accessibility to all previously downloaded kinds inside the My Forms tab of your own account.

If you wish to use US Legal Forms the very first time, listed here are basic directions to obtain began:

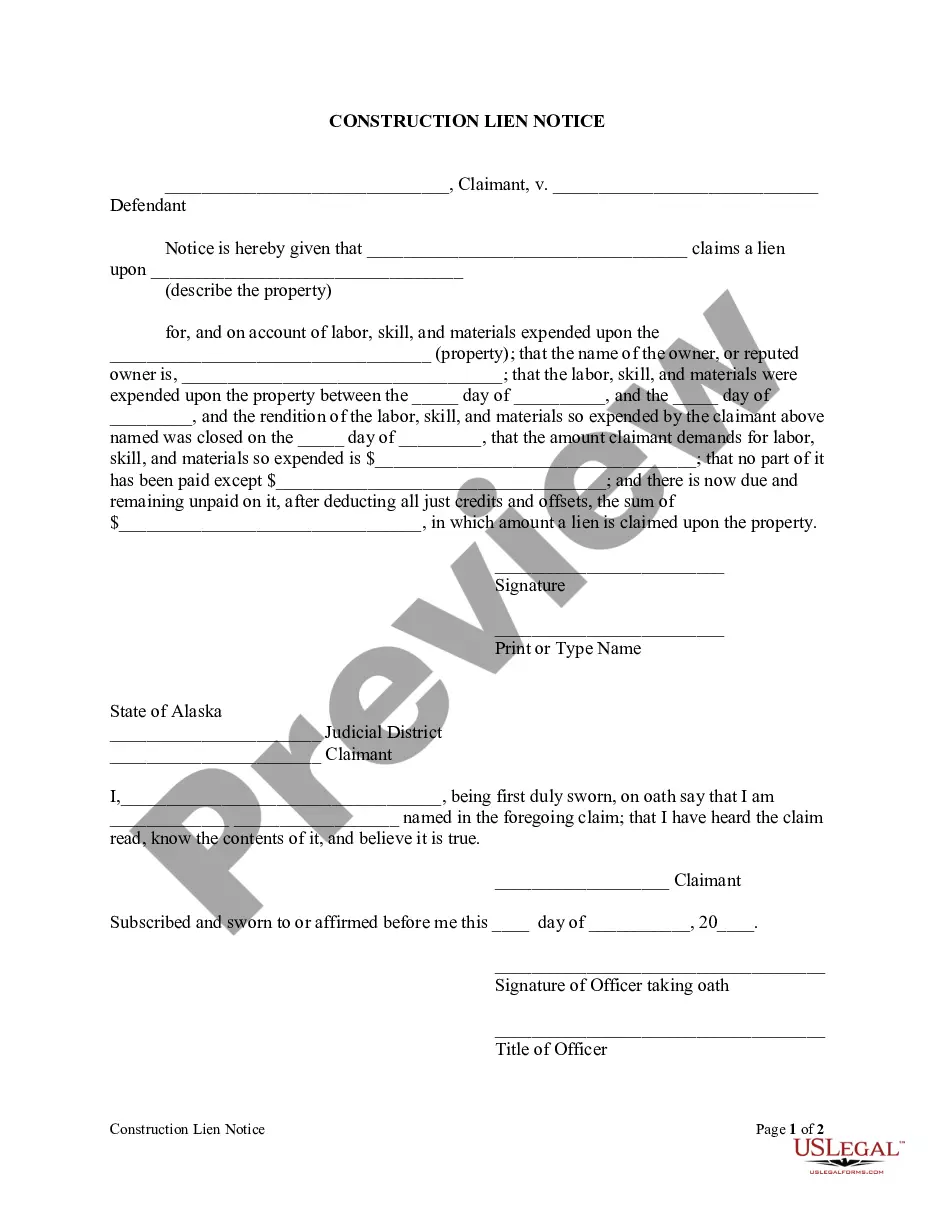

- Be sure to have picked out the right kind for your personal area/county. Click on the Review key to check the form`s articles. Look at the kind explanation to ensure that you have selected the proper kind.

- When the kind doesn`t suit your requirements, use the Look for field towards the top of the screen to obtain the one which does.

- Should you be pleased with the shape, confirm your selection by clicking the Purchase now key. Then, choose the costs plan you prefer and provide your references to sign up for the account.

- Procedure the financial transaction. Utilize your credit card or PayPal account to finish the financial transaction.

- Select the structure and download the shape in your product.

- Make adjustments. Complete, change and produce and indicator the downloaded New Hampshire Joint and Several Guaranty of Performance and Obligations.

Each web template you included in your account lacks an expiry time and it is your own property for a long time. So, if you wish to download or produce yet another duplicate, just go to the My Forms area and then click around the kind you will need.

Obtain access to the New Hampshire Joint and Several Guaranty of Performance and Obligations with US Legal Forms, one of the most comprehensive local library of authorized document web templates. Use a huge number of expert and condition-distinct web templates that satisfy your business or specific needs and requirements.